Distressed supplier turnarounds can be like a poker game. All the players involved have a slightly different hand to play and keep their cards close to their chest, wary of revealing their (sometimes clashing) strategies and priorities.

And just as a poker game needs a dealer, the players/stakeholders — in this case original equipment manufacturers (OEMs), other customers, lenders, vendors, and management — need someone they can trust to set the rules and treat everyone fairly. The good news is that in this high-stakes game, the neutral party can go a step further. They can facilitate collaboration among stakeholders, rebuild potentially strained relationships, and help develop unbiased, achievable solutions. This ensures everyone at the table is on equal ground and has a chance to win in the long run.

Supplier distress has become all too common recently. According to financial information services provider CapitalIQ, in the last three years more than 150 distressed machinery, equipment, components, and parts suppliers filed for bankruptcy, with many others either restructured or liquidated through an out-of-court process — which is just one more reason why it’s vital for suppliers to get turnaround efforts right. Fortunately, there are several levers for achieving that goal, which we have identified through various restructuring engagements.

Successful supplier turnarounds rely on quick, decisive assistance

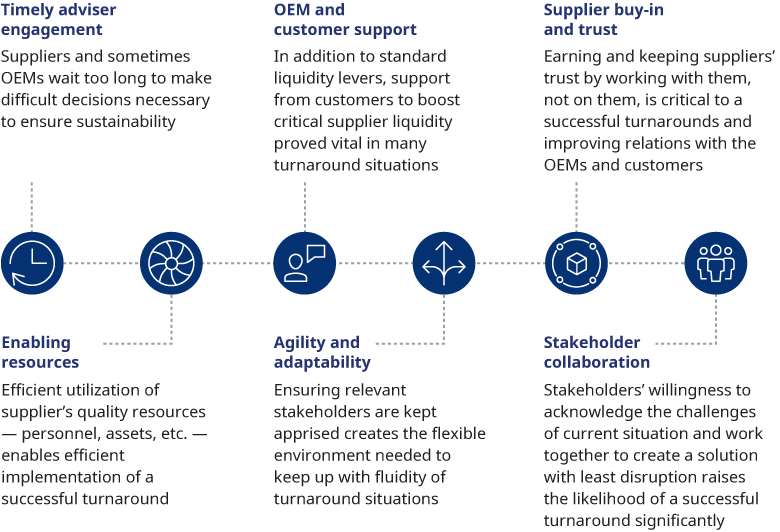

A major part of ensuring that a turnaround can succeed is timing. Suppliers can wait too long to make difficult decisions necessary to ensure sustainability. Sometimes that’s a result of them being overly optimistic. In other cases, they may simply be unable to make difficult decisions because they lack the skills to do so, haven’t experienced similar situations before, or are at the mercy of their OEM customers’ changing strategies. Regardless, suppliers can benefit tremendously from timely engagement with experienced, neutral advisers who make an effort to earn and keep suppliers’ trust, and who work with the suppliers rather than dictating to them.

The more critical the supplier’s circumstances, the greater the need to move fast in assessing how to enable resources most effectively and holistically – not just liquidity-enhancing resources, but also operations and non-core assets. For example, we recently worked with aheavy transportation product manufacturing OEM’s supplier that due to COVID-19 was facing declining production volumes and margins on many of its products. To remedy the situation, an important part of our approach was performing an operational efficiency diagnostic in addition to financial and liquidity assessments, enabling the company to identify and quantify sustainable long-term margin improvement opportunities.

In that case, the supplier client had less than 10 days of remaining liquidity. But even in less urgent situations, turnarounds can hinge on gaining support from the supplier’s customers to augment standard liquidity levers. That may entail some more creative solutions, such as one or more OEM customers extending a line of credit to the supplier or giving access to funds through a new joint venture. More common, though, is for OEMs and/or other customers to “buy forward,” paying for orders in advance so the supplier has additional liquidity for the needed materials and labor. Another lever our clients commonly pull is changing customer payment terms. For example, a customer that has 120-day payment terms will be moved to a net-10 or even shorter term to provide a one-time cash uplift.

Collaboration among OEMs and with suppliers is vital

While loans and prepay agreements can be mutually advantageous, they can get complicated when multiple OEM customers are involved. Some OEMs naturally will be more interested than others in providing support to a given supplier due to customer concentration. A particular OEM might benefit more in one supplier situation, but with another supplier the roles could be reversed. Meanwhile, all the customers involved will want assurances that any money they’re fronting will be used to make their own parts. Hence, having a long-term collaborative view amongst all stakeholders is key. Their willingness to acknowledge the challenges of the situation and work together to create the least disruptive solution possible raises the likelihood of a successful turnaround significantly.

For one of our recent heavy components and parts supplier clients, we negotiated with a conglomerate of OEM customers to secure additional sources of funds. That required frequent, active communication with all of them to create the agility needed to get signoffs, votes, or decisions in such a fluid situation. Full transparency was also essential; messages went out to all of them together rather than one at a time, and separate conversations were discouraged to prevent mistrust or suspicions of favoritism. Achieving the needed level of transparency and speed also relied on getting early buy-in with the team and aligning on realistic goals, communication and voting procedures, and expected outcomes from the very outset of the engagement.

A holistic approach with an aligned long-term goal is a winning strategy

Liquidity management measures aren’t limited solely to finding and coordinating new funding sources for the supplier. Tactical moves to optimize working capital needs — including better managing of inventory/supply chain, pulling accounts receivable balances forward, and adjusting accounts payable terms usage — can provide a quick boost in turnarounds as well. For example, on a recent engagement, we prioritized our heavy parts supplier client’s vendors’ payments based on revenue, margin, timing, and criticality (such as those needed to make parts for the customers that were providing liquidity) and made sure our approach was bought-in by all stakeholders.

Of course, however effective they may be, short-term strategies alone aren’t enough. Among other efforts to achieve the client’s long-term solvency and profitability goals, we created a holistic business plan outlining pricing, costs, operational efficiency, and timing under different scenarios. Not only did the supplier get back on a path to long-term viability, but also its customers ensured their supply chain resilience. In other words, a winning hand for all.