Evolving consumer behaviors

How Healthy Benefits Programs Can Be A Boon For Retailers

By Mathieu Barthelemy, Beth Costa, and Bobby Gibbs

It is a rare thing for a multibillion-dollar market to fly under the radar. In many ways though, healthy benefits programs are an example of just that. Retailers who understand this rapidly expanding market can tap into new pools of “found money” for their customers and grow sales.

What are healthy benefits?

The term “healthy benefits” refers to pools of money made available to consumers to spend on health and well-being through public and private funding. Some of the programs funding healthy benefits have been around for decades, but new ones have rapidly proliferated in the last five years. Taking note of increased consumer awareness of these programs, insurers and employers are expanding their offerings.

In the US, healthy benefits are a large, fast-growing market. Based on an analysis of government records, Oliver Wyman estimates it reached $200 billion in 2023. The range of programs includes the following:

How can retailers use healthy benefits programs to their advantage?

Market forces are reshaping the healthcare benefits industry and creating tailwinds for retailers that accept healthy benefits cards and carry covered products and services. Insurers are expanding the breadth of plans and supplemental benefits they offer, as well as aggressively marketing them directly to consumers. According to a report from the US Government Accountability Office, this year 99.9% of Medicare Advantage plans offer supplemental benefits, compared with 73% in 2019. Retailers are also enabling consumer demand by investing in health and wellness capabilities and offering their own branded healthcare plans.

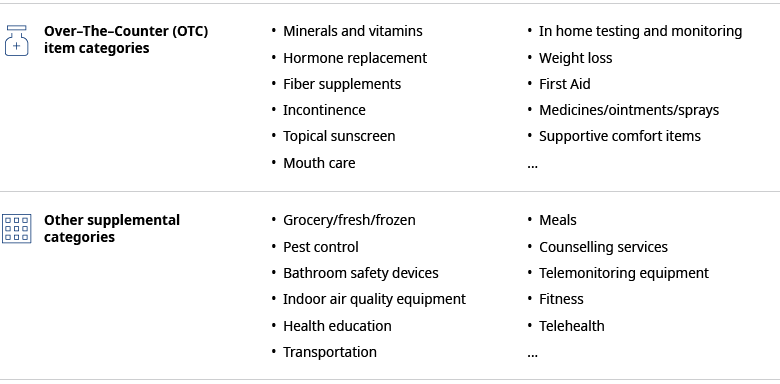

Unlike traditional insurance-funded healthcare and pharmacy transactions, which are processed as business-to-business payments, consumers pay for healthy benefits at the retail checkout. Account funds are typically accessed through “restricted” or “filtered” payment cards, which may flow through either open or closed-loop payment networks.

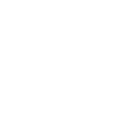

Exhibit 1: Example benefit categories

Allowances for healthy benefits may cover a variety of items found in nearly every grocery store, such as food and over-the-counter medicines. These supplemental benefits may also cover general merchandise categories that range from fitness equipment to transportation services and even pest control.

Source: Oliver Wyman analysis

Funding for these monies primarily comes from federal or state government agencies, private insurers, employers, and employees setting aside pre-tax funds for their health-related expenses. In some instances, Medicare Advantage plan providers may get government funding in addition to the enrollment fees paid by consumers.

How do healthy benefits work?

Accepting healthy benefits cards unlocks many benefits for retailers:

- Creating a more seamless checkout experience by reducing consumer confusion at the point of purchase.

- Delighting customers by helping them access “found money,” so that they can pay for the things they need.

- Driving sales by growing accessible wallet and customer basket share.

- Engaging with health plans to attract investment toward retail-oriented healthy benefit spend and unique solutions for consumers.

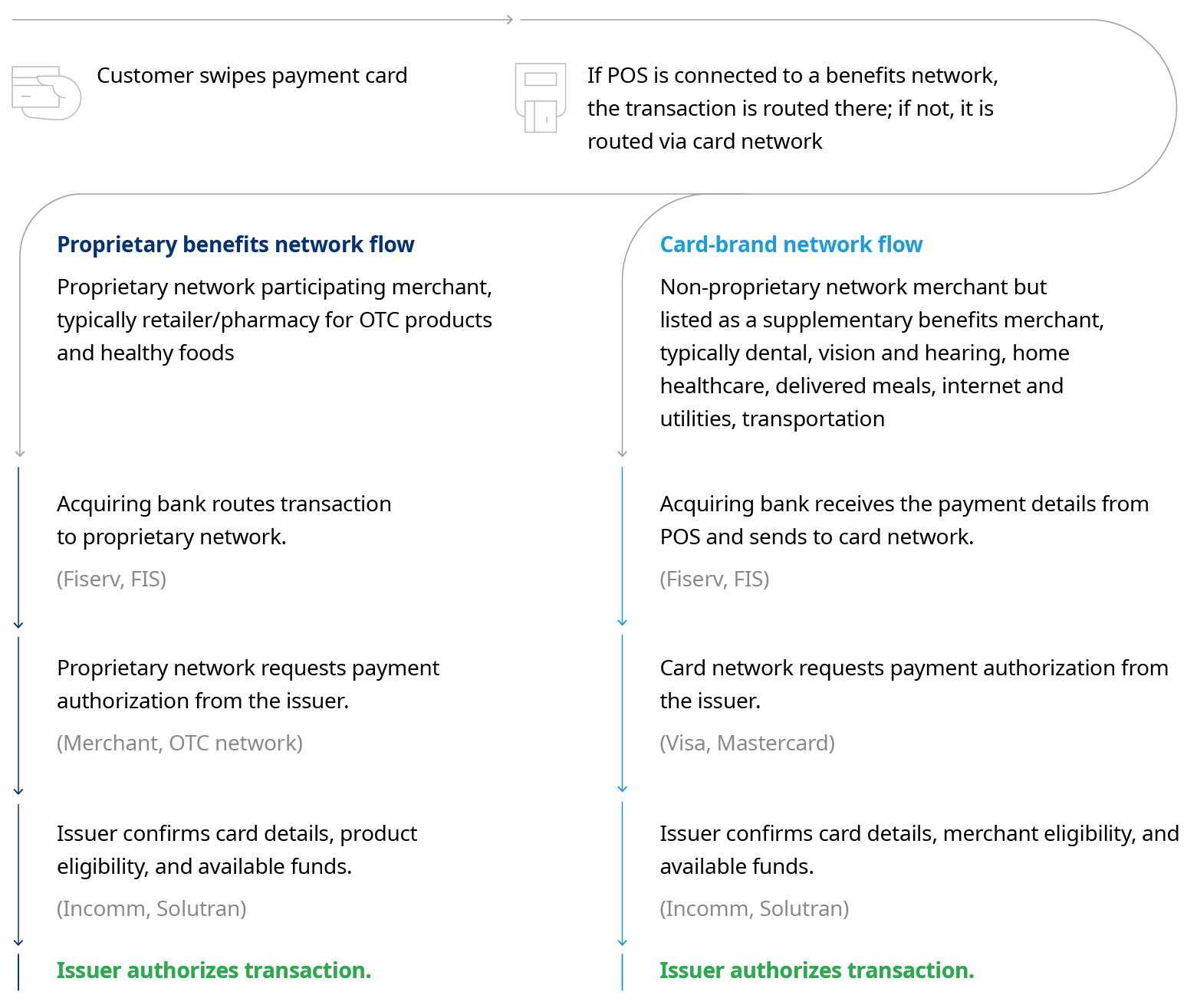

Most healthy benefits programs consist of three basic components: program set up, consumer enrollment and card activation, and shopping. In the program setup, benefits are defined, funded, and communicated to members. Once consumers are enrolled, they receive an account with healthy benefit dollars and a card to access these benefits that they must activate. Consumers are then ready to shop at retailers, but their purchases must satisfy a series of filtering conditions to successfully check out.

Most healthy benefit programs require the retailer to be authorized to accept their card. Authorized retailers’ point-of-sale (POS) systems review the items and approve or adjudicate them if they’re covered by the consumer’s plan. Finally, if there is sufficient funding in the consumer’s healthy benefit account to cover the approved items, payment is processed. Different types of programs, branded card programs, and payment network types drive various types of transaction flows and purchasing permissions.

With purchases using HSA or FSA accounts, items are filtered at the POS and payment is processed through the normal payments flow (See Exhibit 2). FMI members are likely familiar with these transactions and retailers may already be receiving an electronic list of eligible items directly from SIGIS.

Exhibit 2: HSA and FSA flow

Source: Oliver Wyman analysis

For Medicare Advantage, similar activities are performed but often with different partners and processes — and with greater complexity because the filtering often occurs outside a retailer’s POS, requiring data transfers (see exhibit 3).

Exhibit 3: Medicare Advantage flow

- Signs up for program; initially contacts with program questions.

- Initially markets and enrolls member in program; communicates eligible benefit categories.

- Supports program partner and member with outsourced services.

- Curates approved product list (APL).

- Markets program and provides customer servide on behalf of program partner.

- Sends names and benefit information of members for issuer/processor to store.

- Issues card; mails card to embers.

- Activates account by calling the number on card.

- Shops at designated retailer and uses card at checkout.

- Approves transaction.

Source: Oliver Wyman analysis

Recently, dual network cards have debuted. This model could increase transaction acceptance but also create consumer confusion at checkout. The same card works on two payment paths: open-loop and closed-loop. The open-loop flow acceptance is based on a merchant’s eligibility. The closed-loop flow requires product-level adjudication. For retailers that sell a mix of eligible and ineligible products, transactions may be denied based on their merchant code if the retailer cannot also adjudicate specific items within the basket.

What challenges do retailers face in accepting healthy benefits payments?

Retailers face multiple challenges with healthy benefits cards. First, retailers and their third-party processors may not be familiar with the bank identification numbers (BINs) associated with this card to be able to identify the issuer. They may be unable to accept payments from customers due to incompatible equipment and multiple issuer/processor interfaces, making it harder to implement the necessary integrations. These difficulties lead to frustrated customers and lost sales for retailers, sometimes to competitors.

There is also a lack of clarity on eligible items due to inconsistent approved product lists of the various issuers and programs and confusing eligibility, leading to retailer concerns over violating program policies and the potential for enforcement and negative PR. Processing costs and interchange fees may significantly exceed those of other open and closed-loop networks. Lastly, retailers must try to keep informed about the wide range and volume of public and private programs with their own rules, players, and increasingly hard-to-negotiate acceptance costs when engaging consumers and network partners. Retailers may want to understand the potential volume of available customers in their operating areas before investing in changes needed to accept particular cards/benefits.

Retailers recently surveyed by Oliver Wyman and FMI agree that accepting healthy benefits cards is not a pain-free experience. In a 2023 survey, retailers reported a variety of technical issues, from lack of POS integration to network outages. They also refer to a wide range of technology partners, signaling confusion over whom to reach out to for help or additional information regarding acceptance challenges.

What can retailers do to maximize value from healthy benefits?

In an ideal world, these pain points would not exist. Unfortunately, there is no simple solution that ensures universal, seamless acceptance cost-effectively. However, there are potential plays that can address these challenges.

One of the most common issues retailers face is a customer’s card being declined and the cashier not knowing why. In such a situation, the retailer could provide a simple triage process for potential reasons for the transaction issue, including:

- Tasks for the cashier: Match bugs on the card to accepted bugs, check for bugs that indicate a dual network card, call a store manager.

- Tasks for the manager: Confirm none of the common issues is the cause of transaction denial.

- Escalate to a central call center: Retailer’s Third Party Processor (TPP) may need to triage to ensure acceptance of the card BIN and adjudication.

For some retailers, this might be the right solution, for others simply denying payment if the volume of the cards is small or the complexity/cost of acceptance is high or providing even more education for the cashier to complete the transaction could be the right balance.

EVOLVING CUSTOMERS BEHAVIORS

Supporting Consumer’s Nutrition And Health Needs

Read More

Likewise, the solution to many of the other challenges requires a retailer-specific strategy. No one solution to any challenge is appropriate for everyone — all involve choices about strategic and financial tradeoffs, payment partnerships, and the technical infrastructure supporting the retailer’s stores.

Ultimately, healthy benefits cards make healthy choices more accessible for consumers and open a new volume of spend for retailers, but their potential may remain unrealized for retailers who are unable to address the attendant challenges.

Evolving Customers Behaviors

Supporting Consumer’s Nutrition And Health Needs

FMI — The Food Industry Association

Consumers are increasingly focused on nutrition and health, and the food industry has multiple opportunities to address this evolving consumer trend.

Healthy eating has advanced as a priority for shoppers in the past year, even as they are following somewhat less strict dietary approaches. Thirty-one percent of shoppers say they put a lot of effort into selecting nutritious and healthy options, up from 28% a year ago, according to FMI’s 2023 U.S. Grocery Shopper Trends research. When asked about the most important attributes in their primary grocery store, 41% pointed to the availability of nutrition and health information.

Food as Medicine an Emerging Opportunity

With more consumers interested in connecting the science of food and nutrition to overall health, the Food as Medicine opportunity in the retail setting is growing in importance. FMI’s board policy statement supports how Food as Medicine programs are defined by the Academy of Nutrition and Dietetics. Food as Medicine program models executed at the grocery store show both improved health outcomes and return on investment. These models include:

- Prescription programs, including produce prescriptions.

- Incentive programs, such as coupons and vouchers.

- Medically tailored nutrition, including medically tailored meal programs.

- Path-to-purchase marketing, such as signage and nutrition attribute labeling.

- Personalized nutrition education, including classes and health screenings.

Health Lines Up with Consumers’ Value Notions

The word “value” often evokes price, but increasingly consumers are exhibiting additional notions of value when it comes to food and beverages, according to Trends. Shoppers are eying factors including quality, relevance, experience and convenience in considering value. Quality reflects personal food standards and eating aspirations. It includes attributes around freshness; cues of minimal processing; health and nutrition; product sourcing; and ethical considerations such as sustainability and labor standards.

Food Stores Viewed as Strong Health Allies

Shoppers continue to place their trust in food stores to support their personal goals to stay healthy. In fact, trust in their primary food store has increased for this factor — up four percentage points from the prior year.

The food industry has growing opportunities to further showcase the grocery store as an ideal place to leverage registered dietitians and spotlight the role food can play in preventing disease and improving health.

Exhibit 1: Effort in Selecting Nutritious and Healthy Options

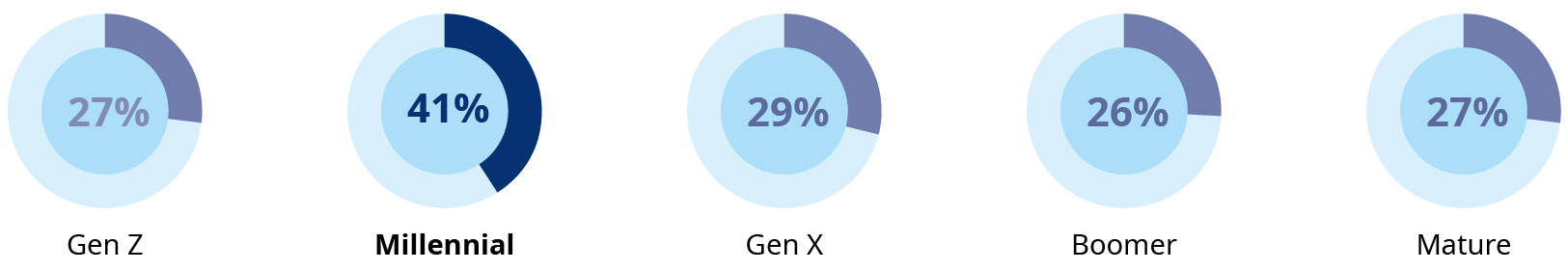

Generationally, Millennials continue to put the greatest effort into shopping to eat healthy

Source: FMI, US Grocery Shopper Trends, 2023