Telecom operators have grown in volume terms in western markets over the last 10 years, with data traffic increasing more than a hundredfold. However, this has not led to corresponding revenue growth. One reason is regulatory actions, especially in Europe. These include the blocking of mergers, or only permitting them with excessive remedies to maintain competition; mandated decreases in wholesale prices; and disruptions to retail businesses such as the abolition of roaming charges. Another cause is overcapacity: Supply has grown faster than demand, as operators move too fast to provide consumer packages with very high or unlimited connectivity. A third trigger has been market disruption: Challenger operators and over-the-top (OTT) services have reduced prices, driving a race to the bottom in some markets. As a result, the market capitalization of telecom operators has underperformed compared to other industries – especially in Europe.

To invest enough to support the future connectivity needs of industry, society, and governments, telcos need to find new ways to boost revenues and profits. Customer convergence, new technologies such as 5G, and new products are fertile fields in which to start the recovery. Also helping is an environment for M&A and consolidation that appears more relaxed: The recent merge between the Dutch units of Tele2 and Deutsche Telekom was allowed without the regulator requesting major remedies.

Despite the trend towards unlimited data usage for customers, telecom operators can still stand out in a number of ways. Although connectivity is becoming a commodity and near-countrywide coverage is taken for granted, network quality – both the experience and the service – will still be a differentiator. Content is increasingly relevant in markets with a high degree of fixed-mobile convergence, though it is increasingly costly. Many customers are willing to pay for a better experience and brand bonding, though this must go further than functional care processes based on apps and websites. And data privacy services can help a telco stand out as concern rises over the use of personal data, especially among older people: Of respondents to a recent Oliver Wyman survey aged 35 or more, 29 percent said they were “reluctant/scared” about companies storing their personal data to personalize services, while 20 percent said they were annoyed by such offers.

Through our work with operator clients, we have identified five main strategies for boosting revenue growth. Their potential varies, and some are long-term bets, while others are short-term, nonstructural measures:

• More-for-more packages

• Outsmarting the competition through Data

• New adjacent products and applications

• Data-privacy and multiservice-platform businesses

• ICT and data services for business

1. MORE-FOR-MORE

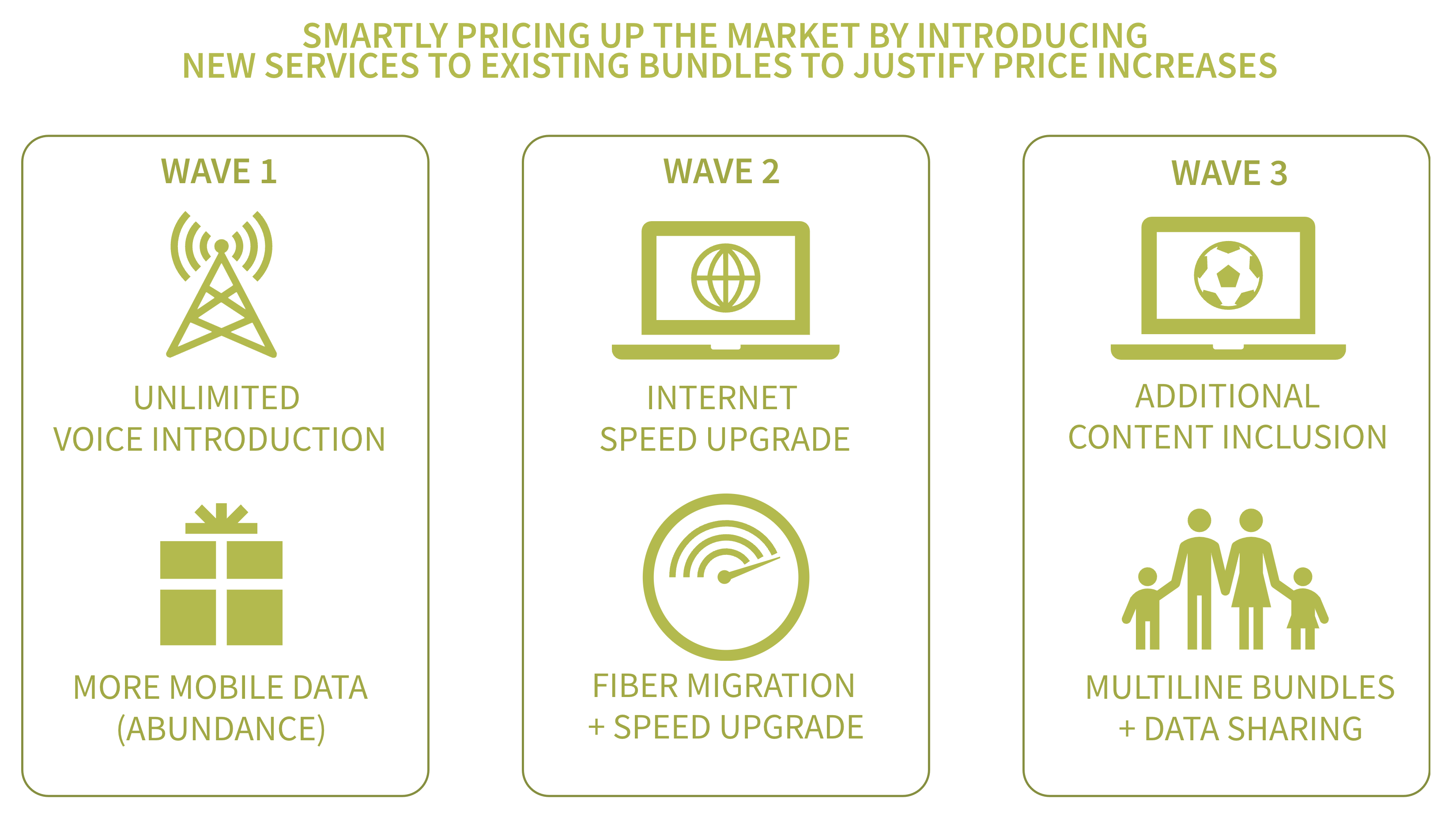

This strategy consists of smartly pricing up the market by introducing new services to existing bundles to justify the price increases. The aim is to capture as great a share as possible of the connectivity wallet – not just the individual’s but the whole household’s.

Some operators have already taken bold steps in this direction in Spain, France, and Belgium, where more-for-more offers have resulted in several waves of price increase. However, for this strategy to be effective, specific market conditions are required. The main players’ market shares should be fairly stable and not too far apart – which will mean that no operator can increase revenues by cutting prices to boost volume, as any volume growth would not compensate for the lower prices. In these circumstances, operators can only make progress by increasing their average revenue per user, which makes it easier for each one to follow such a strategy.

However, the more-for-more strategy is limited to the short term. In a first wave, operators introduce unlimited voice services and then add more mobile data, until abundance is reached. The second wave is mostly based on pricing up faster Internet connection or migration to fiber. The third wave focuses on content addition, both exclusive and nonexclusive, on multiline packages to create family bundles, and on data sharing.

Exhibit 1: More for more tactics

Subsequent waves are possible, but it is important to keep an eye on the low end of the market to ensure that no window opens for lower-cost operators. If major telcos raise their prices too far, it may become viable for competitors to increase their volumes through price decreases in a profitable way. The Spanish market is a good example of the benefits and risks. The big three operators at first achieved revenue growth by means of price increases associated with more content, data, voice, or speed. However, after a couple of years, the price gap between the main brands and the challengers and/or second brands became large enough for the challengers to start a price battle – first for the low segment of the market and then for the middle.

Also, more-for-more strategies have driven up the prices of exclusive content, pushing a number of telcos to obtain it through alternative routes. Some, such as AT&T, have acquired content developers; some have developed their own content, as with Telefónica; and others have formed partnerships with providers of OTT services.

2. OUTSMARTING COMPETITION THROUGH DATA

Any organization that is not a math house now or unable to become one soon is already a legacy companyRam Charan, "The Attacker’s Advantage"

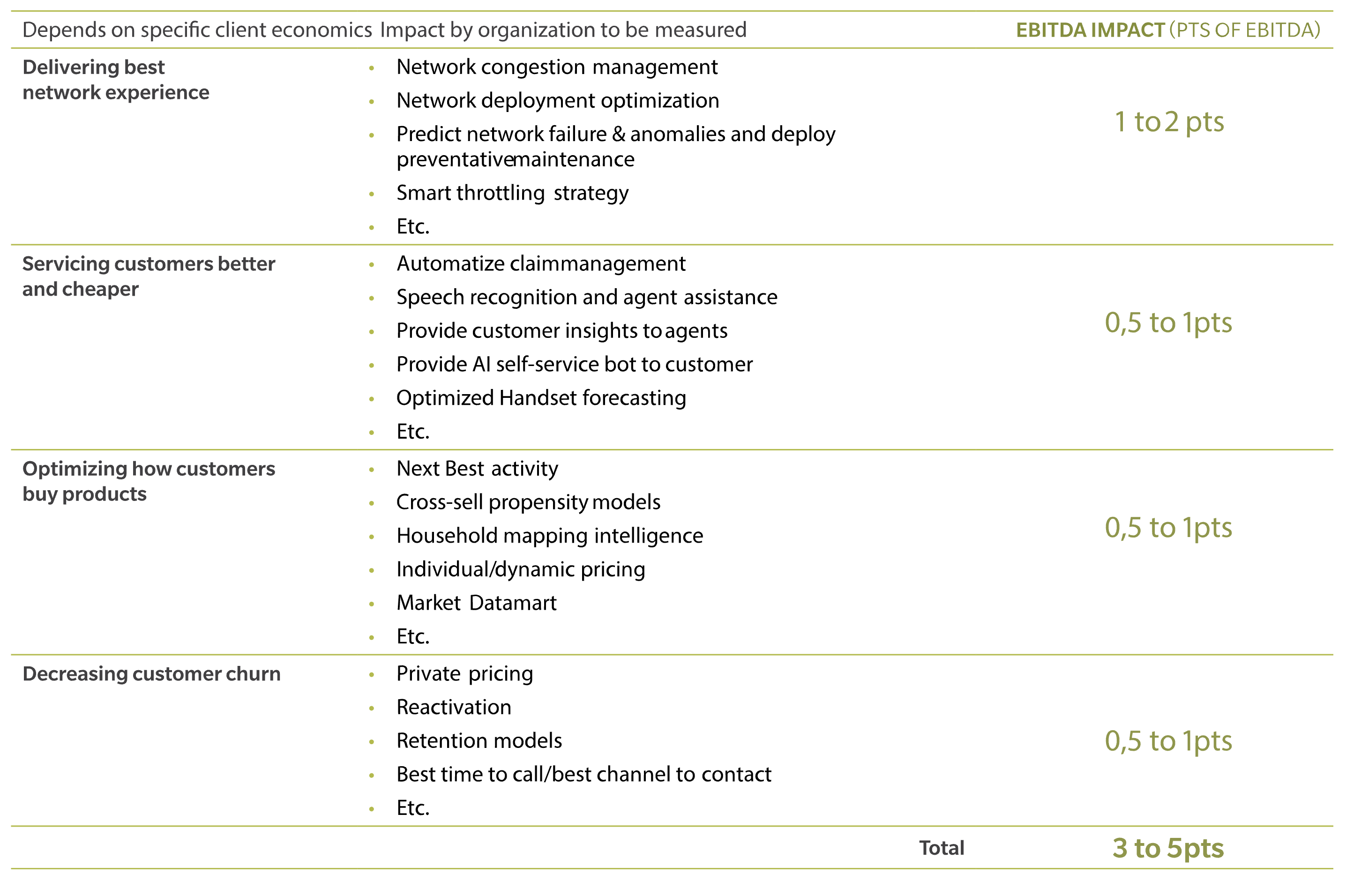

Customers are willing to pay more for pleasant experiences and strong brand bonding. Smart use of customer data combined with strong data management capabilities can form the basis of hard-to-replicate commercial tools and greatly improve performance in the core telecom business, we have found in recent engagements. The gains can include an increase in the rate at which customers can be contacted and a several-point decrease in churn. The resulting impact could be between three and five EBITDA percentage points. Operators can have an impact on two main fronts. (see Exhibit 2).

IMPROVE CUSTOMERS’ DISCOVERY AND PURCHASE OF PRODUCTS

Data can boost commercial performance. They can, for example, improve targeting to make commercial operations more effective; help predict whether customers reached through a certain channel will subsequently accept an offer; contribute to individual pricing capability; and enhance cross-selling models. Another role of data is to map households and markets – for example, the number of devices and individuals in a given house, the services a household is likely to demand, and the value that it can be expected to produce. Most of these capabilities can be implemented in next-generation recommendation engines that employ AI algorithms to optimize revenues or profits. For each client in the customer base, these new engines can work out what action to take with whom, through which channel, when, and how.

Exhibit 2: Outsmarting through data

Source: Oliver Wyman analysis

REINVENT THE CUSTOMER RELATIONSHIP TO IMPROVE THE QUALITY OF EXPERIENCE

Data can help personalize operators’ relationships with each customer and so improve loyalty and retention. First, data can help predict potential issues with specific customers, so that the operator can prevent or mitigate the impact, increasing loyalty and potentially supporting a moderate price premium. Another step is the proactive improvement of the customer experience, which can begin with the use of AI to continuously assess the quality of service and the network. Moreover, by better understanding customer preferences, operators can provide a more personalized experience, even for live interactions.

3. NEW ADJACENT PRODUCTS AND APPLICATIONS

Telecom operators are powerful multi-product service providers, and they should continue to add new products and services over the next decade – just as they did in the past.

Virtual reality already exists in some applications and could soon be ready for the mass market. To work effectively as products, VR applications will need to operate wirelessly, which implies greater mobile bandwidth than at present, at a low cost. They will also require low latency, as uninterrupted service is critical for an immersion experience.

The Internet-of-things is a great opportunity for telcos. The global market is expected to nearly triple from its 2016 level to $750 billion in 2021, according to analysis by Gartner. Some of the business will come from the residential market, but most of the value will derive from the more-complex solutions that businesses will need.

One of the most promising areas is connected cars, as they will generate strong demand for high-bandwidth, low-latency, omnipresent networks. Potentially even more important will be the strong demand for in-car connected infotainment services, which will consume large quantities of data. Some aspects of the IoT will present opportunities to telcos that go beyond connectivity services: Tasks such as security require dedicated bandwidth with no risk of failure – something that should be easier over 5G networks.

Home automation is likely to evolve fast. Currently, homes are mostly connected through TV set-top boxes and Wi-Fi terminals provided by telecom operators. But digital giants such as Google and Apple are pushing for control of the living room with OTT device management services and assistants that respond to verbal commands using AI – Amazon’s Alexa, for example. Some telcos are making bold moves to compete in this space, and they are well positioned to provide some of the new services, including energy management, home security, remote appliance control, and heath monitoring.

As an example, Orange announced a vocal assistant called Djingo in 2017 based on IBM’s Watson AI system. Telefónica has released an AI assistant called Aura, which is voiceoperated and responds to commands to provide billing information, select TV content, and start a video call. It also predicts future needs from past behavior. In our opinion, however, a voice assistant will not be sufficient, and a strong data privacy function will be needed.

4. DATA PRIVACY AND MULTISERVICE PLATFORM BUSINESSES

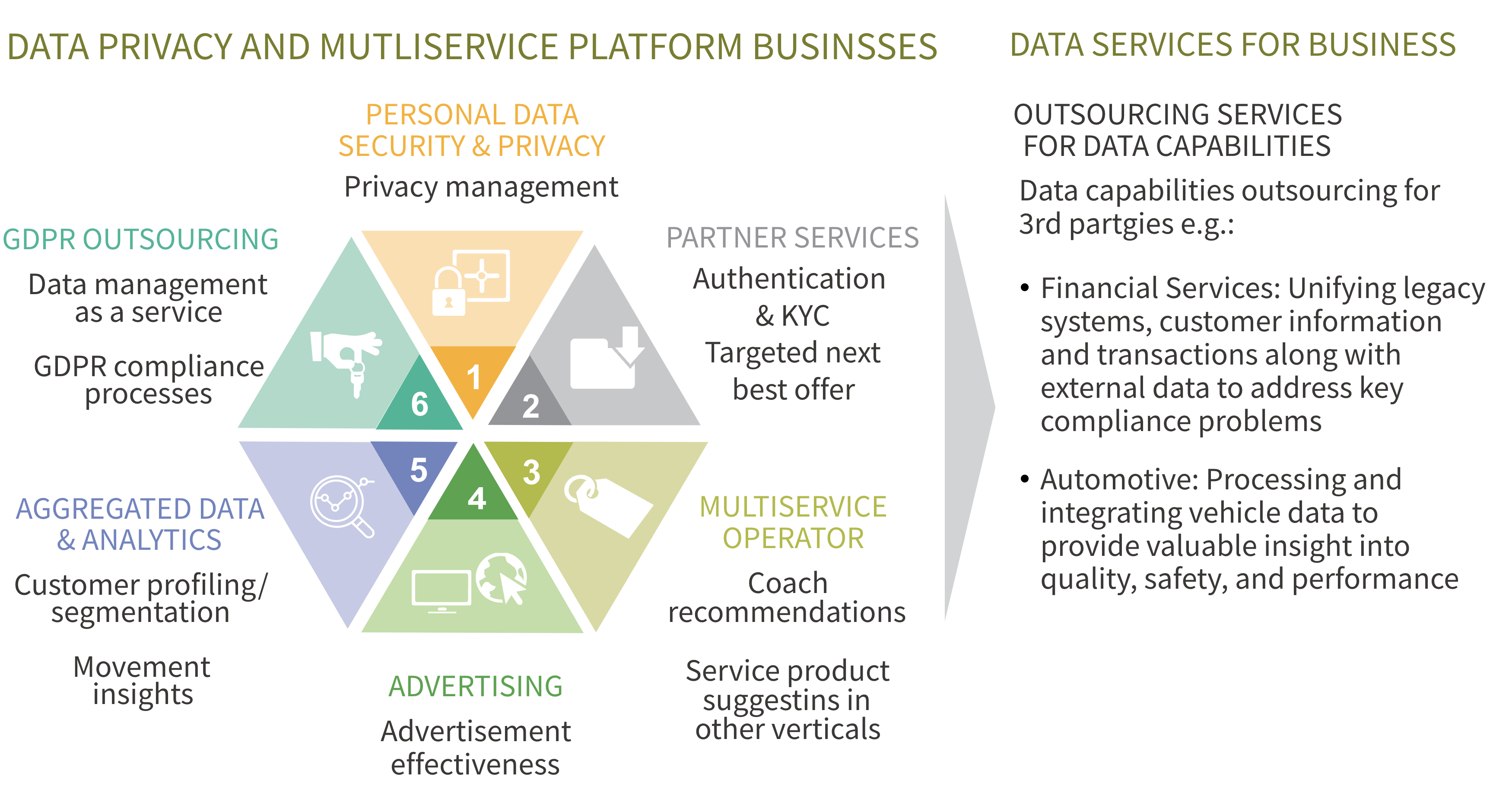

We have identified six short-term opportunities that telcos can exploit and where, in some cases, they are ahead of the competition. However, these require flexibility and may need partnership and collaboration with specialists. (see Exhibit 3).

Personal data security and privacy is an area of potential growth amid growing demands for and rules related to privacy. The most prominent of these is the European Union’s General Data Protection Regulation (GDPR), but other measures are being launched in Asia and the Americas, such as the California Consumer Privacy Act.

Digital life has become stressful and complex, as individuals’ information is increasingly scattered. People do not know how their personal data are being used or by whom and many are concerned that they have lost control over it. Telecom operators could offer privacy management in freemium mode, with extra charges for specific security and privacy services. These could include security services, such as password wallets; data transfer to trusted providers, as with automatic form filling; administrative tasks, which could consist of updating a home address, password, or payment details on different platforms and apps; and dashboards that make data visible across different platforms and apps and let customers give consent for their storage and use. Some of our more advanced telco clients are already working on these.

Exhibit 3: Data privacy & multiservice platform

Source: Oliver Wyman analysis

Some telcos are actually well positioned to run such services. According to a recent Oliver Wyman survey, people trust their banks more than other organizations to protect personal data, but telecom operators came right after banks in second place.

Another opportunity is to act as multiservice operators, branching out beyond telecommunications and using data to become a player in businesses such as energy and insurance. Using databank and home-assistant services as a base, telcos could link a number of different services in ways that would not be possible without access to these customer datasets.

Telcos could also provide partner services related to individual customer knowledge and authentication. They could make it easier to sign up to a new service account, authenticate ATM withdrawals, or validate the identity of customers making purchases on digital platforms. Telcos could also support third-party companies in their commercial activities through services such as targeted pricing, optimized credit scoring, and insurance-risk management. In summary, they have the potential to play a much stronger role in their customers’ digital lives and to capture value in the process.

Advertising and data services for media companies are rapidly becoming a significant source of revenues. Telcos have the potential to supply knowledge about consumers – such as what they watch on TV and online, their movements, and socioeconomic indicators – that can provide insights to media and advertisers. Telcos also control set-top boxes and TV apps, which are a means to push targeted, segmented TV advertising that might easily be extended to all digital ecosystems. This type of intelligence could also be used for traditional forms of offline advertising.

Aggregated, anonymized data are a way for telcos to enter the business of customer profiling and segmentation – a task that is carried out today through market research, which does not rest on knowledge of actual behavior. Also, telcos can help to gain insights into people’s movements and advise retailers on where and how to position displays and promotions for maximum commercial effectiveness. Data on movements can also help mobility services, as they can be used to analyze the market shares and business potential of specific routes for airlines, trains, and buses.

The GDPR also presents an opportunity to develop outsourcing services for businesses. Some small and medium companies are struggling to comply with the regulation’s requirements, leading to demand for GDPR management-and-compliance services. These new services could each be provided in isolation. But, if they are combined effectively with services related to data privacy and databanks, their potential will be significantly higher. The most-advanced operators are working on connecting these elements to form coherent ecosystems, rather than pursuing independent service launches.

5. ICT AND DATA SERVICES FOR BUSINESS

Telecom operators have traditionally enjoyed synergies by offering both connectivity and ICT services to businesses customers. However, ICT providers are now competing in this field, as are new challengers such as Amazon and Akamai, which can offer superior propositions thanks to new technology or control of the cloud.

So far, telcos have had mixed results here. A few have become serious contenders, though with much lower margins than in their core telecom services. But a clear majority have failed to generate revenues that might make the business worthwhile. However, business customers will increasingly need support from connectivity and technology partners. Telcos can leverage their core assets to position themselves in these emerging partnerships. The lesson of the early difficulties is that that this is a go-big-or-go-home business, so only telcos of a certain scale will be able to play.

Additionally, telcos can also offer end-to-end data and digital transformation consulting services to the enterprise market and the midmarket. Some of the biggest spenders here are financial services, manufacturing, and the public sector. For example, financial services firms are currently undertaking transformations involving a number of compliance requirements, and they will also have to unify legacy IT systems, customer information, and external data. The automotive industry needs to process vehicle data to gain insights into quality, safety, and performance.

Telcos active in this arena are offering their business customers data and digital-enabling services to support their transformations and build up their capabilities. Some have launched their own data-as-a-service units, either as part of their broader data monetization services or as part of an extended B2B portfolio. Examples include Telefónica’s Luca, Singtel Dataspark, and Orange Consulting, an arm of Orange Business Services

NEW MARKETS FOR NEW GROWTH

Of these five strategies, most telcos can launch more-for-more – especially, though not exclusively, convergent operators with access to differentiated video content. The four others will require longer development and likely cause substantial disruption to operators’ business models. The strategies are independent of one another and can be pursued in isolation. Alternatively, they can be combined to unlock further opportunities in their areas of overlap.

Some of these revenue strategies will bring telcos into areas that are still unregulated, and the industry’s ability to influence the rules of the future will have a strong impact on how attractive the new markets become. There are plenty of opportunities for growth beyond the areas where telcos are currently active; now they need to step up and pursue them.