The past three years have seen an unprecedented level of inflation, leading to price increases that far surpass any in the previous decade. This environment puts fast-moving consumer goods (FMCG) brands at a crossroads today: Although many have managed to maintain revenues and margins by passing on significant price increases, it has come at the expense of volumes, with consumers “trading down” to lower-priced products, in particular, private label; reducing consumption; or even exiting some nonessential categories. There is also increasing regulatory pressure in Europe to maintain price parity across markets, which threatens manufacturer business models. This article provides more context and suggests actions to consider based on our experience working with manufacturers during the past decades.

Grocery value trends favor lower-priced goods

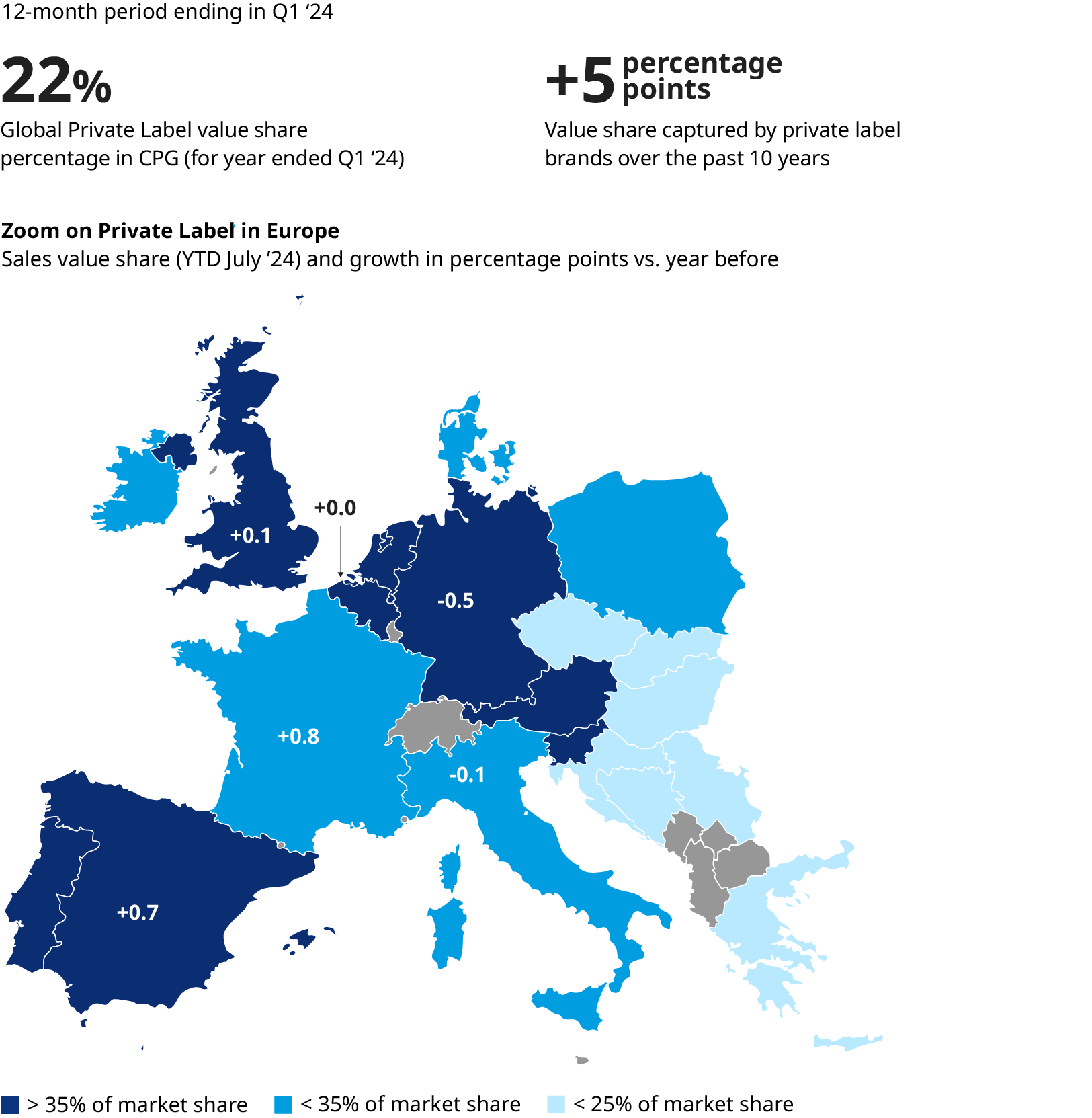

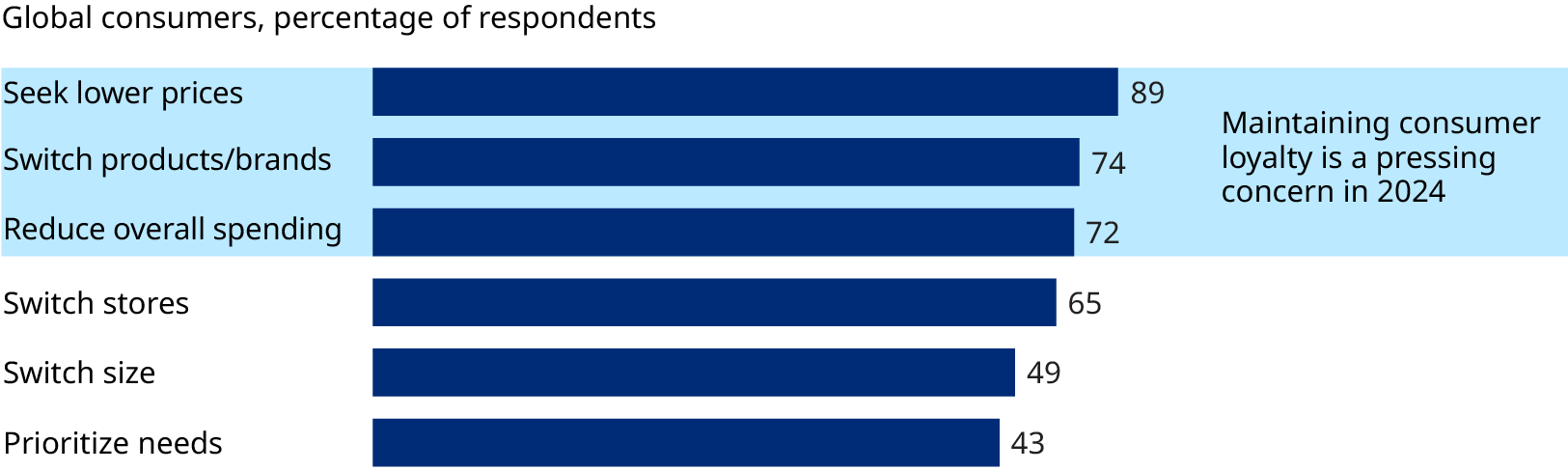

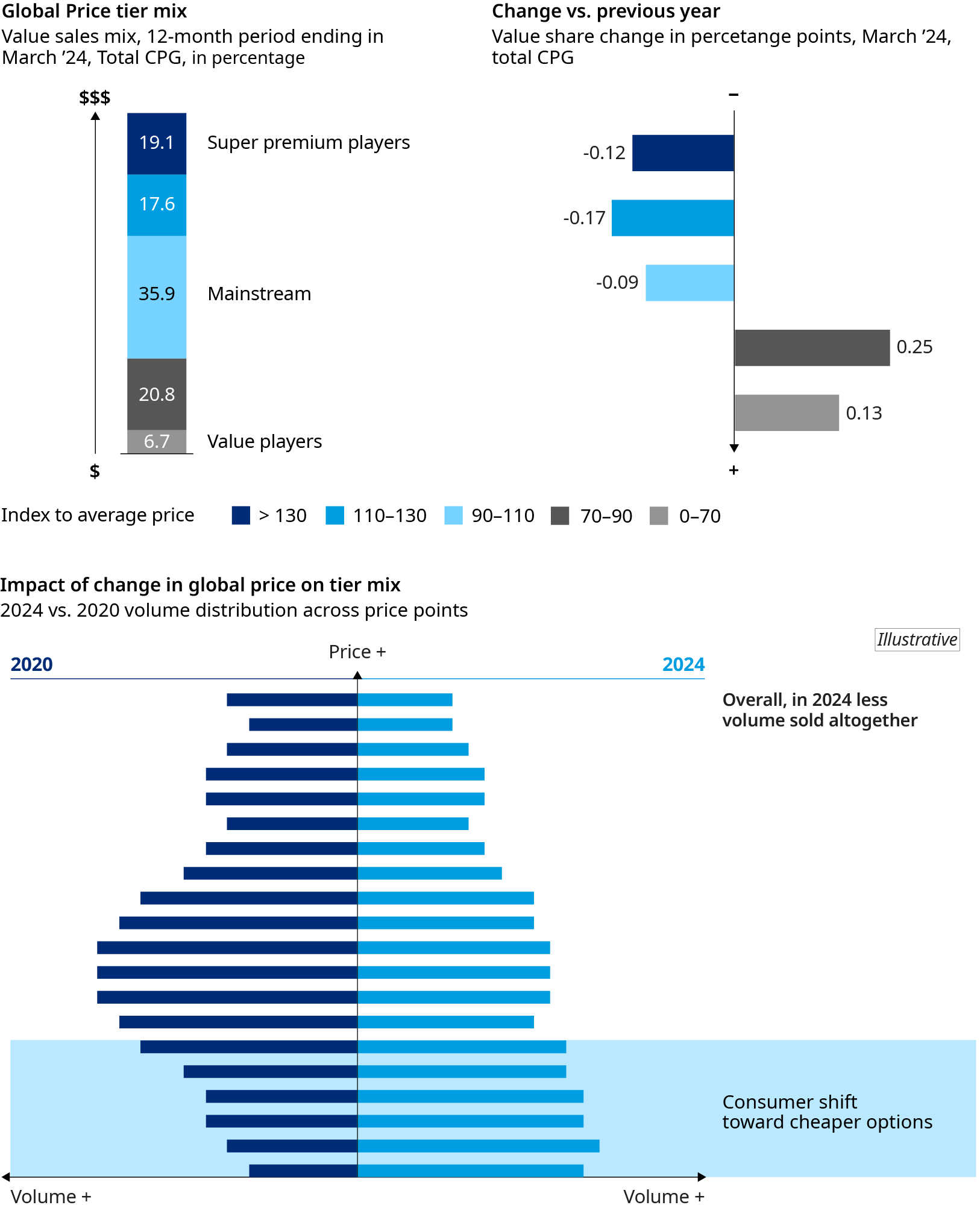

While global inflation forecasts are decreasing for 2024 and beyond, price increases have slowed but not reversed. This trend is accompanied by declining volumes in food sales but stable volumes in non-food categories. Consumers are opting for lower-priced products, especially private labels — a segment that has grown in recent years. This pattern in grocery value trends clearly indicates financially pressured consumers for whom rising costs of living remain a major concern. Rampant inflation following the pandemic created a divide within the population, separating low-income households cutting down spending (seeking affordability, deals, and bundles) and high-income households able to spend more and seeking premiumization.

Premiumization versus affordability in FMCG

Finding the right balance between premiumization and affordability has always been critical for manufacturers. However, this was easier in the favorable economic context of the past decade’s low interest rates and steady growth, when value growth came largely from premiumization. In today’s economic context, changing consumer behavior and the structural shift toward private label makes this balance much harder to find.

Achieving balance successfully calls for rethinking typical pricing approaches, with an increased focus on new consumer expectations and a long-term vision for brand portfolios. Manufacturers should consider the following three components in order to succeed.

Revisit price-pack architecture to follow shifts in consumer behavior

While most manufacturers generally have a good view of shopper segments and consumption occasions that translate into price-pack architecture (PPA), these architectures have suffered distortions due to the past few years successive waves of cost-price increases.

Even in the best of times, it can be challenging to get it right. Often, PPA has been used as a tactical lever (shrinkflation) to cut costs of goods sold (COGS) and hit price points, and not as a tool to build long-term growth and loyalty. In addition, executing a successful PPA strategy requires decision discipline and good coordination from stakeholders across the organization (operations, marketing, innovation, commercialization).

In today’s context, PPA is even more important due to pressure on volumes from consumer behavior, input cost deflation, and the rise of nontraditional retail. To maximize value in this context, it is critical to focus on several approaches:

- Build a good understanding of customer willingness to pay, including for attributes, and how this relates to pack size and cost price/unit.

- Evaluate intra-category switching dynamics and level of substitutability across products in each channel, within your offer but also competitors’, and in particular private label.

- Ensure “segmented pricing” properly de-averages the offer into price points that are aimed for a specific customer segment, with the right balance between affordability and premiumization:

- Affordability: Ensure recruitment/penetration through entry packs under psychological thresholds.

- Value for money: Increase volume with a pack at a competitive price per unit; this is mainly relevant for heavy consumers.

- Premiumization: Grow margin with premium offers (new tastes, new packaging, new formats, new claims, and so on).

Over the past few years, brands have focused heavily on premiumization by adding features and attributes. As the weight of the market shifts downwards, this has resulted in brands addressing a smaller part of total demand and conceding space to private label offerings. Solving this shift requires carefully understanding the equilibrium versus private label and the implications of giving up an affordability positioning — or even value for money in some cases.

A good PPA approach needs to consider the total revenue and margin pool available within a category and address this effectively through a total customer proposition, while considering the different types of categories (routine-based versus occasion-based) and channels.

Ensure a holistic view of system-wide margin impacts from commercial decisions

To make informed pricing decisions, it is critical to have an end-to-end view of the impact of price and volume shifts on total cash margin. This is even more relevant today as volumes shift drastically, and especially important to consider for players manufacturing both private label and branded products, as the volume uptake on the private label side can improve costs per unit on the branded side.

This end-to-end vision in retail requires proper anticipation of the expected impact of volume changes on margin, both in the short and long term. Manufacturers generally rely on elasticity estimates provided by external panel data providers and conjoint analyses, which often leads to a tactical focus on short-term impact. This is most visible in repeated minor price increases that eventually erode the value proposition and break brand and size price ladders, as well as making the economics of the overall business worse.

Furthermore, it is important to align both the pricing strategy and promotional strategy. The target average selling price should be broken down into promo price and regular price. This additionally requires a good understanding of promo elasticity and cannibalization, to allocate investments in the right way and optimize return on investment (ROI) per invested dollar.

Considering the retailer's perspective is also crucial. A successful pricing strategy should create value for both the manufacturer and retailers. This involves reviewing and adapting the "price to retailer" for each channel, in addition to providing recommended shelf prices. A good understanding of margin pools with each retailer considering second-order effects and creating the right level of transparency can foster a mutually beneficial relationship.

Retool innovation and branding to drive affordability and compete with private labels

In recent history, innovation in the FMCG industry has been a driver for premiumization, which was the main way to grow revenues and margins. As we’ve noted, increasingly it is crucial to also leverage innovation to improve affordability. To achieve this, FMCG companies need to rethink innovation as a lever to take out costs rather than add features. This requires a clear understanding of costs per feature versus value add. Discount retailers have been relying on this “design-to-cost” approach to product innovation for a while, and manufacturers can learn from this to rapidly address gaps in their offering.

This value-based approach should of course be carefully thought through to avoid brand dilution and cannibalization. Levers such as sub-branding, private label plays, or new flanker brands to target different customer segments and occasions need to be deployed as relevant. However, this does not mean cutting down on premiumization — both need to coexist and complement each other to cater to the full range of consumers and address all market segments.

A good illustration of a brand addressing an entry price point is Tide’s “Simply Clean & Fresh” laundry detergent which Procter & Gamble introduced in an economic crisis to compete head-to-head with private label offerings. Innovation effort was spent to take cost out and sub-branding was used to segment the customer base and capture more of the demand.

As the cost-of-living crisis holds and regulators in Europe crack down, the challenges remain pressing: offering fit-for-purpose and affordable products to consumers, driving revenue growth, and preserving margins. It is urgent for manufacturers to step up their pricing approach now and re-recruit the consumers they are losing.