A version of this article was published in The Business Times.

Globally, the movement to decarbonize the energy sector is gaining momentum, with $1.22 trillion of global government clean energy committed in the last two years. Advanced economies account for some of the most ambitious programs.

For one, the United States’ Inflation Reduction Act (IRA) is by some measures the largest ever single action of spend, with a strong climate focus — $370 billion committed to support the production of clean energy technologies like carbon capture, solar panels and electric vehicles. The IRA also provides clean fuel tax credits to fund the development of alternative fuels such as sustainable aviation fuel (SAF), clean transportation fuels, biofuels and clean hydrogen.

Similar efforts are ongoing in the European Union (EU), where policymakers have jointly agreed to decarbonize the aviation sector through not just financial incentives but also stricter regulation. Aircraft operators in the EU will be required to provide fuel blends with a minimum share of SAF — starting at 2% in 2025 and reaching 70% by 2050.

Energy players have also announced commitments on decarbonization and plans to facilitate and support their customers in the energy transition.

For example, Chevron adopted a 2050 net–zero aspiration for equity upstream Scope 1 and 2 emissions, and have also created Chevron New Energies, which focuses on low carbon fuels.

A pick-up in momentum across Asia

The emergence of future energy products is supporting the decarbonization push. Although in its nascency, biofuels and renewable fuels are garnering much attention among various stakeholders.

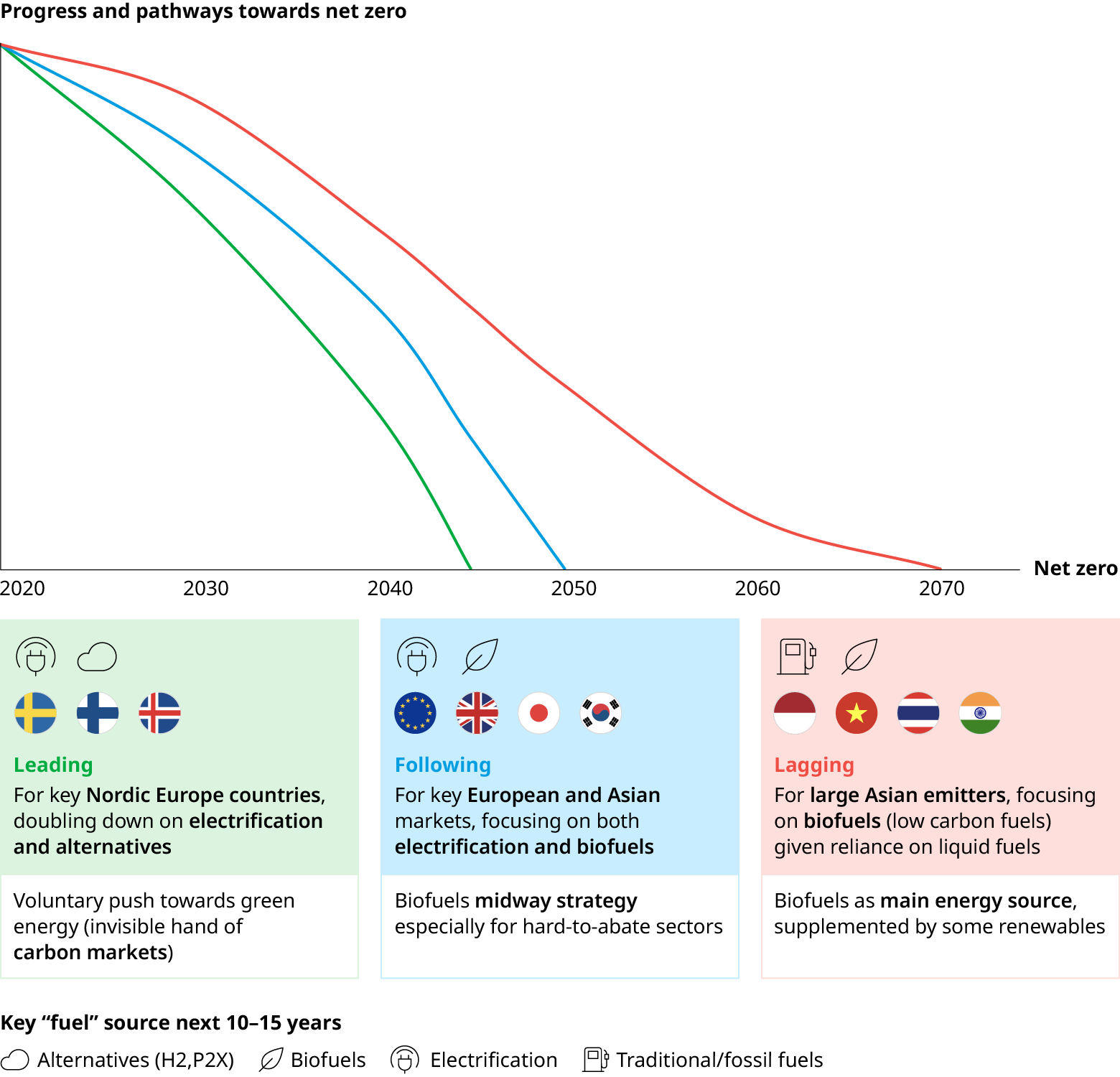

In Asia, demand for these new fuels is growing but varies across markets. Certain Asian markets, particularly developed ones such as Australia, South Korea, and Japan are using a mix including electrification and biofuels as viable methods in their pathways to net zero by 2050.

That said, myriad examples of positive momentum can be seen in Asia. South Korea, for example, plans to expand the use of biofuels in the maritime sector by 2025 and sustainable aviation fuel (SAF) in the aviation sector by 2026. The country has also revised its biofuels blending mandate to 8% by 2030 from 5%, by blending 3% hydrotreated vegetable oil in addition to 5% biodiesel fuel.

The Singapore government is transitioning carbon-intensive sectors such as the maritime industry. In 2022, the Maritime Port Authority of Singapore (MPA) announced a blueprint to transition its port terminals to net zero by 2050. The blueprint — accompanied by a S$300 million fund — will incentivize the maritime industry to begin exploring a multi-fuel future that will enable the use of LNG, biofuels, ammonia, methanol and hydrogen as alternatives. Singapore’s National Hydrogen Strategy will also support decarbonization of transport by providing aviation and maritime players with resources to enable the use of clean hydrogen.

Recently, Singapore’s policymakers have begun mulling the use of “green lanes” for travelers to New Zealand and the US to encourage consumers to opt for flights using SAF and other alternatives.

Elsewhere, the Japanese government has outlined plans to replace 10% of airline jet fuel with eco-friendlier alternatives by 2030. The country is witnessing increasing developments among private and public institutions in advancing the supply and use of cleaner fuels. A Japan-based engineering company is partnering with an oil wholesaler to start Japan’s first commercial SAF production facility in 2025. Moreover, two separate developments are being witnessed simultaneously, whereby research is being done to turn alcohol to jet fuel and turn woody biomass into fuel.

The expanding imperative for alternative fuels

Despite progress in some quarters, most Asian economies continue to lag their western counterparts in their energy transition. Even within Asia, decarbonization can vary country-to-country, as high-performers’ efforts are counterbalanced by high CO2 emitters such as India and Vietnam, which will need to pick up their decarbonization efforts to realize a faster or even timely net–zero target.

Disparities in these countries’ decarbonization efforts can be chalked up to differences in regulatory policies. Furthermore, there is a growing availability of alternative fuels and mixes for industry to explore, though these will depend on each sector’s specific needs, access, and costs. That said, stricter regulation is already forcing energy players and corporates to quickly adapt to alternative fuels.

For example, A*STAR, Singapore’s premier research agency, is working on producing SAF from CO2 using direct conversion process, while Japanese airlines are already expanding their use of SAF over existing jet fuel. Green methanol — a low-carbon fuel made either using biomass or renewable electricity and CO2 — is being explored by global shipping major Maersk as it looks to green its shipping lines.

Collaboration key to alternative fuels transition

To bridge the gap between aspiration and reality, partnerships will be key to ensuring policies and commitments enable the kind of impacts needed to drive widespread decarbonization.

These partnerships must transcend simple international agreements to explore innovative and non-traditional partnerships, such as the Global Methane Pledge which aims to reduce global dependence on methane. Another example is the ICCT’s Transport Initiative (NDC-TIA) that aims to decarbonize transport sectors across Asia by enabling coordination between government ministries, civil society and the private sector.

At the corporate level, there are partnerships looking to fuel the use of SAF up and down the supply chain. For example, SkyNRG and Boeing's partnership will scale the availability and use of SAFs by not just growing production capacity but also engaging with key stakeholders such as airlines, governments, and environmental organizations. Recently, it was announced that Singapore Airlines will buy SAF from Exxon Mobil. Moreover, Certis Group will collaborate with Esso Singapore to use renewable diesel (R20) for its fleet.

Securing affordable finance will be essential to the energy transition, making financial institutions key stakeholders. Non-profit consortiums such as the Southeast Asia Transition Partnership can expand financing for investments into renewable energy sources, but banks and private financiers must provide essential capital needed in Asia to develop the infrastructure needed to support adoption of alternative fuels.

DBS Bank has set ambitious targets to channel financing to low-carbon energy alternatives across seven sectors including aviation, shipping and automotives. By 2050, the bank aims to achieve net–zero for its Scope 3 financed emissions.

A need for a stronger push

Asian economies are generally expected to grow at faster rates than the global economy, implying an increasing demand for fuel. In this context, the region’s companies — and governments — must quickly realize the potential of these alternate fuels so the region can catch up with economies in the west on the journey to decarbonization.

Continued investment in innovation will contribute to the commercialization of cleaner fuels and energy alternatives. This provides a sustainable opportunity for sectors such as aviation and maritime to decarbonize.

Challenges such as high costs may impede access to available alternatives, as will difficulties in ascertaining which technologies will provide the best path forward, given the rapid pace of change. Currently, the market also faces a lack of a commercially-feasible replacement for current fuels, and will require close collaboration between different private sector participants as well as the public sector.

Any solution will need to address shortfalls in energy infrastructure and capacity. As policymakers and enforcers, governments need to invest in developing production capacities, research and development, and talent capacity-building in the emerging green fuel sectors. Meanwhile, on the part of the private sector, a firm commitment to invest and embed alternative fuels into existing systems is key.

The right ingredients — strong but flexible regulation, comprehensive supply chains and effective partnerships — must fall into place for Asia to achieve a zero-carbon fuels ecosystem.

Read The Business Times version here.