We are pleased to present the latest edition of our health insurer financial update, Pulse. We aim to keep you abreast of key market trends and dynamics that impact health insurer financial results and profitability. Earlier this year, we released our analysis of Q3 2023 financials. This update contains our analysis of Q4 2023 financials. We are already working on our analysis of Q1 2024 financials, which will be released later this quarter.

Following an in-depth review of large public health insurance companies, we assessed the profitability of their insured blocks of business, excluding Administrative Services Only (ASO), foreign insurance, and non-insurance businesses. The results showed a general stability in profit margins from Q2 2023 to Q3 2023, but a greater divergence between companies’ performances from Q3 2023 to Q4 2023, with some significant increases and decreases in profit margin seen in Q4 2023. Below we break down the key insights from our review.

Net income trends for insured business

Elevance’s profit margin (net income/premium) dropped by 1.1% from Q3 2023 to Q4 2023, primarily driven by a higher benefit expense ratio. UnitedHealthcare’s profit margin also decreased by 0.6%, with higher medical costs for the quarter. CVS Health (Aetna) saw the largest drop at 2.4%, driven by significantly higher health care costs and operating expenses. Cigna was the only company to increase its profit margin, seeing an improvement of 4.1% from Q3 2023 to Q4 2023, largely due to a low overall tax rate driven by deferred tax benefits, including those from the sale of its Medicare Advantage business. Overall, the unweighted average profit margin of 5.1% is 0.1% higher than the Q3 2023 unweighted average, and 1.5% higher than the Q4 2022 unweighted average of 3.6%.

Medical loss ratio trends for the largest public health insurance companies

On average, the medical loss ratios (medical costs/premium) for all four of the public large companies that we reviewed were 2.4% higher from Q3 2023 to Q4 2023. In Q4 2023, reported loss ratios were 89.2% for Elevance (formerly known as Anthem), 88.5% for CVS Health (Aetna), 85% for UnitedHealthcare, and 82.2% for Cigna. Like profit margins, loss ratios are impacted by seasonal patterns. Overall, the unweighted average loss ratio was slightly higher in Q4 2023 at 86.2% compared to Q4 2022 at 85.5%.

The estimated operating expense ratio of healthcare insurers

Operating expense ratios (operating expense/premium) stayed relatively steady, with an overall decrease of 0.2% from Q3 2023 to Q4 2023. Cigna and CVS Health (Aetna) reported increases of 0.3% and 0.7% respectively, while Elevance (formerly known as Anthem) decreased by 1% and United Healthcare by 0.8%.

Q4 2023 earnings highlights for the six leading health insurance companies

Many carriers commented on the utilization trends they saw during Q4 2023, noting that overall utilization is generally in line with expectations.

Centene

Health benefits ratio for the quarter was 89.5% and 87.7% for the full year, both of which are within the expected range. Breaking it down by line of business, Centene noted that they experienced health benefit ratios of 90.6% for the quarter and 90% for the full year within Medicaid, which is slightly worse than expectations. Medicare’s full year health benefits ratio was 87.1%, and Commercial’s was 79.8%. Premium growth from redeterminations and the special enrollment period in the fourth quarter contributed to the positive HBR performance.

CIGNA

Medical care ratio was better than expectations in the quarter at 82.2%, driven by favorable medical care ratios in the US Commercial business. The full-year medical care ratio of 81.3% was an improvement of 40 basis points from full-year 2022. Overall, CIGNA believes the first-quarter 2024 ratio to be in the range of 81.7% to 82.7%.

Elevance

Elevance experienced a benefit expense ratio of 89.2% within the quarter and 87% for the full year, improving 50 and 60 basis points respectively from prior year periods. The change was primarily due to premium rate adjustments to cover medical cost trends. The expectation for 2024 is a benefit expense ratio of 87%.

Humana

Reported a benefit expense ratio of 91.5% for the quarter and 88% for the full year, both higher than predicted. The uptick in utilization within Medicare Advantage from the previous quarter continued beyond expectations, driving the overall higher benefit expense ratio. Humana expressed optimism that re-evaluating Medicare Advantage pricing and trend-mitigation initiatives would restore margins in 2024.

Molina

Molina saw a business-wide medical cost ratio of 89.1% for the quarter and 88.1% for the full year, both of which are within the target range. Medicaid business experienced a medical cost ratio of 89.2% for the quarter and 88.7% for the full year, both in line with expectations. Medicare Advantage saw a medical cost ratio of 93.3% for the quarter and 90.7% for the full year, both above their long-term target range and impacted by higher-than-expected utilization of supplemental benefits, in-home services, and high-cost drugs, all of which they believe were appropriately addressed in 2024 bids. The medical cost ratio for Molina’s Marketplace business was 79.8% in the quarter and 75.3% for the full year, well below the long-term target range.

UnitedHealth Group

Care patterns remain consistent with the view shared during the third quarter, with activity levels still led by outpatient care for seniors, most notably in the orthopedic and cardiac procedure categories. The medical care ratio was 85% for the quarter and 83.2% for the full year, slightly higher than estimated. Entering 2024, the UnitedHealth Group are confident in their care ratio outlook of 84% +/- 50 basis points.

Q4 2023 Medicaid membership declines, while commercial enrollment sees increase

In Q4 2023, total Medicaid membership for public carriers decreased by 4.3% from Q3 2023, driven by the continued redetermination of Medicaid eligibility. However, total Medicaid enrollment is still about 31% higher than at the beginning of the pandemic. Total Commercial membership increased roughly 0.5% over Q3 2023, as some individuals who lost Medicaid coverage were able to shift to Commercial coverage.

During their earnings calls, most carriers provided insight into their year-to-date membership performance. In addition, some carriers also commented on the ongoing process of states redetermining Medicaid eligibility. The Public Health Emergency officially ended on May 11, 2023, with several states beginning the redetermination process on April 1, 2023.

CIGNA

Ended the quarter with about 19.8 million medical customers, representing growth of 1.8 million members since the end of 2022, driven primarily by growth in US Commercial customers, as well as individual exchange and Medicare Advantage. Assumptions for 2024 year-end include approximately 19.3 million total medical customers.

Elevance

Ended the quarter with medical membership of approximately 47 million members, reflecting a 570,000-member decrease year-over-year driven by Medicaid eligibility redeterminations.

Humana

Ended the quarter with approximately 16.9 million members, a decrease of just over 200,000 from year-end 2022.

Molina

Medicaid enrollment decreased by 200,000 members in the quarter due to the net impact of Medicaid redeterminations, with full-year Medicaid enrollment down 500,000. Molina has been able to re-enroll 30% of members disenrolled for procedural reasons and expects to continue to re-enroll members who have lost Medicaid coverage, though with an expected net loss of 600,000 from the redetermination process.

UnitedHealth Group

Commercial and Medicare added over 1.7 million new members throughout the year and expects to serve 1.5 million additional people with domestic commercial offerings in 2024.

Exhibit 4 displays the changes in reported enrollment for the 16 most recent quarters for Commercial and Medicaid for a set of public companies where counts were available on a consistent basis. In the quarter, total Commercial membership increased by about 0.5 million, while Medicaid membership decreased by approximately 1.9 million in the quarter due to the redetermination process.

Health plan capitalization and yearly changes in healthcare firms, Q4 2023

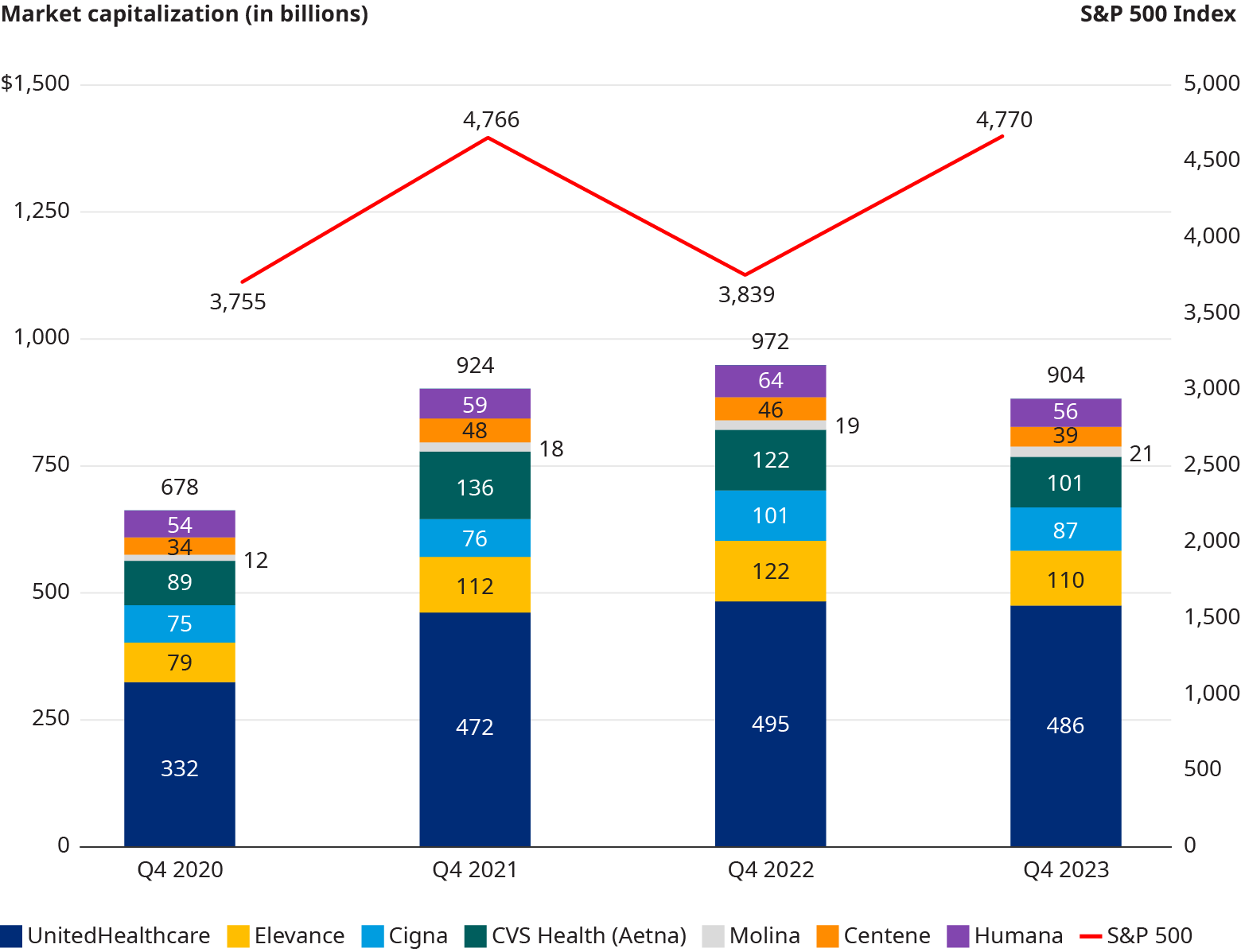

From Q4 2020 to Q4 2023, the collective market capitalization of the seven public healthcare companies we track saw considerable growth. Between December 31, 2020, and December 30, 2023, the aggregate market capitalization of the seven public health plans rose by 33%. During the same period, S&P 500 index saw growth of 27%; 6% less than that attained by the seven tracked public healthcare companies. However, despite the substantial overall gain by the health plans, there has been a noticeable decrease in market capitalization over the last year. From Q4 2022 to Q4 2023, the market capitalization of the seven public companies dropped by 7%, while the S&P 500 index increased by 24.2% from Q4 2022 to Q4 2023.

Most Healthcare stocks Rose in Q4 2023, but only cvs Health (Aetna) beat the s&P 500 Index

The S&P 500 index reported large gains in the quarter with an 11.2% increase from Q3 2023’s market capitalization. Similarly, of the seven tracked public healthcare companies, six also reported gains in market capitalization over the same period. CVS Health had the most growth in its market cap and was only company that saw a greater increase than S&P 500, with a 13.3% increase. Molina saw the second highest increase among the seven tracked public healthcare companies at 10.2%. Both Elevance and Centene showed considerable increases of 8% and 6.3%, respectively. United Healthcare and CIGNA reported increases that were well below that of the S&P 500, at 4.3% and 3.5% respectively. The only company to show a decline in market capitalization from Q3 2023 to Q4 2023 was Humana, with a decline of -6.5%.

Look for the Pulse Q1 2024 financials later this quarter.