A broad range of manufacturers has begun offering pay-per-use models to customers. One example is a compressed air and vacuum products manufacturer offering customers a fixed price per cubic meter of compressed air; another is that of a printing press manufacturer charging for use of his press by the printed page. Even outside of production equipment, we see the spread of pay-per-use models: An elevator manufacturer has offered to maintain ownership of its elevators and charge the customer a variable annual fee based on usage, promising lower total costs.

While some equipment manufacturers are employing pay-per-use models as a way to lock in customers - and maximize revenues over the product life cycle and generate steady cash flows - others are focusing on new customer acquisition or in broadening their offering to a new clientele.

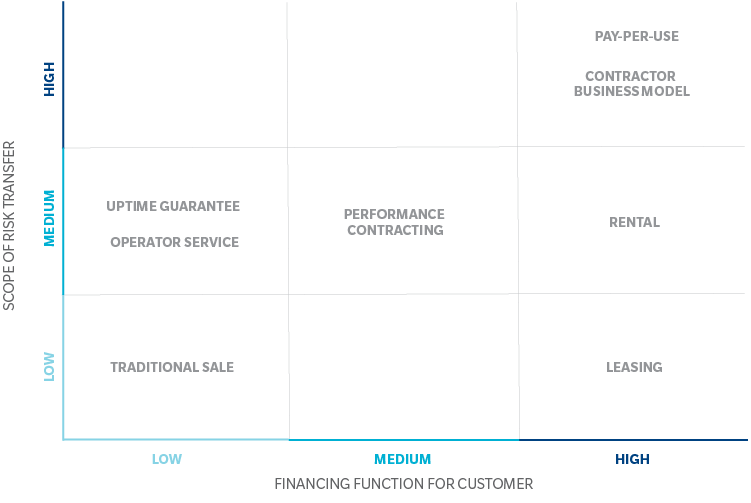

Exhibit 1: Classification of pay-per-use and related business models from an equipment manufacturer’s point of view

Source: Oliver Wyman analysis

WHAT PAY-PER-USE REALLY IS

In a classic pay-per-use model, the user of a piece of industrial equipment does not purchase and own the product. Instead, customers pay a fee that depends on usage and is measured according to clearly specified consumption, output, or other indicators, which nowadays are more easily controllable through sensors connected to the IIoT.

From an economic standpoint, the industrial equipment pay-per-use model solves two issues facing users: Firstly, it addresses the issue of financing (equipment users do not invest upfront but pay later, typically from operating cash flows generated by using the equipment); and secondly, it is a risk transfer mechanism from equipment user to equipment maker, especially with regard to operational risk (having the machine available, and running it at performance and at cost) and business risk (the risk of machine under-utilization when orders and demand fall below expectations).

Pay-per-use is not a new concept. Well before the emergence of the Industrial Internet-of-Things, models had arisen to satisfy customer demand for such comprehensive financing and risk transfer. Think of contract manufacturers that have taken over assembly tasks in the electronics industry, or of “bottlers” that are contracted by beverage brands to fill and package their drinks.

Models similar to pay-per-use have also been used in very specific situations, including mission-critical components with a high up-time requirement such as aircraft turbines or valves for petrochemical plants. Lastly, de-facto pay-per-use models also exist for systems businesses in which the manufacturer of a machine captures most of the value through the sale of related consumables such as cartons for drinks or paper and ink cartridges for printers.

Also, the offline world has solutions on offer when only elements of a pay-per-use model are required, such as leasing or other vendor financing solutions to meet the need for financing or operator models where equipment makers run the machinery for the owner as a service, as was popular in the automotive industry a few years ago.

THINK TWICE–OR ELSE IT IS NOT ALL RIGHT

So, when contemplating the entry into IIoT-enabled pay-per-use models, equipment manufacturers need to ask themselves: Is the customer’s problem being solved in a better way than through existing solutions? Is the manufacturer better positioned than the customer to carry the utilization and operational risks? Is the customer ready to share the necessary data and relinquish a measure of control? Is the customer willing to pay a premium for the manufacturer’s assumption of risk? Will the service usage generate enough income for hardware amortization within a reasonable timeframe? (See Exhibit 1.)

Most certainly, utilization risk represents a key concern. Many pay-per-use models seek to exclude or hedge this risk by putting a minimum-order clause in the contract, thus making these models less attractive for customers. Equally, managing the operational risk can be challenging, as machinery output depends not only on technical performance, but on other input factors such as the quality and availability of materials, the skill-level of the machine operator, and the effectiveness of production planning. This can lead to conflict between the equipment maker and the user, as controlling all these factors by IIoT means is not possible. Therefore, additional efforts of the equipment maker are necessary, such as placing their own machine operators, making the solution costlier and more complex and further blurring the boundary between the equipment maker’s and the user’s business.

These examples show that the answers to the questions we posed are not straightforward and that a detailed analysis is needed to grasp the prerequisites of a successful pay-per-use model.

NO HOPE FOR PAY-PER-USE?

While we have highlighted the various obstacles to pay- per-use, there are areas where it can yield value. With its low supply cost and high contribution margin, machine software leads the list. Software can be delivered through the internet and has practically no incremental cost associated with each new installation. Once a piece of software has been developed, any new user won through a pay-per-use approach generates additional margin. Another promising model may be to implement pay-per-use models for certain machine features that exhibit software-like characteristics. An example is measuring machines or painting machines,for which the customer can temporarily “unlock” and run special programs on-demand. Other attractive pay-per-use applications comprise features that the customer needs occasionally or processes that have an auxiliary function and are not part of the business’s core competencies. Moreover, advantages over offline solutions can be sustained where IIoT connectivity truly adds value and helps control more variables than in the offline world (for example through smart sensors on complex tunneling equipment that operates in tough environments, is prone to breakdown, and is difficult to control).

Lastly, pay-per-use models can be useful in bringing innovative machinery to the market because they lower the entry hurdle for customers and essentially represent a “gain-sharing” agreement between equipment makers and users, where the equipment manufacturer is only paid in full if the equipment delivers on the promise of innovation.

In summary, IIoT-enabled pay-per-use models make sense in certain specific circumstances. Often, they do not fundamentally change the equipment maker’s ability to take over the associated risks, nor do they alter the underlying economics and business logic of an equipment maker vs.an equipment operator business model. It is likely we will see fewer equipment manufacturers successfully adopting a pay-per-use model than some industry experts currently believe. Is pay-per-use the future in machinery pricing? The short answer is: No.