Evolving consumer behaviors

Rising Inflation Triggers Shift In Global Consumer Spending

Inflation has shown signs of easing in recent months, yet consumers worldwide remain apprehensive about their spending power. A June 2023 Oliver Wyman survey of 10,000 consumers in nine countries illustrates that people across the globe still have significant concerns about their ability to pay for essential goods and services, despite a slight improvement in sentiment compared with February this year.

These concerns are widespread in Germany, the UK, France, and the US, with around three-quarters of consumers expressing them. The situation is even more severe in Brazil, Mexico, and the United Arab Emirates (UAE), where that figure is over 90%. As we detail below, consumers adjust their purchasing behavior accordingly.

Shopping behavior is changing worldwide

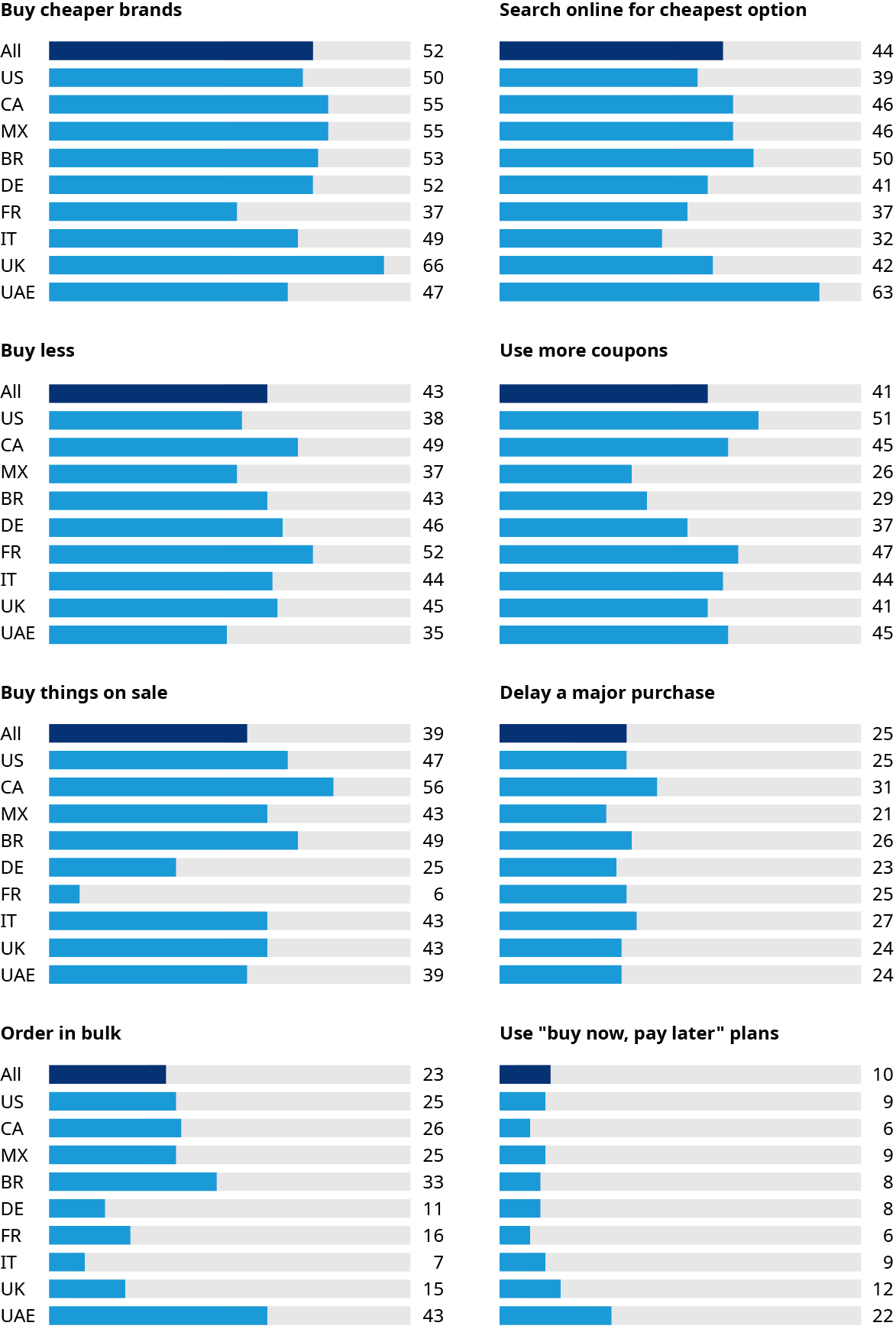

The fear of inflation is evident in consumers' spending behavior on groceries and essential goods. Across all countries, more than 80% of survey respondents stated that they have adjusted their buying behavior, including over 40% who have reduced how much they buy.

In addition, consumers are particularly on the lookout for cheaper alternatives — more than half of those surveyed reported opting for lower-priced groceries, such as private label goods. The UK stands out in this regard, with two-thirds of consumers indicating they are substituting their regular purchases with cheaper alternatives. Increased price sensitivity has also driven consumers globally to seek cheaper options online (44% of respondents) and actively use coupons (41%) to save money on purchases.

In the Middle East, consumers have adopted an approach to saving money that is not yet as widely common in Europe: 43% of respondents in the UAE reported utilizing bulk orders to reduce prices. This reflects a shopping behavior that we mainly associate with North America, where consumers have long been accustomed to purchasing in larger quantities, benefiting from ample space for storage and significant cost savings from wholesale club retailers.

The bulk ordering continues to show strong momentum in Asia as well, though with a different approach. The model of Pinduoduo is based on a group-buying approach, where consumers can team up with others to purchase products in bulk. As this trend continues to gain traction, it highlights how different regions are embracing innovative ways to leverage bulk purchasing for substantial savings. For Europe, the Asian group purchase model seems a more viable option than the American bulk sizes due to typical limitations on storage room. At this point it is not yet an apparent trend.

Exhibit 1: Changing purchasing behaviors, Oliver Wyman Forum consumer survey 2023

Source: Oliver Wyman analysis

Regional differences in consumer spending priorities

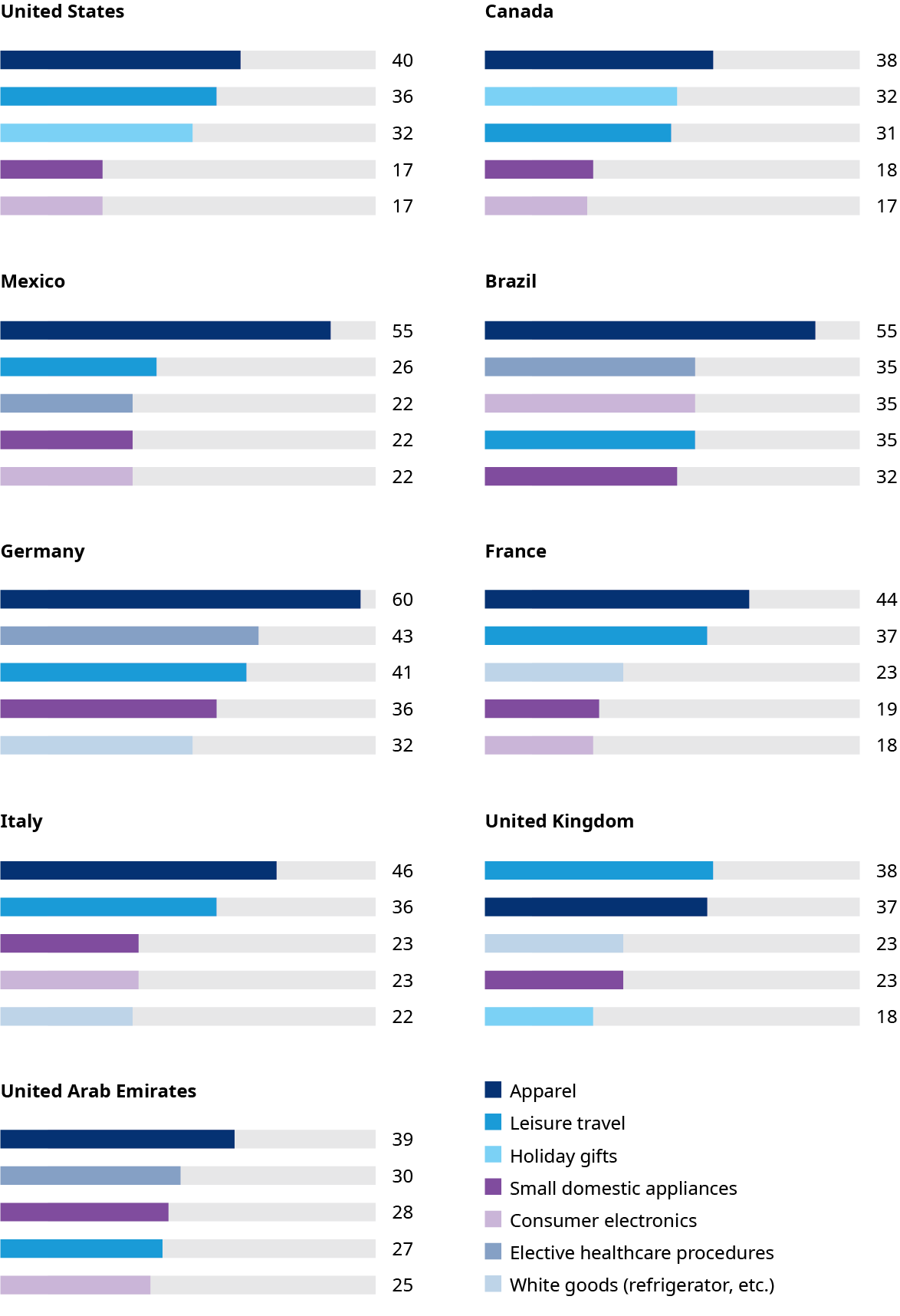

Consumers are also adapting their purchases of discretionary goods. While shoppers are willing to accept stronger cutbacks for some product categories due to inflationary concerns, there are exceptions. Interestingly, apparel remains relatively resilient, with nearly half of respondents stating they will continue to spend as before.

Leisure travel is also valued highly. After the prolonged period of restrictions, lockdowns, and uncertainties during the pandemic, many people seem unwilling to accept inflation-driven cuts to their spend on traveling.

Looking at some regional differences: Consumers in North America are less likely to adjust their spending on holiday gifts, while European consumers say they will continue to purchase white goods. Overall, customers are now thinking much more carefully about whether and how much they are willing to spend on furniture, cars, and home renovations and, if necessary, may postpone their purchase to a later point in time.

Exhibit 2: Ranking of non-essential goods during recession, Oliver Wyman Forum consumer survey 2023

Source: Oliver Wyman analysis

Need for action for retail and consumer goods companies

Inflation effects on spending will remain severe in the short term, particularly in those categories where consumers are more price-sensitive and willing to adapt their spending patterns, such as furniture, cars, home renovations, and white goods (see Exhibit 2). This challenging economic landscape presents a unique opportunity for retailers and manufacturers that possess superior value-for-money offerings and a commitment to leading cost efficiency. To capitalize on this dynamic, these businesses should proactively undertake a strategic review of their product range and pricing strategies. For instance, they could consider implementing targeted price reductions for a limited period. Retailers could optimize their private label product selection to attract customers who are looking for cheaper options. By embracing such approaches, businesses can position themselves not only for short-term market share growth but also for lasting customer loyalty and competitive advantage.