The year 2024 was challenging for both supply chain professionals and supply chain technology startups in Europe, marked by macroeconomic difficulties and geopolitical crises. The pressure on companies to make their supply chains more resilient and sustainable is greater than ever. Our “Supply Chain Tech Report 2024 (SCT24),” a collaboration with Prequel Ventures — the leading venture capital fund for supply chain technology startups in Europe — features deep insights into the current challenges faced by supply chain executives and the ways in which these challenges can be addressed through technological innovation. SCT24 also reviews European supply chain technology startup funding and founding trends, and provides a comprehensive directory of active supply chain tech startups.

Global supply chain faces new normal of disruption

Disrupted supply chains have become the new normal for companies globally, leading to fluctuating costs and more frequent disruptions to service levels and lead times. Such unpredictability in supply chain performance is having a significant impact on businesses worldwide, with many companies reacting by building up inventory. We think smarter solutions are needed — as supply chain disruptions can be expected to continue for the foreseeable future due to a host of supply, demand, and ecosystem stressors.

Transportation, warehousing, and procurement are at the heart of today’s supply chain disruptions (Exhibit 1). But supply chain leaders also are looking ahead to what comes next — with evolving business models, regulation, and greater supply chain interconnectedness of most concern as future disruption drivers. Industry-leading supply chains are looking for an edge through technology, and a wide range of European supply chain startups are set to deliver the innovative solutions they require.

Future trends in supply chain technology and investment

Technology investments in the supply chain today are still mainly being driven by the need for cost savings, lead time reduction, and enhanced operational agility, with leading players viewing their supply chain as a strategic asset and harnessing technology to combat disruption. Many corporates, however, are missing the mark on innovation by focusing on customized, large-scale software rather than agile, best-in-class solutions. And both large and small firms have issues to overcome in adopting new technology: Larger firms often face internal resistance, while smaller firms lack resources and talent. Supply chain tech startups must be able to adapt to both ends of this spectrum.

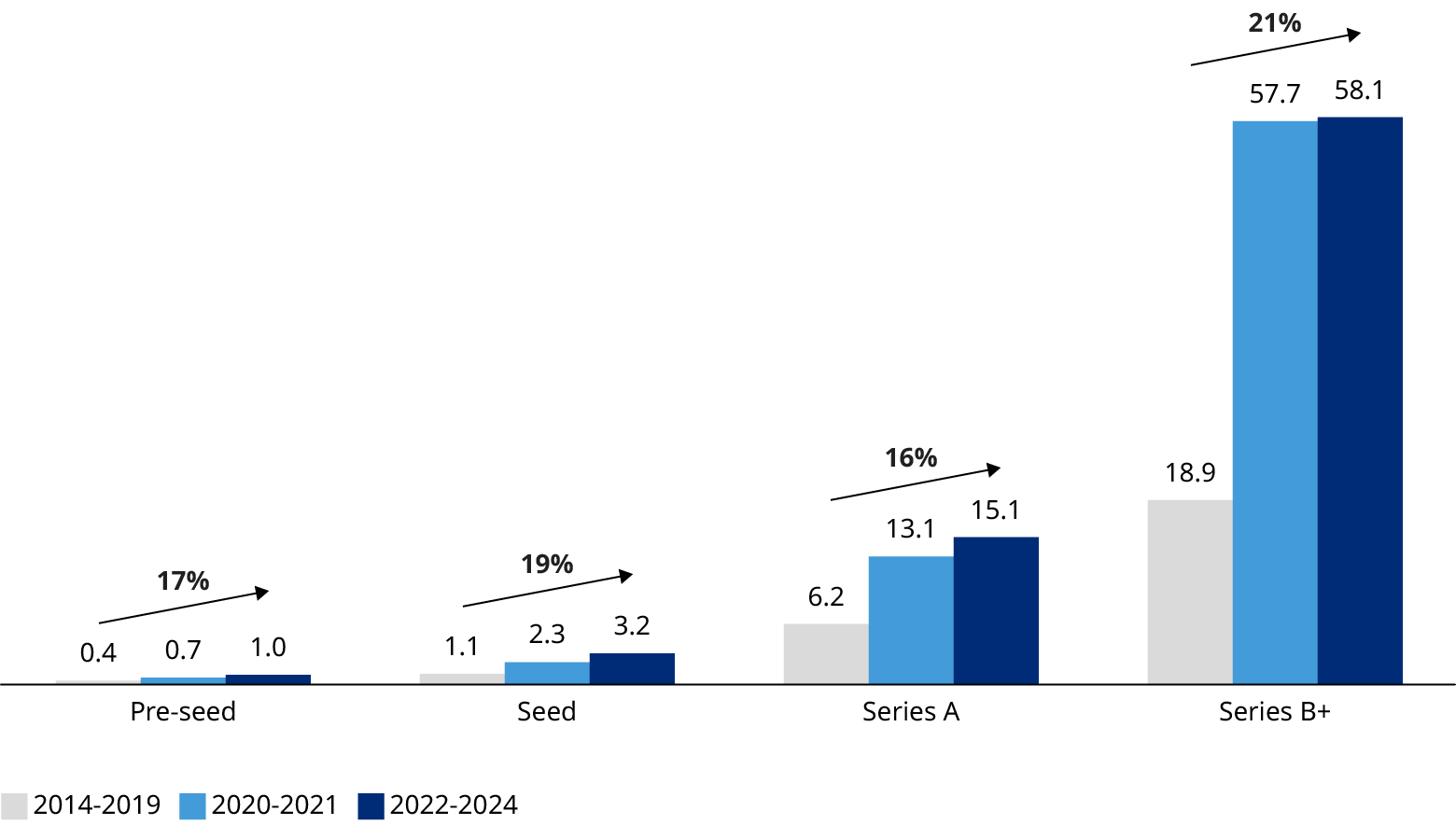

For European venture funds, supply chain and logistics are on the agenda and increasing in importance. Venture fund investment activity is expected to pick up steam again in the next three years, after falling in 2024 due to difficult economic conditions and international crises. The average funding round size for earlier investment stages has increased, and there appears to be high competition among investors for higher quality deals (Exhibit 2). Key supply chain segments that are trending for venture capital funding and new startup activity include sustainability, procurement, and planning.

Next steps in supply chain innovation

Our assessment of supply chain disruption drivers and the European supply chain startup ecosystem leads us to several perspectives for supply chain corporates, startups, and investors to consider.

Corporates need TO embrace tech as a strategic asset

Corporates need to see technology as a key component of their supply chain strategy and as a strategic asset to achieve competitive advantage. Large software vendors often promise fully integrated solutions that will solve all problems but seldom possess leading-edge technology. Companies need to focus on building a strong data backbone and adding best-in-breed technology, including from the startup ecosystem, to make the best use of the breadth of technology available.

Startups should aim to create scalable, compatible solutions

Startups that are developing supply chain technology need to ensure that their products are scalable — expanding rather than replacing existing tools. They need to design their products and services with compatibility with other systems in mind and focus on short and easy implementation for maximum impact. User experience and short time to value for daily users as well as clear ROI-driven business cases need to be top of mind when designing onboarding strategies.

Investors should focus on assessing tech adoption and market needs

Investors in supply chain tech need to focus less on how novel a technology might be and more on what is important in the technology choice and adoption process — such as identifying and meeting needs not being met by traditional tech providers, as well as the ease of integration and implementation. To determine which startups could bring actual incremental value to the table, investors must have a solid understanding of the existing tech stack and use cases within the supply chain domain. Equally, they need to carefully assess supply chain tech business models and understand the profitability and dynamics of the underlying markets before placing their bets.