Although inflationary pressures have eased over the past few months, consumer price sensitivity remains high. In fact, the Federal Reserve’s July Beige Book noted that consumers continue to seek out discounted items or limit their purchases despite moderate price increases. While shoppers have always been interested in attractive prices, their interest in shopping at stores that offer better value for the money is on the rise, according to our most recent Consumer Perception Survey. Retailers delivering on that promise are likely to increase their market share, while those that struggle may see their consumer erosion.

It's critical that retailers adopt new strategies to address this value equation. One effective way to do that is with consumer-centric pricing, which allows retailers to adapt quickly to evolving consumer expectations.

Traditional pricing strategies have limitations

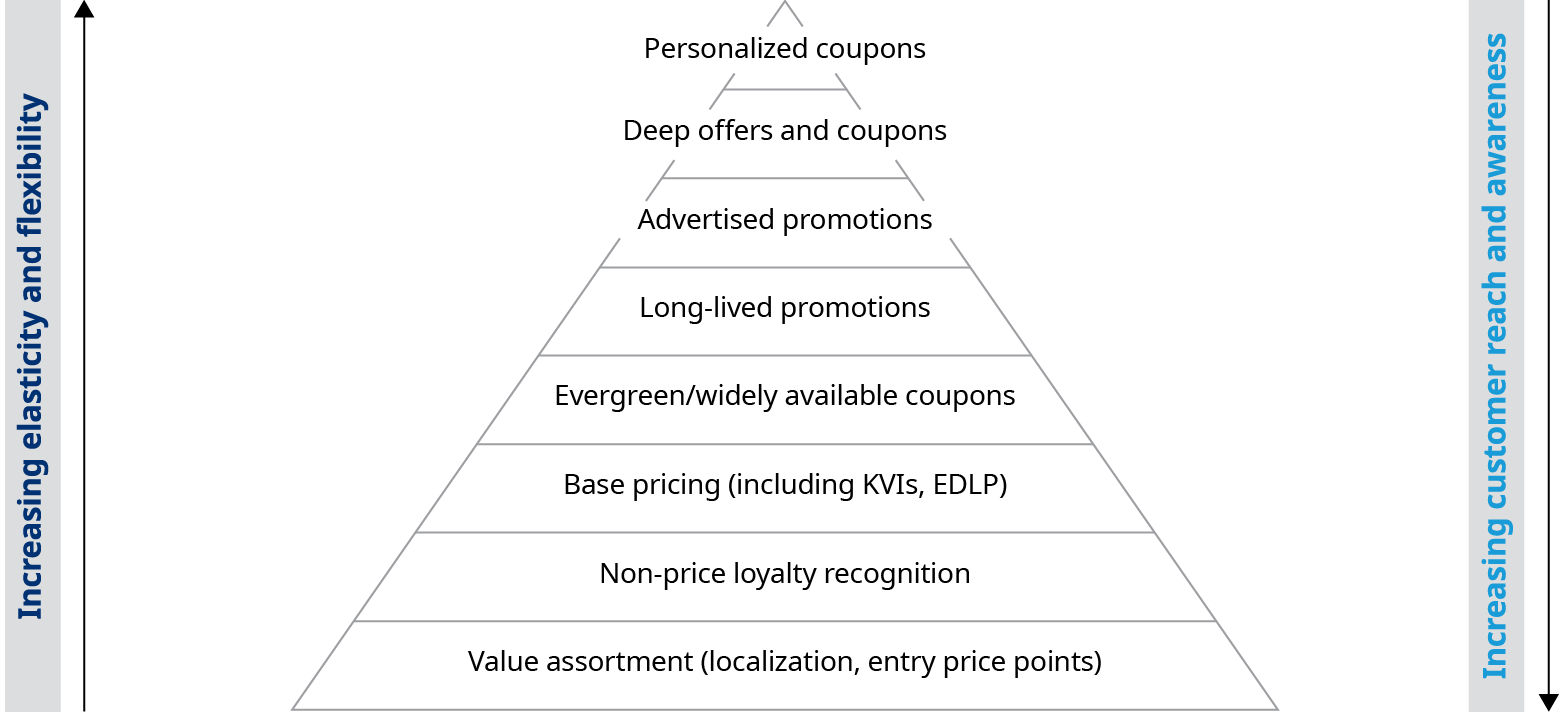

Retailers have several levers to pull when it comes to managing their pricing strategy. Each level of the value stack, as shown in Exhibit 1, differs in its degrees of short-term elasticity and long-term perception impact. A lever such as base pricing has a broad reach as it affects the prices of many items and is visible over time. However, its elasticity is limited since not every customer is interested in the same item, and it cannot be adjusted in the same way for everyone. Personalized coupons provide a higher return on investment per dollar of discount spent but reach fewer customers and do not help drive perception broadly — especially if the customer does not see the offer. Historically, retailers have managed these levels in isolation, without considering how a change in one part of the stack might affect another.

Strategies for effective pricing in retail

Maintain an everyday price gap

Follow a reactive base price strategy and, for example, set prices to stay X% above/below a certain reference price of a discount competitor. Depending on the movements of the reference, this approach often requires a significant investment as a price move is executed across a broad set of items, usually without a relative improvement compared to the reference point.

Focus on promotional programs

Run temporary discounts to promote the right set of items in such a way that the price discount is compensated for by higher volume as well as other secondary effects like a sales halo on non-promoted items. Potential risks include running promotions that are not effective, essentially investing too much money that the promotion cannot recoup, while also training customers only to shop during promotional periods. This approach also comes with additional supply chain stress as product volumes swing in parallel to promotional activity.

Use targeted personalized offers

Deploy personalized offers, presenting shoppers who participate in a company’s loyalty program with custom opportunities not available to other customers. While this usually leverages personal data to find the best and highest elasticity opportunity for each customer or customer group, it can cause double-dipping if the company is already running a mass promotion or executing a base price shift at the same time.

Embracing a consumer-centric pricing strategy

A more strategic and holistic approach to pricing management can enable retailers to be far more responsive to consumer demands and constantly shifting market dynamics. Customer-centric pricing offers a coordinated approach across levers and is the optimal setup to deliver sustainable value to shoppers and shareholders.

The impact on customers and sales trajectory can be significant. Successfully running a customer-centric pricing program requires having the right resources, processes, and support systems in place. We recommend the following three steps before embarking on a customer-centric pricing journey:

Understand the trade-offs between short-term and long-term elasticity

To effectively translate a target average price into the required base price, promotion, coupon, and personalized offer activities, retailers must have an analytical setup that correctly disentangles overlapping effects, provides accurate elasticity estimates, and considers parallel price activities of substitute or complementary items. Based on our past projects, the long-term elastic impacts of a price change can be two times the near-term elasticity.

Optimize value strategy across levers to achieve the net price

To ultimately deliver value with price moves, retailers need to define a strategy upfront, ideally category-by-category to align on intended regular and promo pricing. This includes detailed, bottom-up financial modelling on the trade-offs of category targets, and scenarios of promotional activity to fund base price changes, ideally supported by a technical asset to model pricing scenarios rapidly.

Measure value strategy into an ongoing visibility and control process

Given the additional complexities of managing several levers in parallel, a customer-centric pricing approach requires organizational discipline and control measures. Retailers should create accountability for shelf-price gaps and relevance of net price in a rigorous governance.

Implementing customer-centric pricing — a grocery retailer case study

In a prior project, we helped a grocery retailer transition from a legacy pricing approach, which relied heavily on promotions, to a customer-centric one. Initially, the client was losing market share and customer value perception, feeling pressured to continuously run promotions and spend margin dollars to compete against discount competitors. Across a broader value transformation effort, we helped pivot in several customer-centric ways:

- Restructured retail pricing by ending in-store temporary price reductions and focusing base price activity on items where the discount competition was weaker. This was bundled with differentiated marketing messaging.

- Invested in loyalty programs to address customers directly and with higher ROI measures, including an increased level of buy-more-save-more programs to push volumes.

- Restructured vendor funding agreements to focus on base rather than promotions, including rewarding vendors who brought more funding into the base with better promotional pricing.

- Wrapped tactical changes in an updated planning function to analytically assess every promotion event with advanced machine learning techniques, as well as new governance processes to discuss, align, and regularly report on value promotion.

The outcome was a win for both financial performance and the customer experience. After protecting margins and lowering prices by 8%, volumes of non-promoted items increased by 14%, overall sales grew by 1%, and the relative price index versus the discount competitors narrowed by multiple percentage points. While the exact implementation will differ based on each retailer’s situation, this example of introducing customer-centric pricing can certainly serve as a blueprint for competitors in today’s retail market to ensure an attractive proposition while delivering financial success.