How can an investor make good returns and avoid pitfalls from the energy transition? This is arguably one of the most important and contentious questions in finance today.

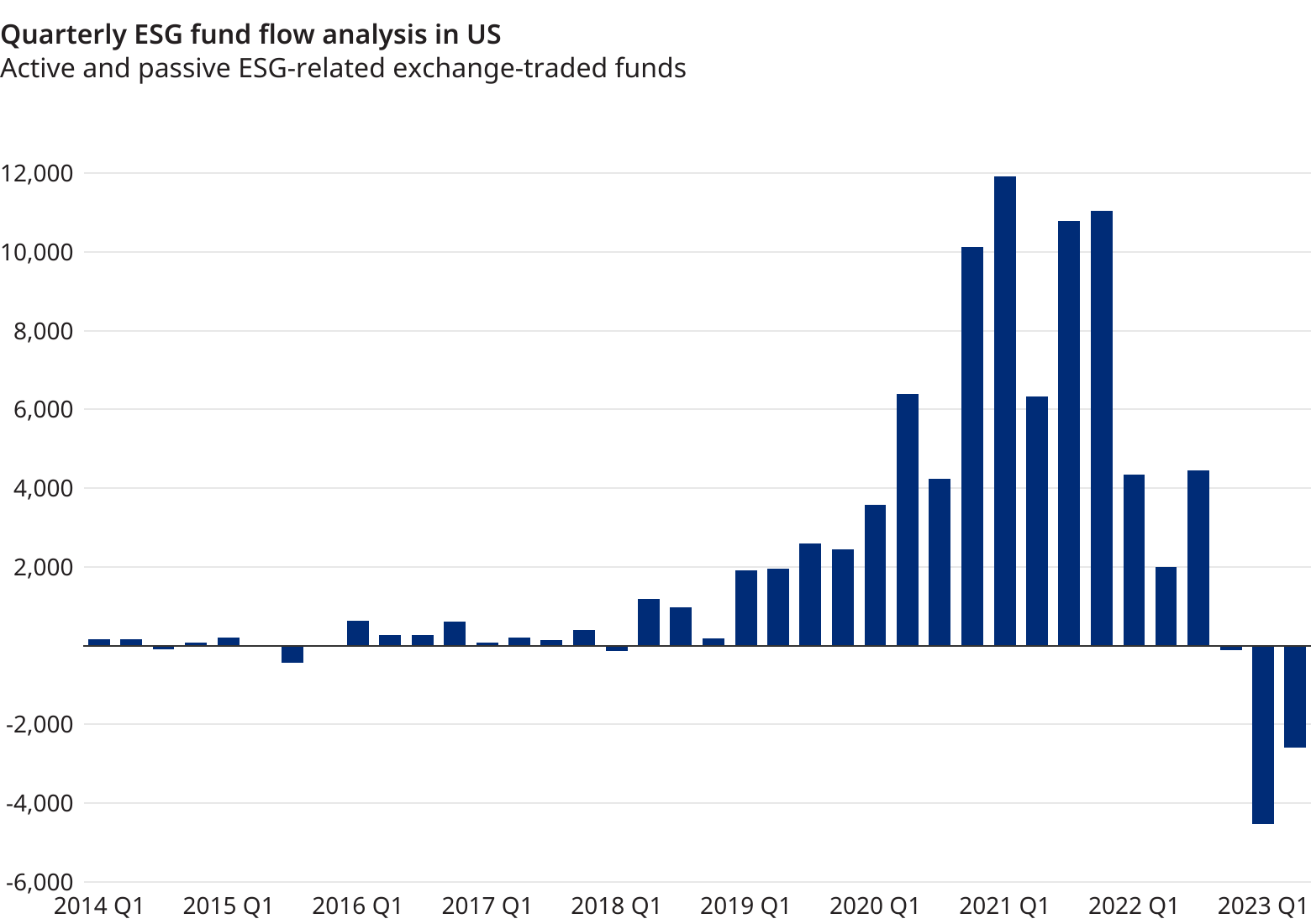

It has been a rough year for funds that focus on environmental, social, and governance factors, or ESG. Adverse politics, performance and product design have all weighed on the sector. Once again, investors have learned the hard way that investing by acronym is never an enduring way to allocate capital.

Many ESG funds suffered a roughly three to four percentage-point underperformance compared with broad equity markets in 2022, according to Oliver Wyman analysis.

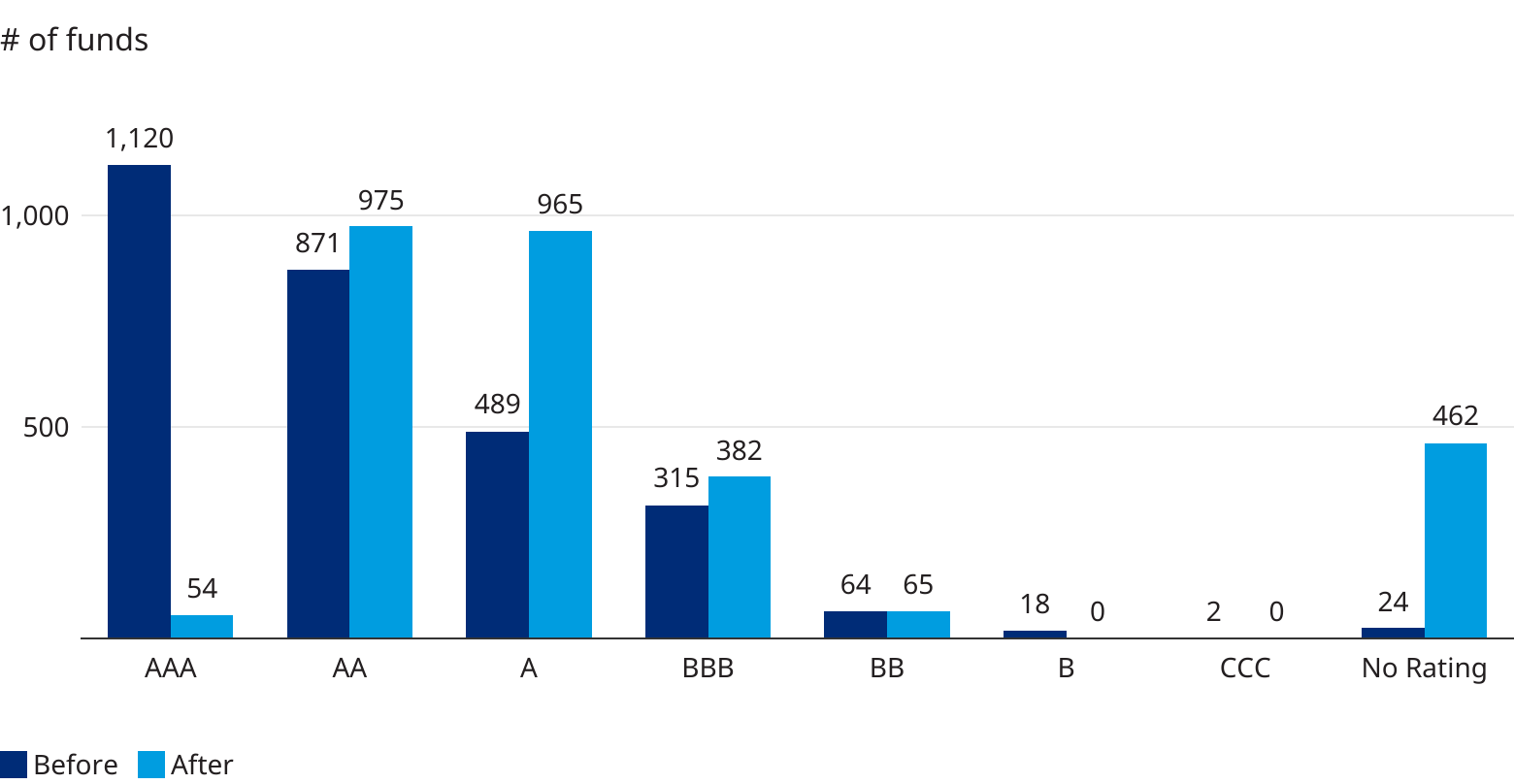

The underperformance helped prompt investors to undertake a more fundamental review of the investment attributes of ESG portfolios. Many were found wanting or overly simplistic. The exchange-traded fund suffering the highest redemptions globally this year is a fund that tracks ESG “leaders”. Meanwhile, MSCI downgraded 95% of the AAA ratings it had given European ESG exchange-traded funds this year as it reassessed funds for new regulations.

Exhibit 1: ESG v1.0 ETFs inflows peaked in 2021 and have been in redemption for the last year

Source: Broadridge Global Market Intelligence

Exhibit 2: ESG ratings from MSCI have been downgraded as a result of new regulations

Source: BlackRock via ETF Stream

Yet, investors remain keen to weave risks and opportunities such as energy transition and energy security into their portfolios. And a flurry of fund launches offers clues to where investors think the next opportunities may lie.

First, investors are increasingly intrigued by “carbon improvers” — firms that are progressively reducing their emissions footprint and generate returns. The first phase of climate-aware investing was to look for firms offering solutions and avoid polluters. But this approach overlooks a key issue.

Greenhouse gas emissions are highly concentrated in a few key equity sectors that make up about a third of the public equity market. These sectors account for about 90% of public company emissions and about 60% of all global emissions, according to Bridgewater Associates. To simply exclude them is self-defeating to real-world decarbonization.

Exhibit 3: The vast majority of global emissions are concentrated in a select number of industries

Industries by order from larger to smaller global emissions

Source: Bridgewater

Any single, overly simplistic static scorecard of how disparate factors might drive superior investment returns fails to reflect the complexities and nuances of markets

The next generation of climate-aware indices are leaning into forward-looking measures of decarbonization. Take the new MSCI Climate Action Index, launched late last year, which includes estimates of future reduction in emissions. One Finnish pension fund alone has switched $17 billion into funds that track this new index.

Second, there is growing interest in capturing value from investing in companies enabling a faster transition. Brookfield, for instance, hopes to raise $20 billion for their second transition fund, up from $15 billion from their first one. Meanwhile, BlackRock recently launched a “Transition-Enabling Metals ETF”. Likewise, General Atlantic and their partners John Browne and Lance Uggla announced an inaugural BeyondNetZero $3.5 billion fund in December to back companies that provide technology to tackle climate change.

That said, there still appears to be a gap in equity funding for new capital-intensive solutions for sectors with hard-to-abate carbon impact. Venture capital, which has been conditioned by free money and tech moonshots, is not yet well set up for this. Also, some new technologies may require longer terms than the typical 10 years of funds. So, a new 15-year, $1.5 billion fund by Generation Investment Management’s Just Climate firm is an intriguing development to watch.

Fourth, a handful of institutional allocators are dipping their toes into “impact funds,” which seek to measure not only returns but real-world outcomes. Swedish private equity firm EQT is looking to raise €3 billion — which, if successful, would be the largest ever impact fund in Europe.

And fifth — and most profoundly — energy security and energy transition are being woven into core portfolios. But like all investment themes, there is no one way to do this.

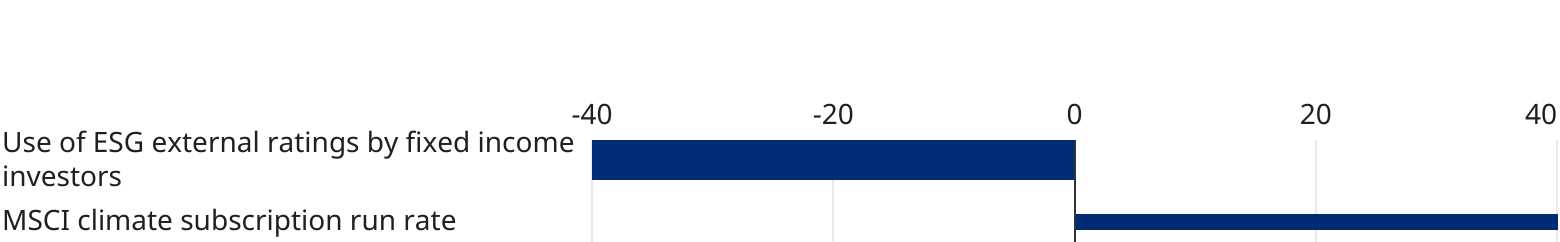

Investors appear to be using more bottom-up data to shed light on specific investment issues with the use of ESG ratings as a primary tool plummeting, according to a new HSBC survey. MSCI reported a 40% growth in the second quarter in its climate data subscription business.

Exhibit 4: Use of ratings is plummeting as investors may desire to weigh the key data themselves

In %, June 2022 - June 2023

Note: Industry use of External ESG ratings from HSBC report is only fixed income ratings as the primary input

Source: HSBC-Survation ESG Survey (June 2023); MSCI Q2 Earnings Call Transcript (July 2023)

Technology, media and telecoms funds dominated inflows in the late 1990s but got washed out when the dotcom bubble burst in 2000. Yet today tech investing has evolved and is deeply embedded. We are likely to see a similar pattern on energy security and decarbonization. Incorporating 21st century risks and opportunities in these areas will become mainstream for investment portfolios.

This article by Huw van Steenis is an expanded version of an op-ed that appeared in the Financial Times on August 7, 2023. The writer is vice-chair at Oliver Wyman, former global head of banks and diversified financials research at Morgan Stanley and served as senior adviser to Mark Carney when Governor of the Bank of England.