This is a FMI authored article.

The proverbial question regarding the chicken and the egg tends to focus on which came first. For food retailers, however, the issue is entirely different – particularly when considered within the context of an animal advocacy campaign highlighting this aspect of the food animal production system.

Recently, retailers have found themselves in the cross-hairs of animal advocacy groups regarding two poultry-related production issues: cage-free eggs and slow-growing broiler chickens. The advocate positioning on these topics is often based on optics, where the perception is contrary to the reality. Their view, moreover, tends to be rather myopic, seldom taking into account all the considerations and implications.

In the case of egg-laying hens, advocates may support a housing system that appears better but ultimately may not offer the best protection and safety for the bird; will likely escalate food safety issues; prove riskier for workers; have disadvantageous environmental impacts; and will be costly for egg producers to build and maintain. Appearances aside, advocacy positions on animal welfare issues are often not based on the best science of animal husbandry. Pressure campaigns by advocacy groups are laser-focused on getting the retailer to commit to a position that ultimately restricts consumer choice.

Such pressures offer sub-optimal conditions for decision making. Food retailer positions on issues such as animal housing system and production methods must carefully be considered, weighing all the factors: animal comfort, food safety, worker safety, and system costs. In addition, the retailer must keep in mind the ultimate impact on customers. As the purchasing agent for the consumer, retailers must be cognizant of the level of their customers’ knowledge, beliefs, and willingness to pay for the production attribute being advocated.

This is especially relevant since activist demands rarely, if ever, contain funding plans for a seamless transition to new production methods, meaning that the cost burden is passed along to the consumer. Also, activists often fail to include contingencies for how their position affects low income and Supplemental Nutrition Assistance Program (SNAP) and Women, Infant and Children Assistance Program (WIC) customers. Cage-free eggs, for example, are not eligible for SNAP purchase in many states. If that is the only option available, SNAP customers will miss out on this important source of protein or else the retailer must take on the rigorous task of getting SNAP eligibility and approval for cage-free eggs.

Knowing that retailers must keep both the economic and ethical needs, wants, and preferences of their customers in mind, the FMI Foundation recently joined forces with the Foundation for Food and Agriculture Research and the Animal Agriculture Alliance to fund consumer research exploring the topic of consumer attitudes regarding cage-free eggs and slow-growth broilers. Jayson Lusk, Ph.D., a food and agriculture economist at Purdue University, led a research team that embarked on two separate studies at the end of 2017: one surveying 2,000 egg consumers regarding their egg purchase thoughts and practices and another surveying 2,000 chicken consumers regarding their understanding, preferences and willingness to pay for slow-growth broilers.

Trying to recreate a scenario that consumers may face in their local grocery store, the study asked respondents to make a series of choices among products that varied in price and other attributes: production practices (cage-free, pastureraised, slow growth, and conventionally raised), labeling claims, packaging, product color, and appearance. The objectives of the two studies were to determine consumer awareness:

1. Knowledge about cage-free eggs and slow-growth broilers

2. Beliefs about the adoption of cage-free eggs and slow-growth broilers on animal welfare, retail prices, producer profits, environmental impacts, and the trade-offs among these issues

3. Willingness to pay for cage-free and slow-growth attributes relative to other egg and broiler characteristics that may be of importance

4. Responsiveness to information about production practices The findings from this research were shared with key food and agriculture stakeholders to inform decision making on these issues in the retail setting.

The cage-free egg issue

In recent years a significant number of restaurants, foodservice providers, and food retailers have made public commitments to move to a cage-free egg supply by 2025. Currently, just shy of 17 percent of the egg industry house their hens in cage-free housing systems, and this number includes certified organic eggs, which require a cage-free housing system. That is about 52 million layers out of a 310-million egglaying population. To meet the demands of the current pledges, about 240 million layers would need to be housed in cage-free systems. This would require more than half of the egg production industry to completely convert housing systems in less than seven years.

From the consumer perspective, there is also an added economic burden with cage-free eggs. In March 2018 the cost of conventionally housed eggs was about 12 cents an egg or about $1.44 a dozen. The cost of eggs produced in cage-free housing was about 20 cents an eggs or about $2.40 a dozen. While activists argue that the cage-free costs will go down when the systems become more prevalent, they fail to factor in that the costs of building all these new systems will have to be recouped (pun intended) by the egg farmer—and that means a higher-priced cage-free egg.

General consumer beliefs about egg consumption

Survey results substantiate why eggs are considered such a popular, customer– attracting grocery commodity. Almost nine out of 10 consumers agreed with the following statements: eggs taste good, eggs are affordable, eggs are easy to cook, and eggs are healthy. However, only three out of 10 consumers agree with the statement egg-laying hens are well treated. This low consumer perception regarding the treatment of egg-laying hens is an area of vulnerability and likely accounts for why many retailers felt the need to support the move to cagefree housing.

Our research findings regarding the consumption rate of eggs point to a very stable product, with 53 percent of survey respondents indicating their egg consumption has remained the same over the past five years, 41 percent saying theirs has increased, and only 6 percent stating they are consuming fewer eggs.

The egg choice experiment; the consumer willingness to pay for attributes

Through the online survey instrument, participants were given 12 opportunities to choose between two cartons of eggs, each carton bearing different combinations of label claims and offered at various price points. (See Exhibit 1.) From this information, we were able to extrapolate the market share power of each label claim and the amount consumers were willing to pay for each attribute. To our surprise, the most sought-after attribute was non-GMO with a median score indicating that most were willing to pay just shy of 50 cents more per dozen for non-GMO eggs. The next most preferred attribute was organic, followed closely by the Omega 3 enhanced claim: Both attributes had a median score signifying that most would be willing to pay a bit more than 30 cents more a dozen for these products.

The cage-free claim came next with most indicating a willingness to pay right at 30 cents more per dozen for this attribute. You may recall, the current differential is just shy of a dollar more per dozen for cage-free eggs. It is noteworthy that the cage-free claim had the largest mean differential, meaning a wider range of scores on the willingnessto-pay (WTP) scale. For instance, a strong majority were on one end of the spectrum in the 0 to 40 cents more a dozen WTP range, while 25 percent were on the other end of the chart in the greater than $3 WTP category. This indicates that for some customers the cage-free attribute is very important, but the number of customers holding such a deep-seated conviction is low. Given the low scores in the middle of the WTP range, consumers either care a great deal about this issue or not much at all. There are not many for whom it is a lukewarm conviction. For now, and the foreseeable future, it appears that the majority of shoppers would pay a maximum of 40 cents more per dozen for cage-free eggs.

Exhibit 1: The egg choice experiment: Consumer willingness to pay for attributes

Source: FMI analysis

The egg choice experiment: consumer responsiveness to information

Survey respondents were divided into four equal groups: one group served as the control group and was given no preparatory information about cage-free eggs prior to making their attribute choices; the remaining groups were respectively given information that either supported cage-free housing, was basically neutral, or offered a mildly contrary opinion about the benefits of cage-free housing. In the final analysis, the information shared did not appear to make much difference in respondent opinion and willingness to pay for the cage-free attribute. This low receptivity to information indicates most consumers have already made up their minds regarding the cage-free issue.

The egg choice experiment: effects of limited choice

One other noteworthy finding was how removal of conventional eggs altered the share of consumers choosing to refrain from buying eggs. In each of the 12 egg choice scenarios, consumers were provided the option of “if those were my two choices, I would not buy eggs that day.” In the scenario where both conventional and cage-free eggs were available, only 4 percent of the respondents chose the “no purchase” option. However, in the scenario where only cage-free was available, 17 percent opted for “no purchase.” It appears that restricting or limiting consumer choice would have an adverse effect on egg purchase. What is not clear is how long-lasting or far-reaching that effect would be.

Consumer beliefs regarding cage-free eggs

Survey participants were asked to evaluate the various attributes – organic, cage-free, all-natural, non-GMO, Omega-3 enriched – across the five categories of Animal Welfare, Cost, Healthiness, Safety, and Taste. Consumers gave certified organic the highest marks in cost, healthiness, and safety. They gave cage-free the highest score in the animal welfare category, indicating that most consumers believe the cage-free housing system to be most beneficial for the comfort and well-being of the egg-laying hen.

Summary of the key findings regarding cage-free eggs

Price remains the most significant driver when it comes to the purchase of eggs, and this should be a matter of concern for those companies who have made a cage-free-only commitment. Though there is room for the cage-free market to grow, it will likely never reach majority market share. While a few shoppers are willing to pay a significantly higher price for cage free eggs, as already noted, the strong majority indicate their willingness to pay for cage-free tops out at 40 cents more a dozen.

This is significantly below the current near-dollar more difference between cagefree and conventionally raised eggs.

Consumers apparently feel well informed about cage-free eggs, have established viewpoints on the subject, and are not particularly receptive to new information.

Broiler chickens – the issue

In 1957, the average broiler chicken weighed only 905 grams. By 2005, due to improved breeding, better feedstock, and enhanced poultry care, the average boiler weighed 4,202 grams. To be clear, this dramatic increase in average broiler weight was not the result of genetic modification, but rather natural breeding and better feeding. Some have pointed to this 364 percent increase in average broiler weight as resulting in birds with legbone disorders, unable to support their own body weight, and incapable of displaying natural bird behaviors such as roosting.

Activists have contacted restauranteurs, foodservice providers, and food retailers urging them to commit to standards that – among other things – support the exclusive use of slower-growing breeds of broiler chicken.

The broiler chicken survey

As was the case with the egg survey, the 2,000 participants in the broiler chicken study were asked a series of questions about general consumption habits; inquiries gauging their understanding of industry practices; questions accessing their beliefs about various label attributes; and finally, their options in 12 separate choice tests of packaged chicken breasts, bearing various label attributes and offered at differing price points.

General consumption of broiler chickens

Survey scores registering general consumer opinions about broiler chickens revealed favorable shopper views on the taste, affordability, healthiness, and preparation ease of today’s pullets, with all these areas recording “agree” scores in the mid 80s to low 90s. The chicken is sustainable score of 69.8 percent was obviously lower, and the all packages of chicken taste about the same score of 46.5 percent strongly disagreeing with the statement and only 32 percent agreeing, raises the specter of consumer concern about consistent quality of broiler meat. However, an area of vulnerability for the broiler industry is revealed in the response to the statement: Meat producing chickens are well treated. Only 28 percent of consumers agreed with that statement, while 26.6 percent said they disagreed with it.

Consumer consumption of broiler meat appears very stable, with almost half of the survey respondents indicating their chicken consumption rate has remained the same in the past five years, 47 percent stating it has increased, and only 4 percent recording that they’ve decreased their chicken servings.

Willingness-to-pay results of the broiler chicken choice tests

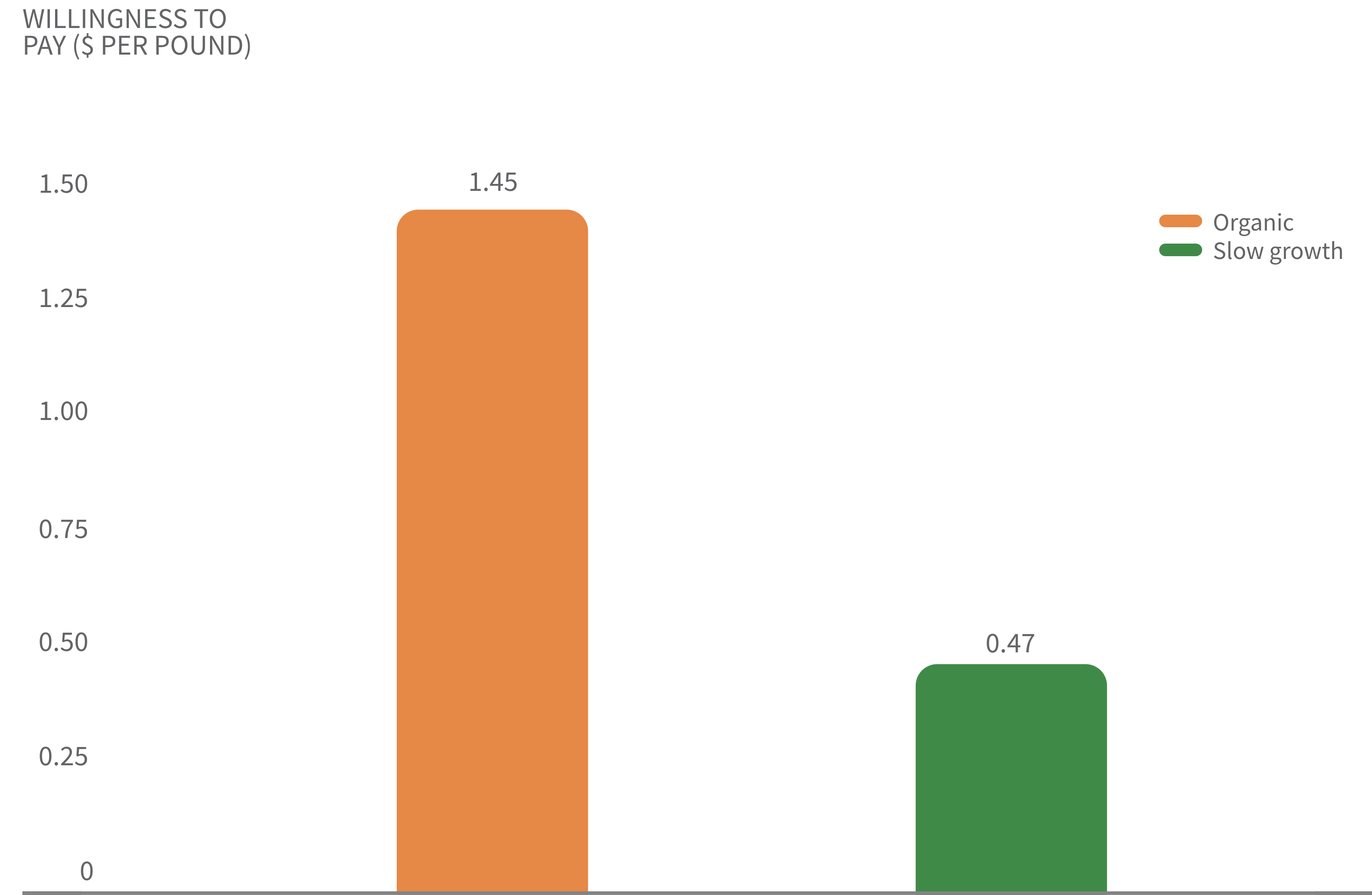

Analysis of the willingness-to-pay (WTP) for slow-growth broilers reveals a limited range of conviction about this concern, with few revealing deep-seated opinions about the issue. Just over a quarter of consumers indicated they would pay between 0 and 20 cents more a pound for slow-growth broiler meat. Almost 30 percent recorded they would pay between 60 and 80 cents more a pound for a slow-growth product, and the WTP span taps out at $1, with just over 40 percent saying they’d pay that additional amount per pound for the slow-growth attribute. Comparing those numbers to the more than 35 percent who indicated they’d pay up to $3 more a pound for organic chicken reveals a concern that is still in its infancy, with limited committed subscribers. (See Exhibit 2.)

Consumer responsiveness to broiler information

Cross-analyzing the willingness-to-pay results with each group’s exposure to preparatory information further substantiates that the broiler issue is in the early stages of development. Comparable to the egg survey methodology, the broiler survey respondents were broken into equal groups, with one group receiving no information, the second group receiving pro-slow growth information, and the third group being exposed to an antislow-growth infographic.

The results were telling, showing that consumers are receptive to information about this concern and that their opinions are far from being settled. Among those who saw the anti-slow growth infographic, 100 percent registered a WTP of less than 40 cents a pound more for slow growth broiler meat. It should be noted that this was the choice bearing the least amount possible. Among those receiving no previous information, almost 30 percent recorded a less than 40 cents a pound willingness to pay and 70 percent indicated they would pay between 40 cents and $1 more for a pound of slow-growth broiler meat. Those who were presented pro-slow information split almost evenly to into two groups: those whose WTP capped out at $1 more per pound and those willing to pay more than a $1 more per pound.

Very seldom in research is the data so clear, but the results here can’t be confused. Whatever information the respondent was given – either pro or con – was persuasive and shaped their responses.

The relative importance of broiler chicken attribute labels

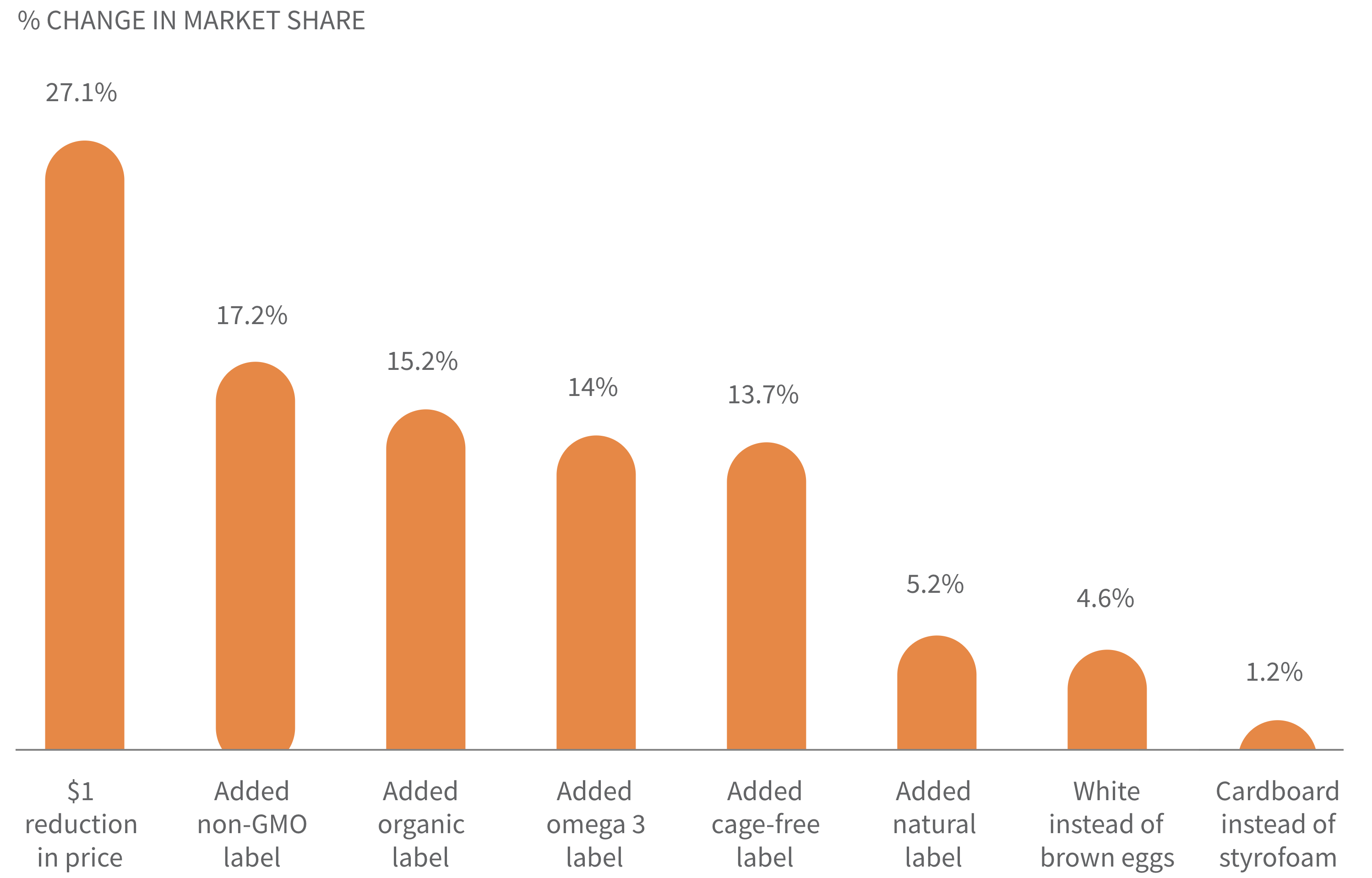

Interpreting the impact on market share of the various labeled attributes creates the pecking order of consumer preferences. The attribute with the greatest market share impact was $1 reduction in price; addition of non-GMO label was a distant second; organic and nohormone label almost tied for third; and the slow-growth label trailed in fifth place but was kept out of the cellar by the no antibiotics attribute, which came in sixth.

As could be expected, regardless of the information they received, the market-share percentages deceased as the price increased for slow growth broilers. The most dramatic plummet came in the no-information group: If there was no cost difference for slow growth broiler, about 60 percent indicated they would choose it; however, as the price rose, that number steadily declined, with only 30 percent saying they would select slowgrowing broilers if the option was $1 more per pound.

The telling results of the broiler chicken belief questions

Survey respondents were asked a series of questions meant to test their knowledge of broiler industry production practices. The results reveal a startlingly huge opportunity for the chicken industry to improve consumer awareness of broiler handling and care practices. Fewer than 3 percent of those surveyed knew that all broilers produced in the U.S. are raised in a cage-free housing environment. Only 12 percent were aware that meat producing chickens in the U.S. are NOT fed added growth hormones. When asked, “How long does the typical meat producing chicken live”, the most frequently picked answer was about 12 weeks, which is twice the six-week life span of the average broiler.

Perhaps the most revealing results came when consumers were asked to evaluate the organic, no-antibiotic, all natural, non-GMO, no hormones added, and slow-growth claims according to these qualities: healthiness, cost, taste, safety, and animal welfare.

For the control group, organic outpaced the other attributes, taking top scores in the healthiness, cost, safety, and animal welfare categories. This group also rated the slow-growth attribute as last in the healthiness, taste, cost, and safety categories and only granted it a third-place position as providing better animal welfare for the broilers.

However, there is a different story among the group exposed to the pro-slow growth information that touted the better animal welfare features and improved taste qualities of the slow-growth attribute. This group rated organic highest in the cost and safety categories, but in line with the information they had been given, the group named the slow-growth chicken as the top vote-getter in the taste and animal welfare categories.

Exhibit 2: The broiler chicken choice test: Consumer willingness to pay for slow-growth broilers

Source: FMI analysis

Summary of the key findings regarding slow-growth broilers

When it comes to broiler purchase decisions, price remains the significant driver for most consumers.

Significantly, the consumer has a low level of knowledge about broiler production in general and is particularly unfamiliar with slow-growth chickens. The research conclusively shows that consumer choices and willingness-to-pay for slow-growth are sensitive to information. All indications are that the consumer is something of a blank slate regarding broiler production practices and will be swayed by whatever compelling case they are exposed to.

Finally, most consumers do not currently have a positive disposition toward slowgrowth claims. It simply is not a term that resonates with the most shoppers or holds positive animal welfare connotations for them.

Conclusion

The chicken and egg issues for the food retailer remain far more complex than simply a matter of which came first. The research funded by FMI Foundation, the Foundation for Food and Agriculture Research, and the Animal Agriculture Alliance regarding consumer perceptions of cage-free eggs and slow-growth broilers point to a number of complicated chicken and egg considerations, the top two being.

- Retail companies that have made a cage-free only commitment should take a serious look at the fact that the cage-free egg market may never reach majority market share

- The current low level of consumer awareness regarding broiler production is an open opportunity to inform shoppers about all the considerations that must be explored in determining a position about slow-growth chickens

When considering such complicated issues as animal housing systems and production methods, food retail decisions must carefully view the concern from multiple vantage points. This process is made more difficult when facing pressure from activist groups, but the many different perspectives of animal comfort, food safety, worker safety, system costs, supplier consequences, and the ultimate cost and effect upon their customer should all be factored into the retailer’s decision-making equation.