The terms and conditions of manufacturer-retailer relationships are at a crossroads. An important topic for many years, it has now reached a critical juncture, with many stakeholders seeking a fundamental reset. It's not just retailers leading the charge; brand manufacturers are also realizing that growing revenue is about more than just trying harder. It's about trying differently.

Why retailers and suppliers must adapt to evolving market dynamics

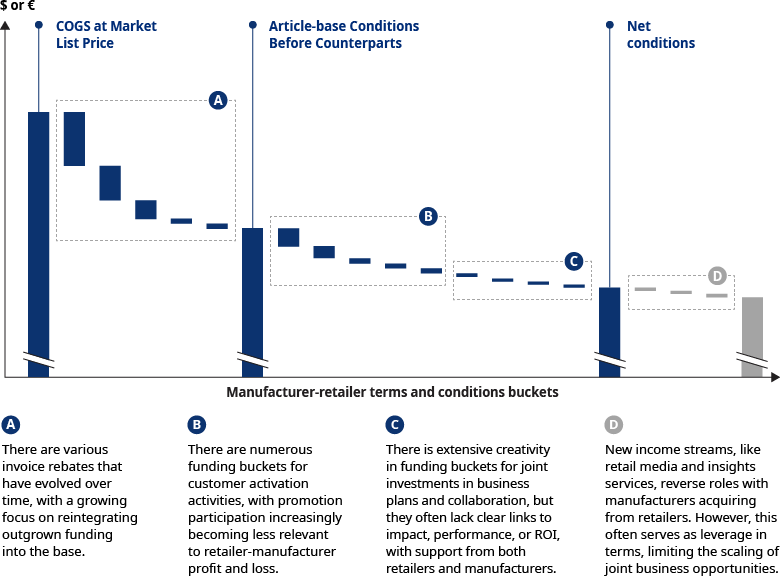

Decades ago, retailers in Western markets took bold steps toward more customer-centric strategies, changing the industry with category management approaches and supply chain integration initiatives. In parallel the terms and conditions between retailers and suppliers shifted from a rental model to a focus on cost of goods and joint activities. This shift was necessary and mutually beneficial.

However, this model is now reaching its limits because of a convergence of factors, signaling a new phase in the manufacturer-retailer relationship. In mature markets, growth, particularly in volume, has stagnated. Premiumization, once a compensatory strategy, is becoming less viable in the face of rising costs of living.

Innovative strategies for retailers and FMCGS to drive growth

Retailers and fast-moving consumer goods (FMCG) companies must find new ways to enhance the value of customer interactions and drive volume growth. Several factors are adding urgency to the need for change.

Stagnation in traditional retail models

Stagnation in the current model is evident, with traditional strategies no longer effective in driving volume growth. Retailers and manufacturers are eager to move away from a reality where supplier investments aren’t delivering results, and suppliers are reevaluating their channel investments to drive growth and value.

Resource-intensive negotiations

Negotiations over terms and conditions not only consume a significant portion of resources, but also often fail to drive meaningful change for both retailers and manufacturers. It's time to focus on growing value together through customer value generation and improved efficiencies.

Barriers to future retail success

The struggle to scale personalization and retail media is limiting the potential for higher-margin business models. However, customer demand and technology are ready for a more personalized interaction, which is crucial for scaling new income streams.

Competitive realities in SKU-level negotiations

Retailers that negotiate net conditions at the SKU level tend to have better overall terms and conditions. The rise of value-led retailers favoring SKU-level agreements is sending strong signals to the industry.

The race to achieve net zero

Meeting long-term sustainability pledges announced by leading manufacturers and retailers will also drive the evolution of supply terms and conditions. Collaboration and joint actions are essential to reduce CO2 emissions and drive innovation.

Keys steps to develop a new target model in retail

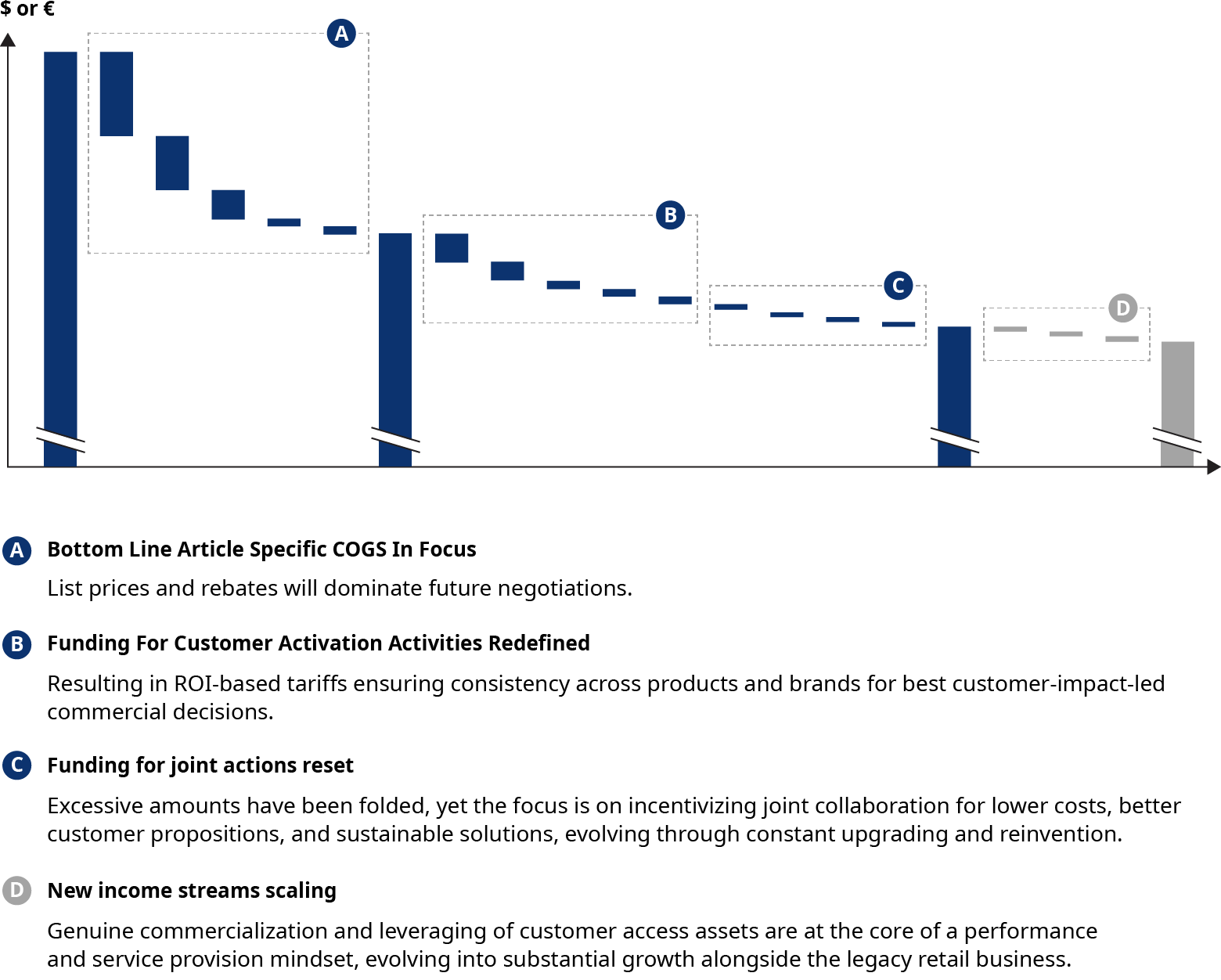

Many manufacturers and retailers have long been aware of the need for a new model. Now they’re moving on it, launching all manner of initiatives. Across all of them, some consistent patterns have come through.

Prioritizing of COGS and volumes

In the quest for sustainable growth and price competitiveness, it is crucial to prioritize the cost of goods sold (COGS) and volume in the core operations. While agreeing on the genuine COGS may present challenges, it is essential to move beyond side battles and engage in a mature discussion about how to genuinely grow volumes and value-added activities. The resulting transparency should empower customer-led choices and decisions.

Streamlining complex and outdated structures

The industry is burdened with overly complex and outdated structures, including hundreds of terms, conditions, and agreements built on incremental deals each year. This abundance of complexity not only wastes time, resources, and energy, but also poses a significant risk as it often leads to erroneous commercial decisions. To drive efficiency and effectiveness, it is imperative to streamline these structures.

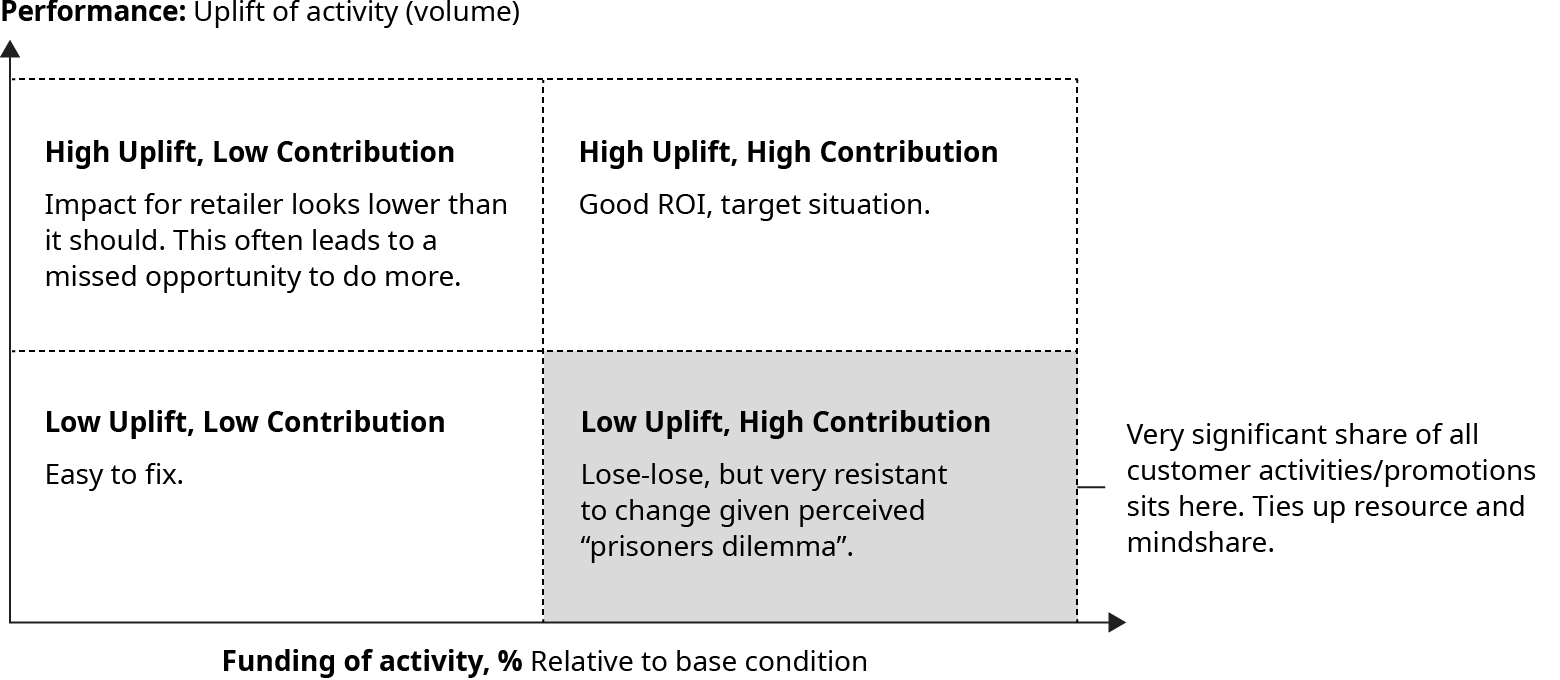

Reducing terms tied to ineffective activation activities

One of the pressing issues in the industry is the disproportionate share of terms and conditions tied to activities that don’t work anymore. Many businesses — manufacturers and retailers alike — have fallen into the trap of overinvesting in promotions instead of into the core customer proposition. This imbalance can easily lead to a vicious cycle of increased promotions intensity. Both retailers and brands are eager to break free from this cycle.

Embracing opportunities at the retail-to-consumer intersection

Shifting from average offers to personalized propositions is key to capturing the immense potential of the retail-to-consumer intersection. By developing terms and conditions that align with this approach, retailers and brands can create mutual incentives to invest in and scale personalized offerings, and by extension boost customer value.

Moving from silo optimization to an end-to-end perspective

This idea has been around for many years, but in most cases has not really changed the way of operating beyond some ordering integration. Only adopting a genuine end-to-end (E2E) perspective will allow companies to unlock further cost savings, reduce waste, enhance overall efficiency, and build a more sustainable supply chain. This will require more resource focus and therefore better alignment on bigger incentives in the mutual terms and conditions.

Navigating the challenges of change in the retail industry

Undoubtedly, the path to implementing these changes is not without risks and challenges. First, considerable financial realities and the trust of stakeholders are at stake. Absolute clarity about the target state, thorough preparation, and meticulous execution are required, demanding a significant effort over the course of a year or two.

There is also the perceived risk of losing out in comparison with the other supply chain partners. The prisoner's dilemma looms large, with the fear that whoever moves first will be at a disadvantage. However, recent case studies provide reassurance that change is possible. By engaging in mature discussions, negotiating terms and conditions, and breaking free from the constraints of the past, organizations can transition to a better, more future-proof approach.

Questions retailers must ask to boost business

A look ahead at 2025 raises several questions for your business. First, is your current terms and conditions structure truly ready to deliver the right balance of growth and profitability? Is it genuinely helping you and your value chain partners combine forces and tap into new growth plays? And is the annual effort required to run the terms and conditions systems in line with the incremental return it generates?

If you answered ‘no’ to those questions, then you might be ready to challenge your status quo and pursue a better future. The path is a difficult one, but it offers a tremendous opportunity to achieve market success.