Changes to the Medicare Advantage Star Rating program pose significant headwinds for insurers. The Centers for Medicare and Medicaid Services April 5 published a final rule that will reset the number of plans earning a Star bonus payment and potentially change the composition of winners and losers through the introduction of a new Health Equity Index reward. The changes take hold in measurement year 2024, impacting ratings starting in 2026. Additional changes expected in future rulemaking will compound challenges for Medicare Advantage plans.

Oliver Wyman analyzed the impact that the final rule and pending changes could have on plans based on their recent Star performance levels.

Overview of Changes

Plans have been anticipating several modifications to the Star Rating program since they were proposed last December. Six key themes have been top of mind for Star leaders ever since:

6 Key Changes to the Star Rating Program

Social risk factors include dual eligibility, disability, or low-income subsidy eligible; contracts must have high enough concentration of SRF members within their population to be eligible for either a full or partial reward

Impact of the Changes

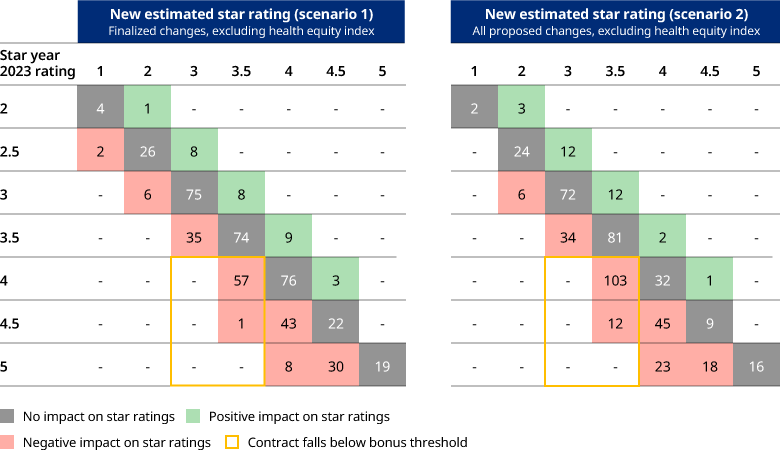

To better understand how these changes will impact the industry, Oliver Wyman modeled the key themes and how they would change Star ratings in 2026 and beyond. We assessed two scenarios — one including program changes finalized by CMS in April, the second looking at both finalized changes and those still pending from the proposed rule. Key themes modeled in each scenario are called out in the table below. A more detailed overview appears at the bottom of this post.

Scenario 1 only models confirmed measure changes as of CMS’s April 2023 Final rule. See “Scenario Modeling Methodology” for more detail on what is included

These changes were modeled against the 507 Medicare Advantage Prescription Drug contracts that received a 2023 Star rating. We calculated each plan’s score before and after changes are implemented. The entries represent the number of plans having that combination of before and after results. The HEI and removal of the current reward factor are not modeled in this analysis due to lack of sufficient accurate data.

In Scenario 1, 36% of contracts experience a decrease in their New Estimated Star Rating and 48% of contracts see a decrease in Scenario 2. Our analysis found that under Scenario 1, nine Medicare Advantage Prescription Drug contracts would improve performance enough to qualify for a bonus payment but 58 plans could see a decrease in ratings that prevents them from earning the quality bonus payment.

The outcomes are even less favorable under Scenario 2 where only two Medicare Advantage Prescription Drug contracts would move into bonus eligibility and 115 plans could move out of bonus eligibility. Since the HEI and removal of the current reward factor were not modeled, the actual results will differ somewhat from this analysis, although the magnitude of changes to bonus eligibility is anticipated to be similar. CMS’ simulation of replacing the reward factor with a HEI found that seven contracts gained stars while 54 lost stars.

Plans Should Act Now

The biggest impact on plan performance is likely to come from the HEI and changes to the weight carried by different measures. Preparing for those changes requires active management and planning from health plan leaders.

The HEI is designed to reward contracts that meet two criteria: having a high percentage of enrollees with social risk factors and delivering strong relative Star measure performance on this population. This reward will naturally favor Dual-eligible Special Needs plans since they have a high percentage of members with social risk factors, experience managing these vulnerable higher-risk members, and tailored benefits to support this population. Non-D-SNP plans can qualify for the HEI, but they need to actively monitor and manage Star performance for their social risk factor populations. That starts with assessing enrollment and evaluating opportunities to expand services for this population, including revisiting product design, distribution, member activation efforts. Efforts to expand capabilities and better serve this population need to be carefully planned, deployed, and monitored. And leaders need to be patient. It will take time to yield results.

CMS’ plan to change the weighting for various measures will be a mixed bag, too. Reducing the weight of the patient experience/complaints measure and the access measure will come as a welcome change to plans that struggled with CAHPS performance in recent Stars cycles. But this shifts the emphasis back to HEDIS and drug measure performance, which have become increasingly competitive as performance and cut point thresholds have risen over the years. Plans need to reexamine their competitive standing in each of these categories and find new areas to unlock performance improvement to balance the headwinds they are likely to find from other program changes.

Plans also need to prepare for additional measure changes, including potential changes around the hold harmless policy. While it was a relief that CMS did not finalize the Improvement Measure Modification for SY 2026, a change is looming on the horizon.

Stars leaders undoubtedly have their hands full as they seek to earn the Star bonus in this evolving environment. Oliver Wyman will continue to assess how changes to the Stars program will impact plan performance over the next several years.

Scenario modeling methodology

Additional details on how we modeled changes to the Star Rating program:

To learn more contact Matthew Weinstock, Senior Editor, Health and Life Sciences.