The individual health insurance market saw unprecedented growth over the past few years. Enrollment in the Affordable Care Act Marketplace climbed 78% between 2020 and 2024, hitting a record 21.4 million enrollees. Growth over the past couple of years was driven by a unique convergence of economic, public health, and health policy adjustments.

The new Congress and incoming Trump administration must decide the fate some of those policies, including the enhanced premium tax subsidies and other expanded spending like navigator funding. Created in response to COVID-19 and the resulting economic downturn, the enhanced premium tax subsidies led to a 20% increase in the number of people eligible for help buying Marketplace coverage. They are set to expire at the end of 2025. Navigator funding is set annually.

Despite these question marks, we think factors taking place in the broader market will continue to boost individual coverage, not the least of which is the mounting interest in Individual Coverage Health Reimbursement Arrangements. ICHRAs allow employers to reimburse employees a set amount of monthly tax-free money for health insurance premiums and other qualified medical expenses. By some estimates, the percentage of employers offering ICRHAs grew by 30% between 2023 and 2024.

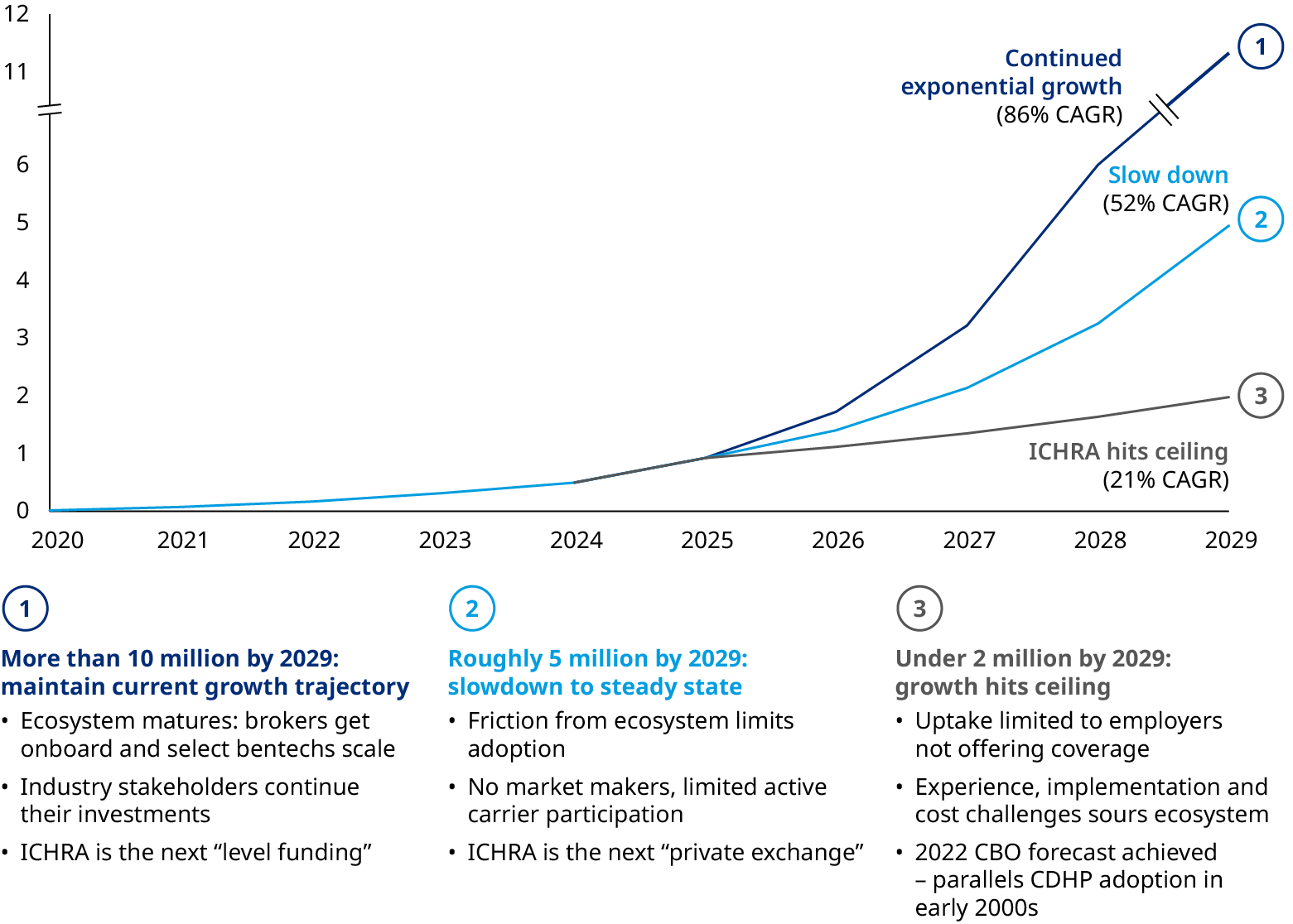

ICHRA performance over the next couple of years will be crucial in determining the size of the individual market. Insurers and brokers need to be equipped to understand the role that they will play. Below we detail three scenarios for ICHRA growth and important strategy decisions for carriers.

Giving employers another lever to pull

Employers expect to see health benefit costs rise 5.8% in 2025, according to data from Mercer. That would be the third year in a row of cost increases above 5%. For decades, employers shifted more financial burden to employees by raising deductibles and other cost-sharing mechanisms. But ICHRA can be a cost-effective alternative for some employers. The benefits include:

- Lower costs: In general, the marketplace tends to have lower average provider reimbursement rates. In addition, marketplace premiums are defined based on the market as a whole rather than the employer’s population, which can be particularly attractive for sicker employers with above average risk.

- Lower cost trends: While group rates have grown by 22% over the past five years, individual marketplace rates have stabilized and have been experiencing reasonable increases in recent years

- Predictable costs: The employer sets a defined contribution, which can be adjusted year-over-year and is not impacted by medical cost increases

ICHRA also represents a trigger that unbundles employment and health insurance, according to Oliver Wyman Senior Advisor Terry Burke. “It will drive more choice, greater flexibility and a stable individual exchange market. The technology is scalable, employers are beginning to warm to the concept, brokers are getting educated and positioning ICHRA as a group alternative and payers are beginning to strategically explore their adoption of an ICHRA platform. I think 2025 is a tipping point for ICHRA and you will see significant growth in 2026 and beyond. ICHRA is here today, and here to stay,” he said.

The Departments of Health and Human Services, Labor, and Treasury were similarly bullish on the concept when ICHRA launched in 2020, suggesting that more than 800,000 employers will eventually offer them and 11 million people will use them to get health coverage.

Entering a transformative moment for individual coverage

The future of ICHRAs can take a few very different trajectories. Companies like Centene and Oscar have publicly stated their intentions to build out ICHRA opportunities. If they and other players continue to invest, then ICHRAs can maintain their momentum — similar to level funding which was built through the ongoing efforts of major carriers, third party administrators, and aligned brokers.

But if ICHRAs are left to their own devices, there are enduring challenges:

- BenTech maturity: There are over 100 benefits technology players in the space looking to enable employers in offering ICHRAs to their employees, but few have a complete solution. For those building out a more comprehensive offering, their capabilities are still nascent, and the experience is still fractured.

- Broker skepticism: Many brokers are still non-believers, lacking conviction on the future of ICHRAs and their relevance to their employer clients. And without a clear broker compensation structure and value proposition, brokers will continue to be a barrier to growth.

- Administrative pain points: A fractured and often subpar administrative experience, particularly for small- and medium-size employers that may not have the internal capabilities to navigate the nuances of ICHRA. That includes a dizzying go-to-market experience given the array — and sometimes conflicting messages — from carriers, brokers, and bentechs.

- Product offering maturity: There’s frequent misalignment between the existing product offerings on the ACA Exchange and the new cohort of employer-subsidized members entering the marketplace, including broad networks and a wide array of optional ancillary benefits.

If these challenges are not resolved, then ICHRA growth will slow or hit a ceiling, suffering the fate of other niche offerings like private exchanges and consumer-directed health plans.

Capitalizing on the future

Carriers need to think proactively about a few key areas as they prepare for this critical phase:

- Assess the potential for ICHRA in their markets and local factors that are at play — ACA Marketplace, brokers, employers, carriers, and providers.

- Understand how ICHRA growth will impact the rest of the group commercial market and how payers can take advantage of the momentum while preserving margin and membership.

- Determine what can be done to shape the evolution of ICHRA locally through broker programs, employer awareness, and countering moves made by competitors. Also understand the consequences of delaying action.

- Smooth out the transition to ICHRAs for employers and create a positive experience for employees by researching and identifying suitable benefit technology companies with which to partner, developing ICHRA-friendly product options, and supporting customers transitioning from group coverage.

We will examine these strategies in more detail in upcoming articles.