As a signatory to the Paris Agreement, Indonesia is committed to reducing carbon emissions and achieving net zero by 2060. The country has already rolled out various decarbonization technologies, including renewables and biofuels, such as biodiesel (B-40) and palm-based sustainable aviation fuel (SAF), and is emerging as a key player in international vehicle electrification through its development of end-to-end electric vehicle (EV) and battery supply chains.

While the government seeks to honor Indonesia’s commitment to net zero, the challenge lies in balancing efforts to reduce greenhouse gas emissions with aspirations to develop Indonesia into a high-income country. Carbon capture, utilization, and storage (CCUS) could prove to be an important technology to help achieve both goals. So much so that incoming president Prabowo Subianto recently announced BP3I-TNK, a climate change control and carbon trading agency in charge of boosting the use of carbon credits in Indonesia. The state-owned oil and natural gas company, PT Pertamina (Persero), meanwhile, announced its intention to implement CCUS in the Sukowati oil and gas field at a full scale by 2032.

Aside from what CCUS offers in terms of decarbonization, it also has the potential to provide economic benefits, such as job and income generation, as a carbon dioxide (CO2) storage location for international sources.

The potential of CCUS in Indonesia

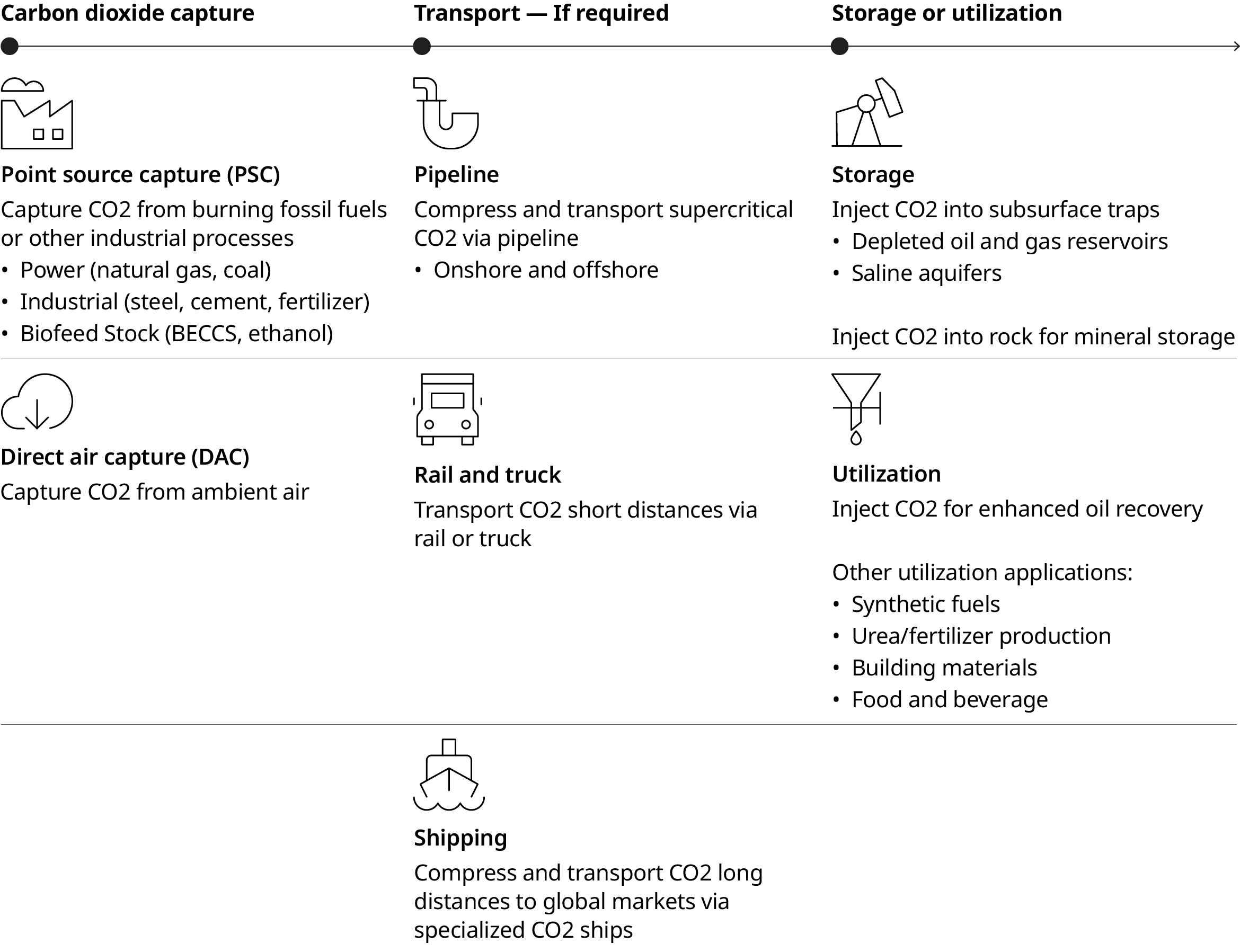

With significant storage potential and its favorable location, Indonesia has the potential to become a regional leader in the CCUS end-to-end value chain — from CO2 aggregation to shipping, handling, and sequestration and/or utilization — and is actively exploring opportunities to develop the ecosystem into a solution for domestic and international industrial emitters.

As the sector develops, however, it’s likely that Indonesia’s fragmented geography will result in a dispersion between emissions and storage sites. Although pipeline transport is the most cost-effective, Indonesia’s layout limits its transport options to specialized CO2 vessels and tanker trucks — calling for investment in and development of carbon infrastructure and transportation. This infrastructure will be crucial for connecting CO2 capture and storage sites and might also offer synergies with international CO2 storage.

Exploring major sources of CO2 emissions in the country

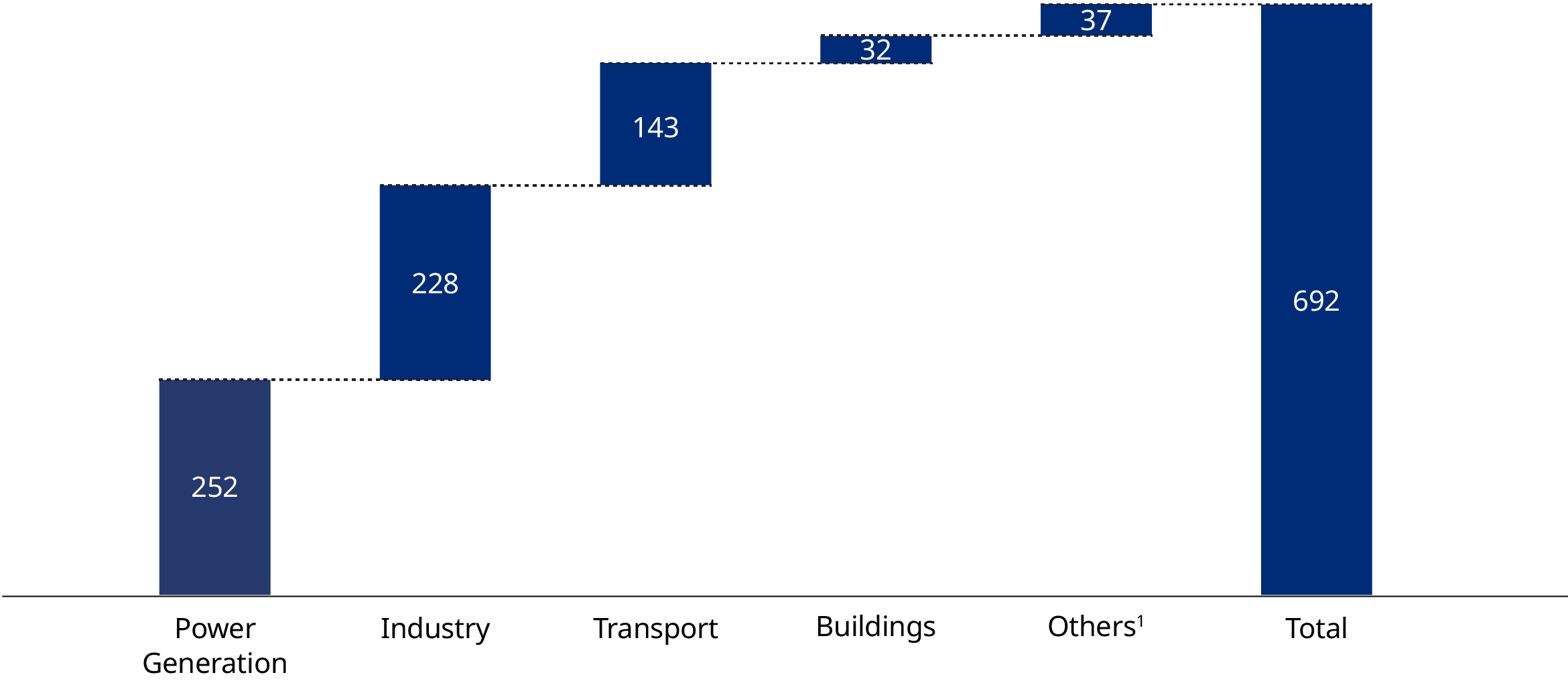

Power generation and the industrial sector are Indonesia’s two main sources of emissions, collectively contributing to 69% of its Scope 1 emissions, which refer to CO2 emissions from primary fuel combustion and process emissions. Although power, which also supplies other key sectors, including buildings, contributes more to Scope 2, the industrial sector is the largest contributor to total emissions after taking its Scope 2 emissions into account. For this reason, significant attention is given to decarbonization solutions for the industrial sector in the next section.

The transportation sector, meanwhile, is also a relatively large emitter (mostly Scope 1), but the path to decarbonization can be achieved through the electrification of vehicles, biofuels, and hydrogen fuel. However, this first requires a successful transition to clean power generation.

Scaling CCUS opportunities in Indonesia

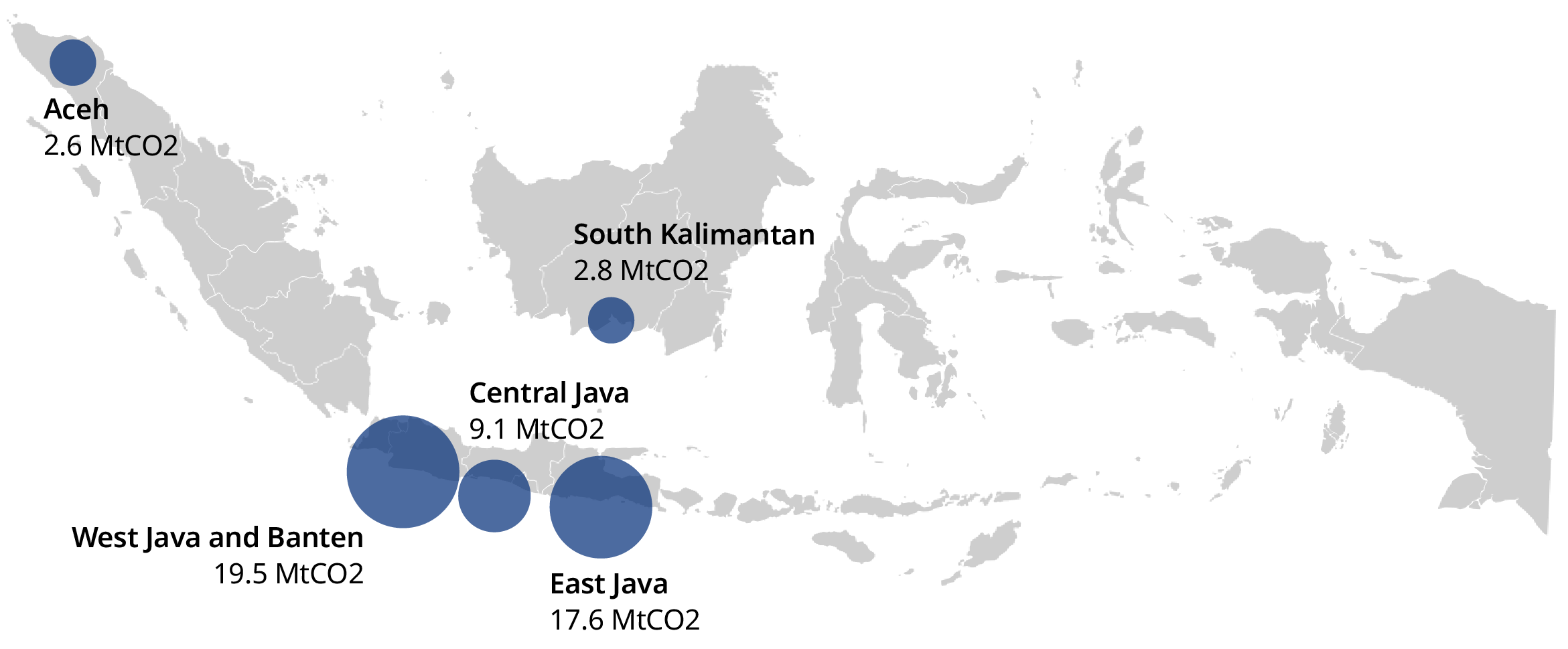

Steel and cement are the largest-emitting industrial sub-sectors, with blast furnaces contributing 60% to 70% of total industrial CO2 emissions in the primary steelmaking process. Clinker manufacture, in particular, releases a significant amount of CO2 from chemical reactions and coal combustion, and is the most carbon-intensive process in cement production. The emission sources from these two sub-sectors are largely concentrated in the Java area.

CCUS as a key enabler of decarbonization in steel and cement production

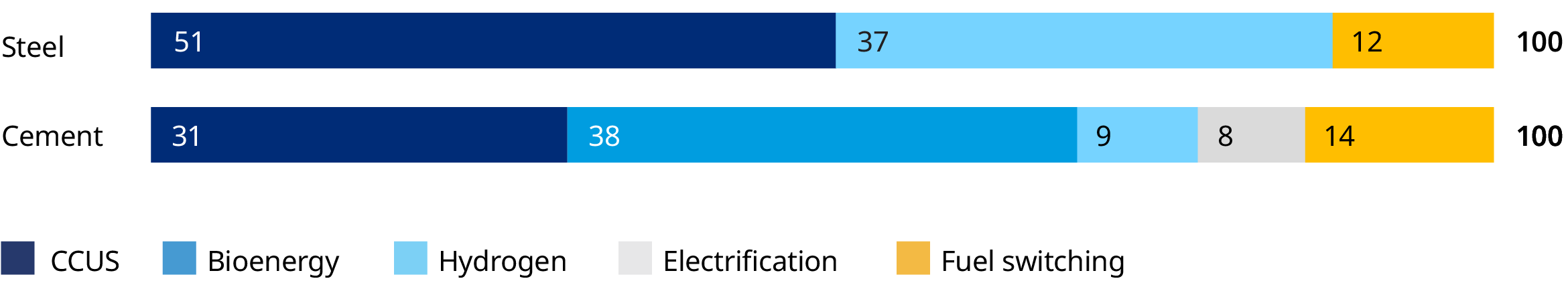

Steel: The International Energy Agency anticipates that CCUS technologies could be responsible for about half of the cumulative CO2 abatement in the steel sector from 2024 to 2050, and CCUS, together with clean-hydrogen DRI-EAF (direct reduced iron in the electric arc furnace), could be key global decarbonization levers in steelmaking. CCUS has the potential to reduce emissions by 90% with an additional cost of 65% to 120% for a green premium, while hydrogen-based DRI-EAF has the potential to reduce emissions by 97% with an additional cost for a green premium of 35% to 70%. Although decarbonization can largely be achieved through material efficiency and substitution of existing carbon-intensive practices, CCUS is still important for carbon abatement in this industry.

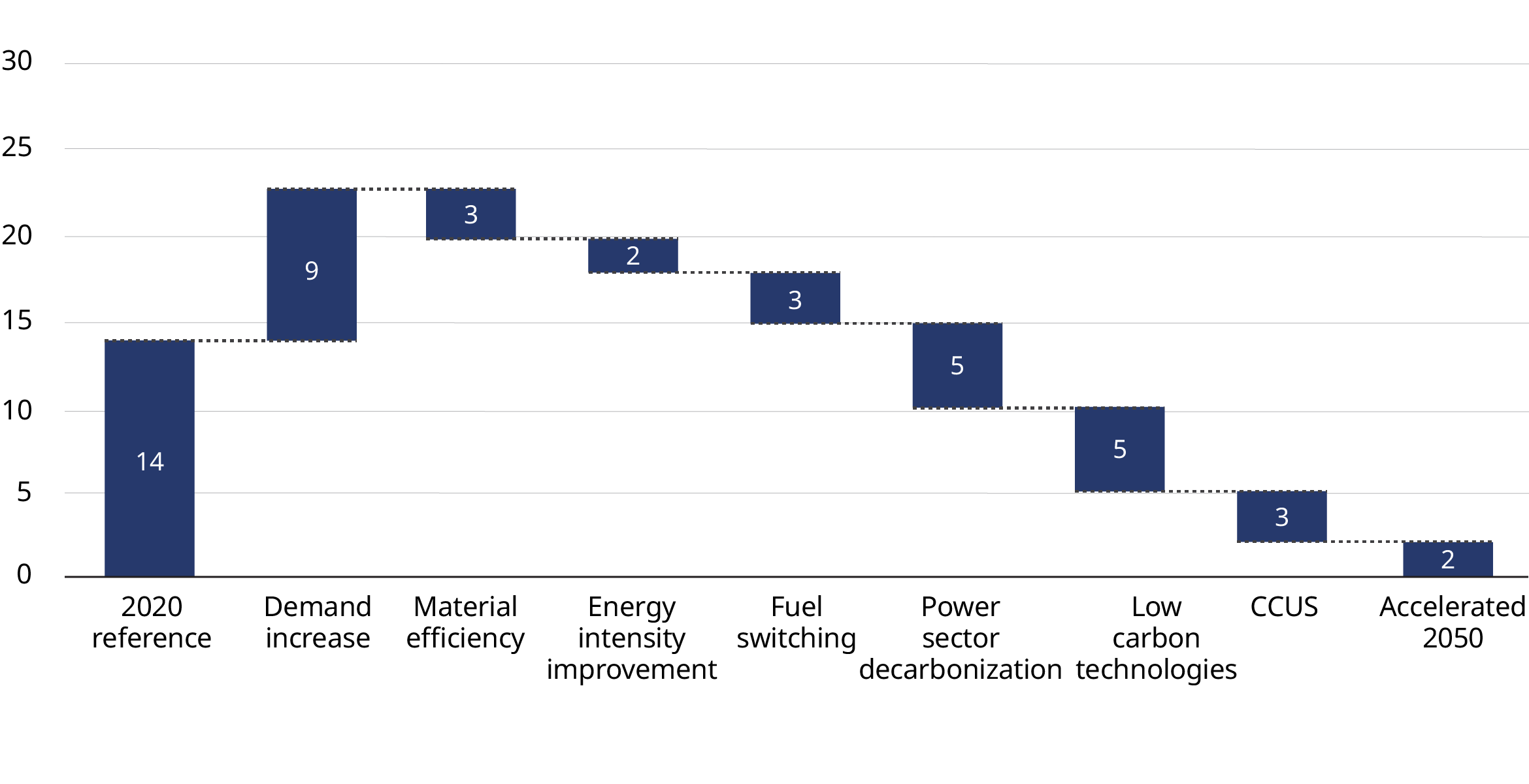

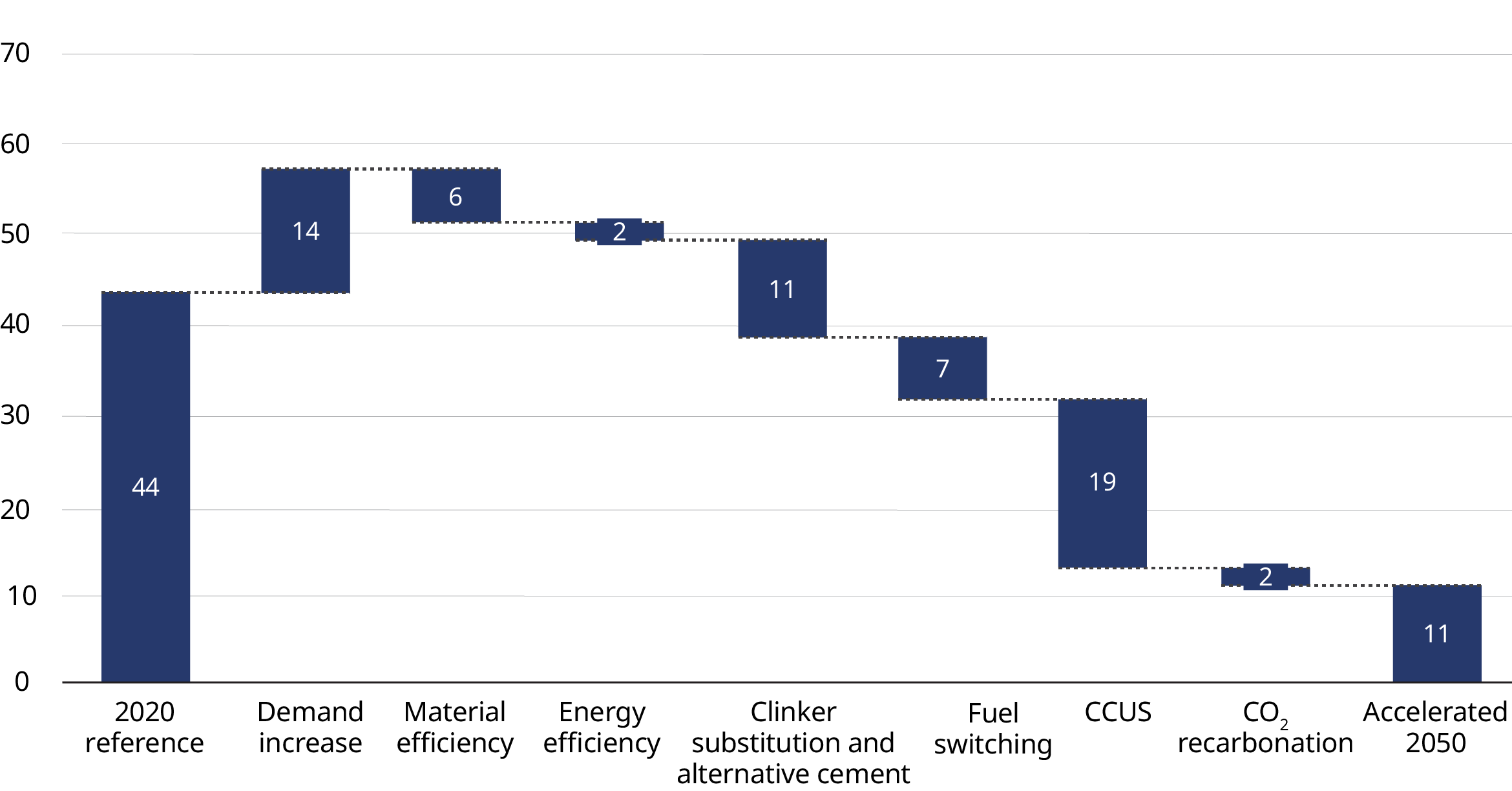

Cement: CCUS could also play a vital role in carbon abatement in the cement industry, where just over 30% of cumulative CO2 abatement due to CCUS technologies is anticipated between 2024 to 2050. Globally, a combination of CCUS and bioenergy (including waste to energy) could be key decarbonization levers for cement, with hydrogen still in a relatively nascent stage. In Indonesia, meanwhile, the major levers are material efficiency and substitution of existing carbon-intensive technologies, with additional reliance on CCUS to reach the accelerated 2050 scenario.

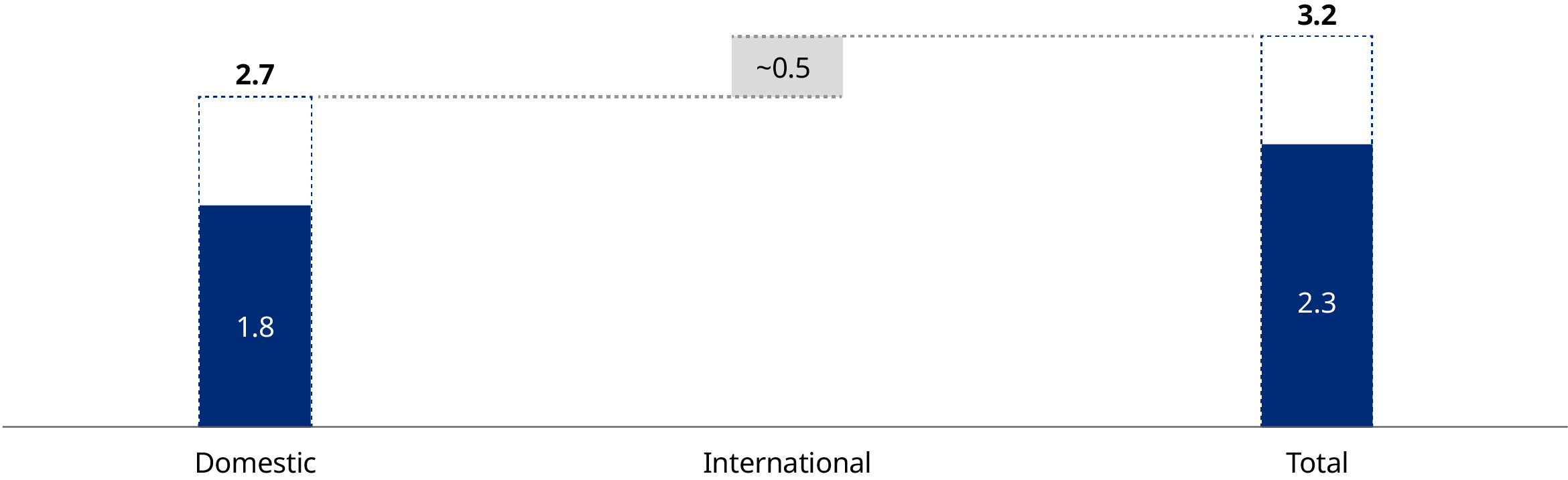

Emissions abatement via Indonesian CCUS can generate US $2.3 billion to US $3.2 billion annually by 2050.

Across the key emitters, we expect a varied range of “hard to abate” emissions in the cement, steel, and industrial sectors, which could best be mitigated via CCUS. At a cost of between US $100 and US $150 per ton for mitigation (either sequestration or utilization), CCUS in Indonesia, specifically from the overall industrial sector, including steel and cement, could be worth up to US $1.8 billion to US $2.7 billion annually.

In addition to the attributable value of CCUS to abatement in key Indonesian sectors, it is also interesting to consider how the country’s substantial nickel industry will decarbonize. Ironically, the production of nickel — used across a range of decarbonization technologies, especially batteries and EVs — is primarily powered by captive coal-fired power plants. As this sector grows and drives the net-zero transition globally, it will consequently increase carbon emissions in Indonesia and thus will likely turn to CCUS solutions for abatement.

Besides the domestic potential, there is potential from international neighbors, such as Singapore, Japan, and South Korea, which do not enjoy the same privileges as Indonesia in terms of abundance of geological storage and aquifers. After combining the domestic and international CO2 markets, the total attributable market size for CCUS in Indonesia amounts to between US $2.3 billion and US $3.2 billion.

Key steps to accelerate CCUS industry’s growth in Indonesia

Leveraging Indonesia’s vast CO2 storage potential for CCUS growth

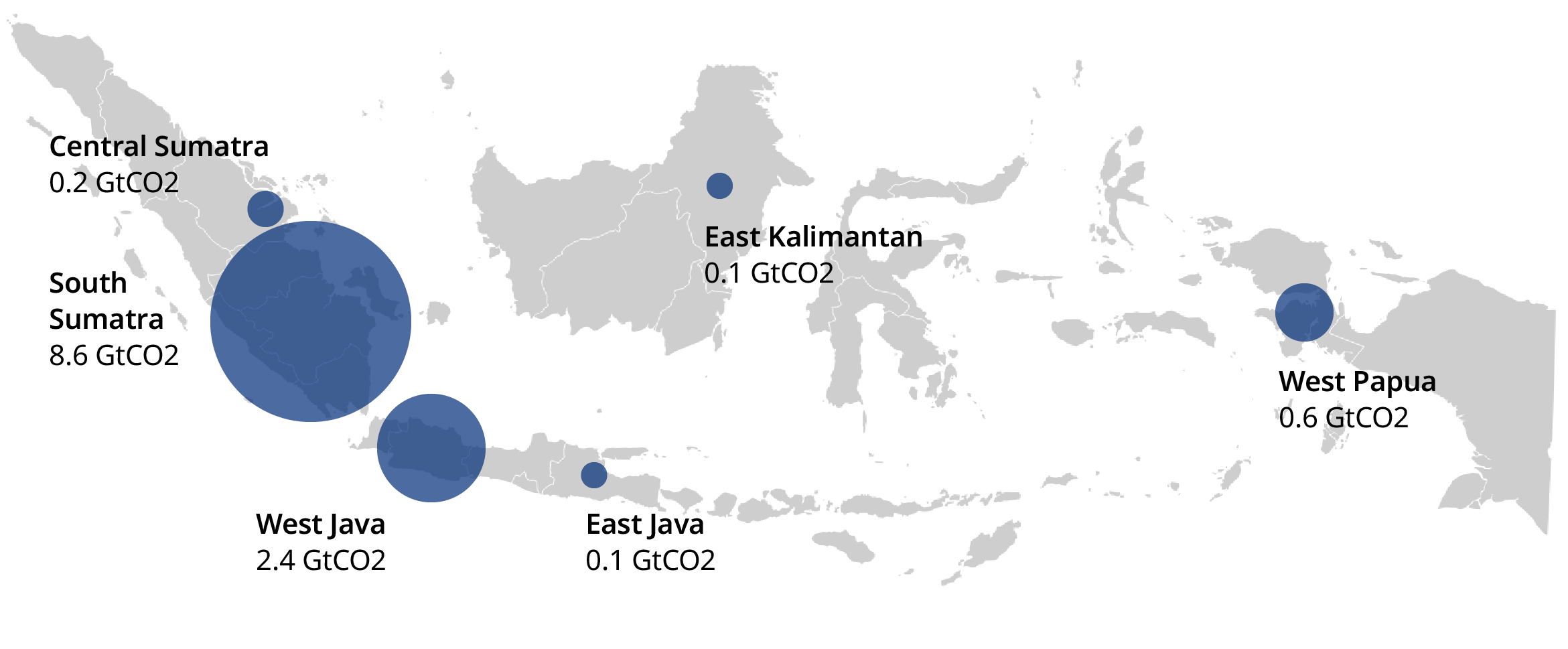

Indonesia has massive potential within the domestic and international CCUS value chain, owing in part to its considerable capacity for CO2 storage in the form of saline aquifers and depleted oil and gas reservoirs, which are primarily located in South Sumatra, West Java, and West Papua.

Added to this is the fact that the government has made significant progress in harnessing the potential of the CCUS economy through its Presidential Regulations 14/2024 to implement CCS across industries and allow cross-border carbon storage.

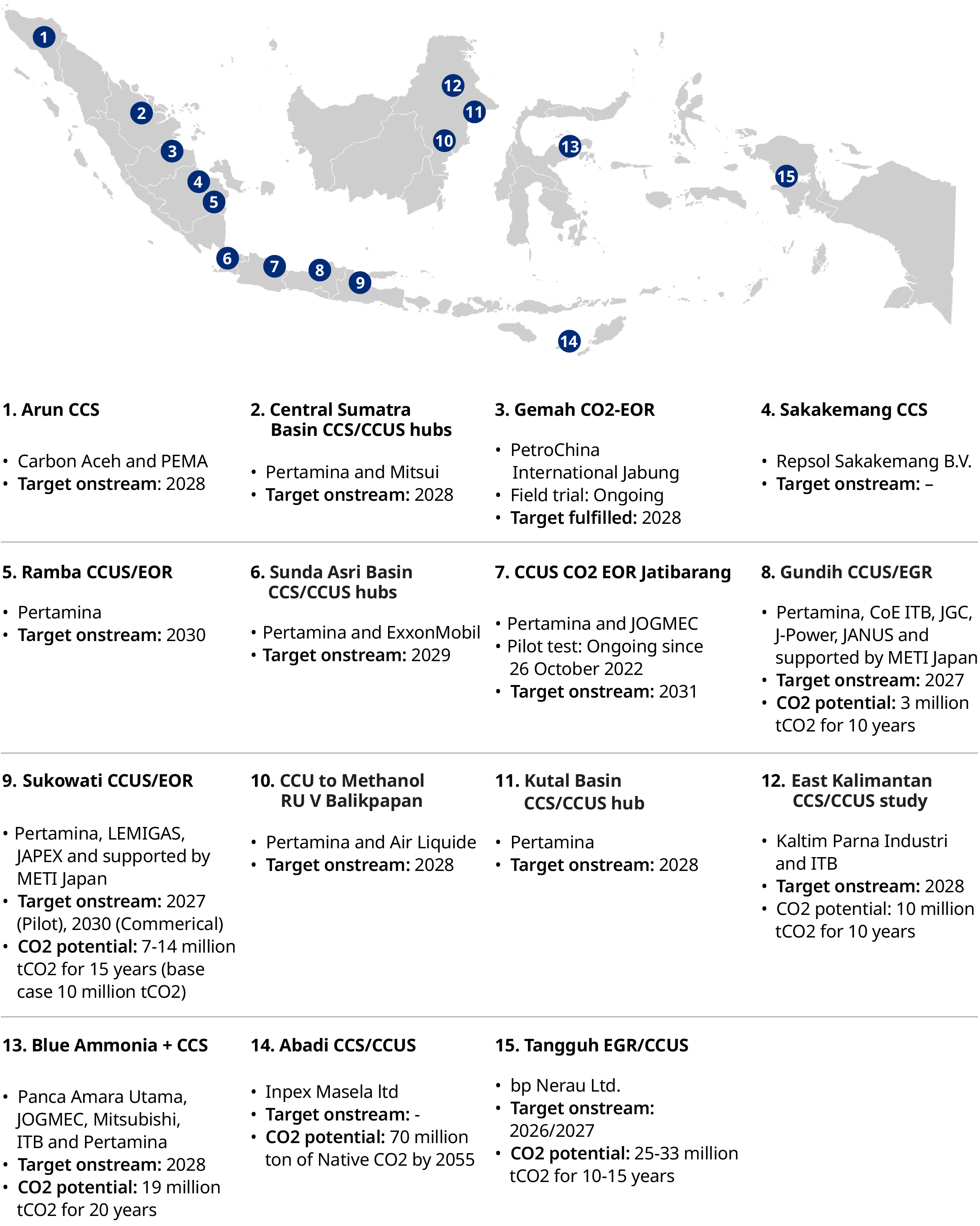

Partnerships between various local and international entities are already flourishing, with approximately 15 CCUS projects planned in Indonesia, eight of which will commence operations between 2026 and 2035 — contributing to 8.6 million tons of CO2 reduction by 2031.

Oil and gas companies are leading the wave of adoption, with notable projects including investment from ExxonMobil and data sharing between Chevron and the state-owned Pertamina to develop CCUS facilities. Initial discussions are also underway with other governments, including Japan and Singapore, to establish cross-border projects that could help them achieve their national emission reduction targets.

Overcoming infrastructure, financing and technical hurdles in Indonesia’s CCUS growth

Infrastructure development is required across the entire CCUS value chain, and Indonesia will need to establish strategic partnerships to bridge the gaps in its infrastructure, financing, and technical expertise.

For starters, significant infrastructure is required in the carbon capture stage, similar to the world-first construction of an industrial-scale CCS plant at Heidelberg Material’s cement facility, where 400,000 tons of CO2 (about 50% of the plant’s emissions) will be captured and stored each year. At the storage sites, CO2 is injected into a porous rock space and filled with salt water to trap it permanently.

Indonesia’s CCUS developers and industrial producers will need to collaborate to develop infrastructure to capture CO2 from high-concentration sources and, barring the availability of nearby aquifers, transport it to storage or utilization sites. This requires dedicated transport solutions for pressurized or liquefied CO2. Typically, pipelines are only economically feasible at high flow and short distances (up to 300 kilometers), whereas shipping is more feasible for longer distances.

Significant infrastructure investment and the right technical expertise are needed for these processes, but initial developments need to be synergistic with domestic CCUS opportunities. Furthermore, the Indonesian government has specified that at least 70% of carbon storage operations should be for domestic use.

Building strategic partnerships to drive CCUS investment in Indonesia

To secure partnerships and develop infrastructure, Indonesia will need to establish multi-party collaborations to meet its requirements for technical know-how and investment capital.

To add on to the first wave of foreign participants with an urgent need for decarbonization, Indonesia could encourage local emitters and CCUS players to invest through suitable incentives, mandates, and participation models for different stakeholders.

There are examples of successful collaborations in other parts of the world that combine the financing and technical capabilities and key assets from different players to deliver end-to-end CO2 transport and storage as a service to emitters in domestic and international markets.

Leveraging synergies and adjacent businesses for CCUS growth in Indonesia

Currently, Singapore and Indonesia have signed a letter of intent for cross-border carbon transport and storage, similar to bilateral collaborations between South Korea and Malaysia to conduct a feasibility study of securing at least one storage site and a hub in Malaysia and that of Japan and Australia to assess the cost of exporting CO2 from Japan (JX oil) to Australia (Chevron).

But to capture synergies, Indonesia first needs to consider what a standard domestic end-to-end CCUS process would look like, before considering how this model could be developed into a cross-border business model. As the ecosystem develops, opportunities in adjacent and feasible businesses, such as local CO2 aggregation and CO2 utilization, will naturally become available.

Furthermore, transporting captured CO2 to a CCS hub will require a level of aggregation from individual plants, where smaller local players can tap into potential opportunities for value-added services within the CCUS value chain.

Importantly, captured CO2 does not necessarily have to be stored, but can also be used in a variety of ways. This is particularly true for low-concentration CO2 streams where the high cost of concentration and storage are less feasible. However, the market for CO2 utilization is nascent and will likely only grow after research and development and policy changes help to develop more viable utilization pathways.

However, our previous paper shows the market for CO2 utilization is still nascent and is expected to remain small until further research and development and policy changes are made to develop more viable utilization pathways.

As it stands today, there are various potential utilization pathways for captured CO2, of which CO2-to-X is potentially the most viable, especially for construction material use cases in concrete curing and aggregates.

Driving more demand for CCUS via broader enablers

The global growth of the carbon credit market will spur demand for domestic and international CCUS in Indonesia. Carbon removal credits (as opposed to carbon avoidance credits) are expected to fetch a higher price and experience greater growth in the coming years. The global carbon removal credits market is expected to reach over US $100 billion by 2030, with an average price per ton of around US $60 to $80.

However, for Indonesia to benefit from this expanding market, the government needs to incentivize decarbonization through a carbon tax and recognize CCUS as a key solution to carbon abatement to improve its economic viability.

A robust demand for high-durability carbon removal credits from voluntary carbon markets is an ideal driver. However, in its absence, the growth of a vibrant cross-border market, supported by government-to-government partnerships, is crucial.

To enable this, the Indonesian government needs to encourage partnerships with foreign players for the development of cross-border capture, transport, and storage infrastructure. It must provide adequate legal assurance for the risk and liability around the loss of containment, and it should accelerate support for the development of robust measurement, monitoring, reporting, and verification (MMRV) standards for durable carbon removal credits to allow further cost reductions and market development.