For decades, consumer goods companies have capitalized on the convenience and profitability of ultra-processed foods (UPFs), which are cheaper to produce and distribute while enjoying higher profit margins and widespread popularity. In contrast, healthy and fresh foods have often been perceived as premium offerings, primarily accessible to higher-income consumers. However, these companies are now facing a transformational moment. Rising healthcare costs associated with consumption habits are leading to stricter regulations, while consumer attitudes are shifting toward healthier options.

Health insurance payers and government agencies are increasingly funding programs to promote healthier consumption, reflecting a growing awareness of the need for balanced diets. Today, health and wellness considerations motivate 20% of in-home eating occasions, compelling retailers and product suppliers to strategically adjust their offerings in alignment with the increasing consumer focus on healthier living, longevity, and the concept of "food as medicine."

Restricted spend benefits programs represent a $90 billion market opportunity

Restricted spend benefits programs represent a $90 billion market opportunity

How restricted spend benefits can empower consumers

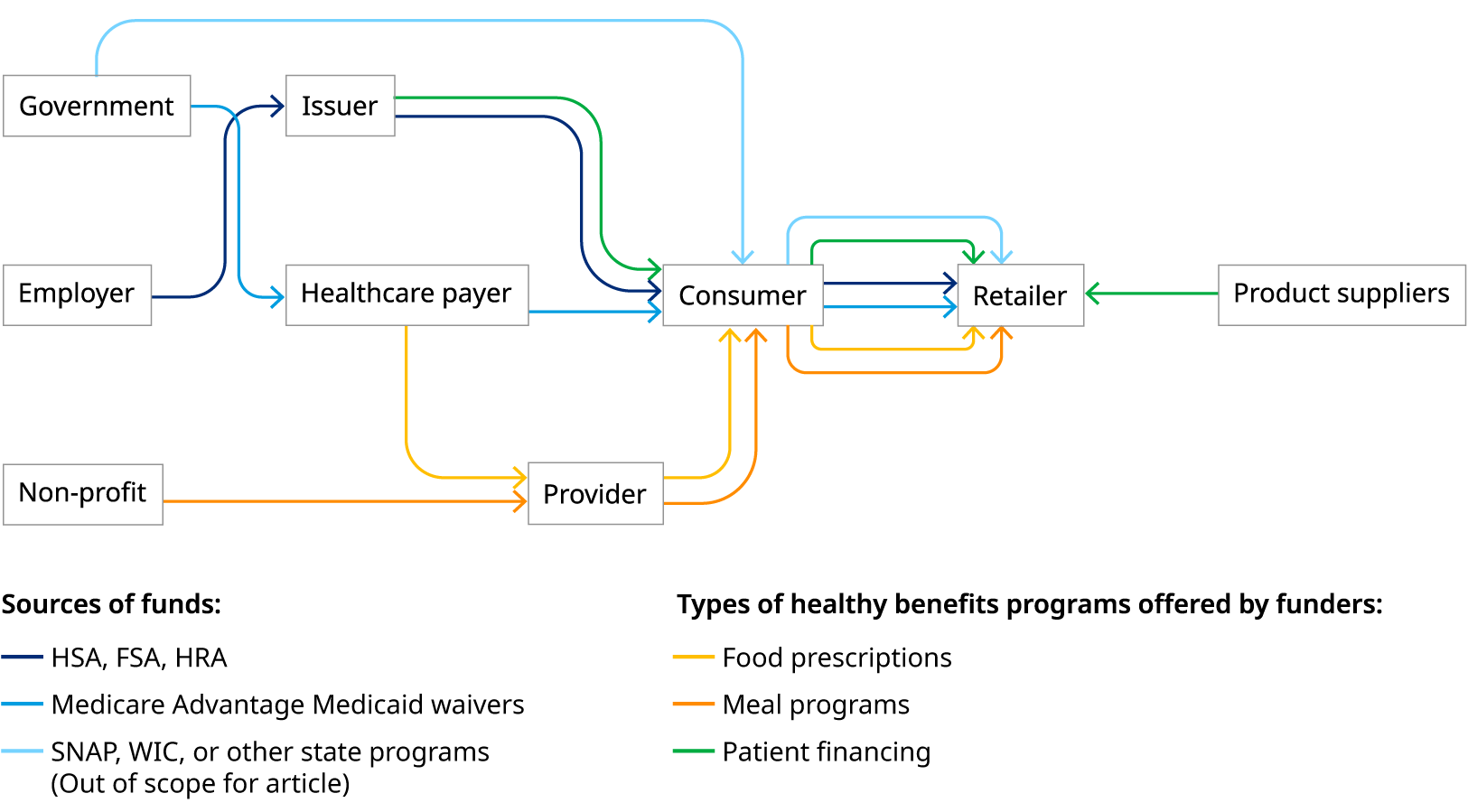

Restricted spend benefits programs utilize funds allocated to consumers for purchasing a range of health-related items. These programs cover expenses for over-the-counter products (such as vitamins and medications), healthy foods, ancillary needs (like vision and hearing services), medical and safety equipment, fitness equipment, meals, and counselling services (including nutrition, mental health, addiction, and financial health).

Funding for these programs primarily comes from government agencies, health insurance payers, employers, insurers, and nonprofit organizations. The funds are accessed through “restricted” or “filtered” payment cards, which require specialized connections to retailer point-of-sale (POS) systems.

There are three main formats for these programs: health savings accounts (HSAs) and flexible spending accounts (FSAs), which are funded by employers and individuals, and Medicare Advantage, which is funded by the government (see our article for a detailed explanation of HSA/FSA/Medicare Advantage flows). Between employer-sponsored initiatives, government programs, and other nascent programs, we project there’s nearly $90 billion of potential spending available via healthy benefits.

How retailers are riding the healthy benefits wave

Retailers are innovating with a variety of new business models to capture a larger share of healthcare expenditure, including retail health clinics. By leveraging their existing assets in food categories, over-the-counter products, medical equipment, and prescription drugs, they are positioning themselves as key players in the health and wellness market. Nearly 75% of retailers now partially or fully accept HSAs, FSAs, and Medicare Advantage programs as payment methods. This shift not only facilitates greater consumer access but also encourages spending on health-related products. Retailers are also developing programs that highlight eligible products through embedded communications and in-store signage, making it easier for consumers to make informed choices. Additionally, partnerships with payers allow retailers to cross-sell products and share valuable customer data, enhancing their service offerings.

Consumers start to shift toward healthier eating choices

Consumers are increasingly embracing health and wellness movements, and this health consciousness is reflected in their purchasing behaviors. They are demanding products that support healthier lifestyles. According to our study in partnership with the Food Industry Association (FMI) and Circana, 20% of eating occasions are now driven by health and wellness considerations. Furthermore, 60% of consumers actively seek functional products with added health benefits, such as probiotics, vitamins, and supplements. However, there remains a disconnect, as only 23% of consumers believe that manufacturers and food processors are effectively helping them maintain their health, reflecting a four-point decrease from the previous year. This gap presents an opportunity for brands to better align their offerings with consumer expectations.

How consumer packaged goods companies can expand their role

As retailers capitalize on the health trend, consumer goods companies have a unique opportunity to shape and enhance consumer engagement. They can bring healthy options into the mainstream, broadening accessibility while targeting budget-conscious consumers. These companies can strengthen their health and wellness positioning in four key ways:

1. Stakeholder engagement and proactive partnerships

There are many players in the healthy benefit ecosystem: retailers; healthcare stakeholders, including providers and health insurance payers; government agencies; and other types of players like HSA/FSA card issuers, employers, nonprofit standards organizations, and nonprofit funders. Consumer goods companies can initiate or deepen engagement with these stakeholders. With increased competition, program administrators like Solutran, InComm, Nations, and Soda Health are driving more retailer-oriented programs and helping define eligibility lists, making them key stakeholders to engage with for insights into key initiatives.

There are numerous opportunities for consumer goods companies to establish potential collaboration including for joint marketing initiatives, cross-selling opportunities, and data sharing to better understand consumer preferences and behaviors.

2. Shopper education and information

Transparency regarding food content and production processes is becoming increasingly important, with 76% of consumers considering it crucial in 2023. Approximately 48% of shoppers would like to see more information about which products are eligible for HSA/FSA or MA, according to FMI research. This represents an opportunity for manufacturers to be more proactive in adding messaging to packaging and how they highlight their eligibility for specific programs, potentially through prints or stickers.

3. Link up with promotions

Consumer goods companies can integrate healthy benefits into their marketing campaigns and seasonal promotions, such as product-focused seasonal offerings and push campaigns like end-of-the-year reminders about using FSA benefits. Engaging with online platforms such as HSAstore.com and FSAstore.com can help boost sales and promotions year-round.

4. Portfolio realignment and product innovation

Product suppliers should continue to invest in research and development to create products that align with the specific requirements and preferences of the healthy benefits market. This includes developing products that cater to the needs of individuals with HSA and FSA accounts or Medicare Advantage plans.

Rethinking strategies for healthier consumer options

While ultra-processed foods are inexpensive to produce and transport, and have long shelf lives, the distribution of fresh and healthy foods presents significant challenges. Consumer goods companies must fundamentally rethink their strategies to effectively meet the increasing demand for healthier options. Here's how:

- Strategy and portfolio realignment: Ensure you have a plan to transition to healthier foods and leverage this shift across your brands

- Partnerships: Engage with the broader health ecosystem, including health insurance payers, government agencies, and health benefits program administrators and establish partnerships with retailers

- Resourcing: Allocate enough funds to support the move toward healthier products and seize new opportunities

- Innovation: Speed up the development of healthier food options. Consider creating an Innovation Business Unit, making acquisitions, or partnering with retailers. Align your product portfolios with health goals and anticipate consumer shifts like the impact of weight loss drugs

- Operating model: Set up the right capabilities, talent, structure, and governance to execute your strategy effectively

- Supply chain: Develop a supply chain that balances speed and quality. Consider local production for freshness, optimize logistics, and adjust distribution strategies for quicker delivery

- Communication: Strengthen your communication and branding to educate consumers on the health benefits of your products and build trust

The pressing question is how quickly established consumer goods companies can adapt to fend off competition as consumer demands for health and wellness, along with the importance of government and insurance payer-funded programs, continue to rise. This is a pivotal moment that could determine their future success.