Corporate venture capital can be a boon for the pharmaceutical industry. It gives incumbent pharmaceutical companies access to cutting-edge innovations, lowers risk for research and development through co-investment, and diversifies pipelines geographically and technologically. For early-stage biotechnology companies, it provides essential funding, external validation, and access to invaluable resources, talent, and infrastructure.

Still, companies must be strategic in knowing when, how, and why to leverage these types of investments. We explored five key hypotheses to test recent shifts in pharmaceutical venture capital flows, providing insights into the current state and future trajectory of capital flow:

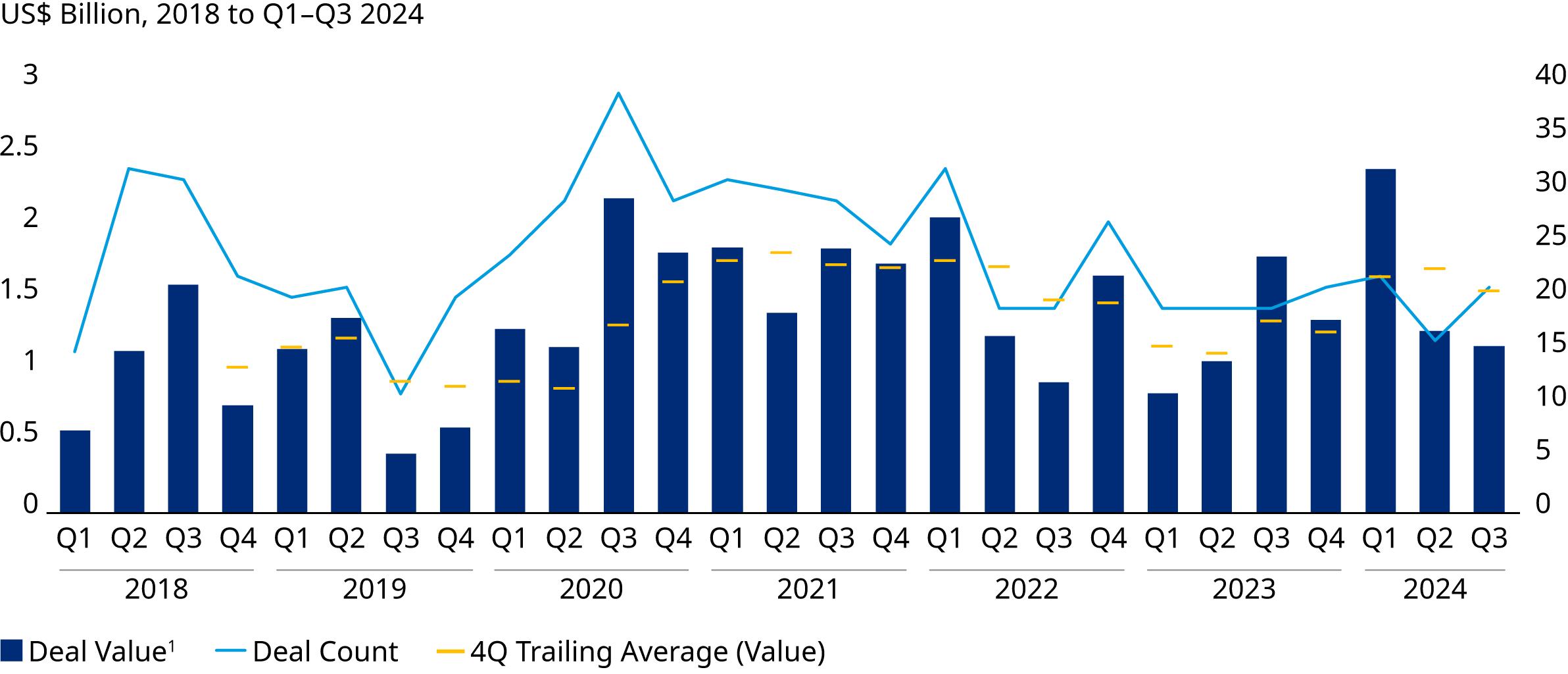

Hypothesis 1: Investments Have Rebounded Following a Post-Pandemic Drop

Oliver Wyman Assessment: True

A particularly strong Q1 2024 saw a surge of deal value to $2.4 billion, driven by substantial investments like Mirador Therapeutics’ $400 million to develop precision therapies for immune-mediated diseases and CRISPR Therapeutics’ $280 million focused on gene editing. Total deal value has continued to rebound post-Covid, reaching $1.5 billion on a rolling four-quarter average basis, up from $1.1 billion in Q2 2023 and 68% above the same period in 2019. Deal volume remains stable at roughly 20-25 deals per quarter . We believe this increase in activity reflects declining valuations following a post-pandemic peak in 2022 (see fig. 5 for Digital Therapeutics valuations).

Hypothesis 2: There’s a Shift Away from Pipeline Candidates Towards Enabling Technologies

Oliver Wyman Assessment: Partially True

Foundational technologies and capabilities like artificial intelligence and gene editing platforms are driving future innovation for pharmaceutical companies. While corporate venture capital investment remains heavily skewed towards classical product acquisition with more than 75% of investments directed towards products rather than enabling technologies, there has been a gradual increase in the share of investments allocated to technology and capabilities. Investments this year so far have reversed this trend so it will be interesting to monitor Q4 for investments outside of pharmaceutical products.

Hypothesis 3: Niche Therapeutic Areas Are Emerging as Investment Targets

Oliver Wyman Assessment: Partially True

Immunology and oncology continue to be key drivers of pharmaceutical venture capital investment, accounting for over 65% of deal value in the first three quarters of 2024. However, emerging therapeutic areas, particularly in central nervous system disorders and neurology, are gaining traction, comprising approximately 10% of deal volume and value. This diversification reflects a broader trend towards addressing unmet medical needs in non-core therapy areas.

Hypothesis 4: Boom in Digital Therapeutics Investment Is Over

Oliver Wyman Assessment: True

A steep decline in investment in digital therapeutics has been observed, with total investment volume and value plummeting from $0.7 billion in 2021 and 2022 to less than $0.1 billion from 2023 to H1 2024. This downturn could be attributed to inflated valuations and notable high-profile failures.

Hypothesis 5: Investment in New Modalities Is Eating Into Capital Allocated to Small Molecules

Oliver Wyman Assessment: True

Investments in small molecules now comprise less than 50% of the volume and value of CVC flows. Notably, RNA investments have seen a significant decline since the pandemic, while cell therapy, which accounted for 22% of deal value in 2021, has also slowed in Q1-3 2024. Conversely, gene therapy has been growing rapidly in both volume and value, indicating a shift in focus. Peptide deals are becoming smaller in average value per deal.

Understanding what’s next for corporate venture capital

The rebound in corporate venture capital investment presents opportunities and risks for large pharmaceutical companies. A robust investment strategy can be a key differentiator in slower investment cycles, leading to higher return on investment as valuations drop. Continual allocation of capital throughout downturns can bring in better-value deals, but organizations must be strategic. They should conduct an internal assessment with early research teams to determine where they can gain the most value, including looking at new technologies and capabilities. And while we expect investment opportunities in niche therapeutic areas to continue to grow, companies should make sure those outlays compliment their core portfolio and capabilities, especially in manufacturing. Finally, they should avoid getting swept up in hype cycles by undertaking comprehensive due diligence and market analyses.