How Decarbonization Is Changing The Future Of Commodity Trading

Commodity traders have played a crucial role in balancing volatile markets over the last few years — resulting in three consecutive years of record growth in gross margin. As carbon heavy commodities — a trader’s traditional playing ground — come under additional scrutiny, it could seem that the record days are over and the trader’s role will diminish. However, the reality could not be further from that. Newly emerging low-carbon commodities require the commodity traders’ skillset (commercial nimbleness, access to financing, ability to operate under uncertainty, ability to structure novel client-centric solutions) to thrive and the commodity trading community is likely to take a significant role in supporting the growth and accessibility of green commodities. Trading of low-carbon flows will be an important part of their revenue stream and a new set of frontier opportunities will arise offering ample opportunities to continue generating profits.

Commodity traders are in a position with significant potential

Last year, the commodity trading industry achieved record-breaking profits of over $145 billion in gross margin.

This performance was largely the result of traders building optionality through midstream assets, contract flexibility,

as well as securing financial flexibility over the past few years that was monetized during volatile times. Much of the

industry’s growth can also be attributed to a relentless focus on fulfilling customer needs, balancing supply and demand,

and an ability to read markets despite policy uncertainty and indecisive market sentiment.

And further profits seem to be on the horizon with volatility here to stay; The combined effect of underinvestment

in conventional energy sources or more general extraction of natural resources, continued demand growth, and the

hesitancy to further accelerate investments into lower carbon energy sources has made the global commodity system

increasingly vulnerable to shocks. The relative tightness in the oil markets is unlikely to disappear in the coming

years and similarly addressing the many physical constraints and policy challenges in lower carbon energy sources

takes time.

Commodity traders are in a prime position to continue balancing this volatility and thus reap the rewards. With a

deep understanding of market dynamics and risk management, traders are best placed to use their existing commercial

skill set to optimize and balance commodities’ affordability, security, and sustainability in the decades to come.

Their playbook of commercial agility, entrepreneurial incentives, structuring and origination capabilities, financial

ingenuity and a lean operating platform will be critical to establish, manage, and balance traditional as well as

low-carbon commodities going forward.

As real-economy businesses need to demonstrate progress towards decarbonization targets later this decade, new

opportunities for intermediaries like commodity traders will arise. Their existing toolkits will be perfectly applicable

ensuring more successful years to come. There is a growing consensus across industry stakeholders and policy makers that

achieving net zero at scale relies on effective risk-reward sharing across public and private entities with accountability

and incentives to ensure that human efforts and innovation result in the most effective capital allocation.

The future for commodity traders starts with low carbon

The production and consumption of carbon-heavy commodities is expected to drop over the next

decades – with oil and coal consumption estimated to decline by around 75% and 90% by 2050 to meet the IEA’s

Net Zero Emissions Scenario. As a result, the margin outlook for the commodity trading community – currently

mainly active in these more carbon-intensive markets – could seem grim and dreary.

However, with low-carbon commodities and adjacent transition relevant elements – such as renewable power, energy

transition metals, carbon markets, advanced fuels, and hydrogen carriers – likely to be the fastest-growing segments, it

is expected that they will eventually compensate for the inescapable decline of fossil commodities over the coming decades.

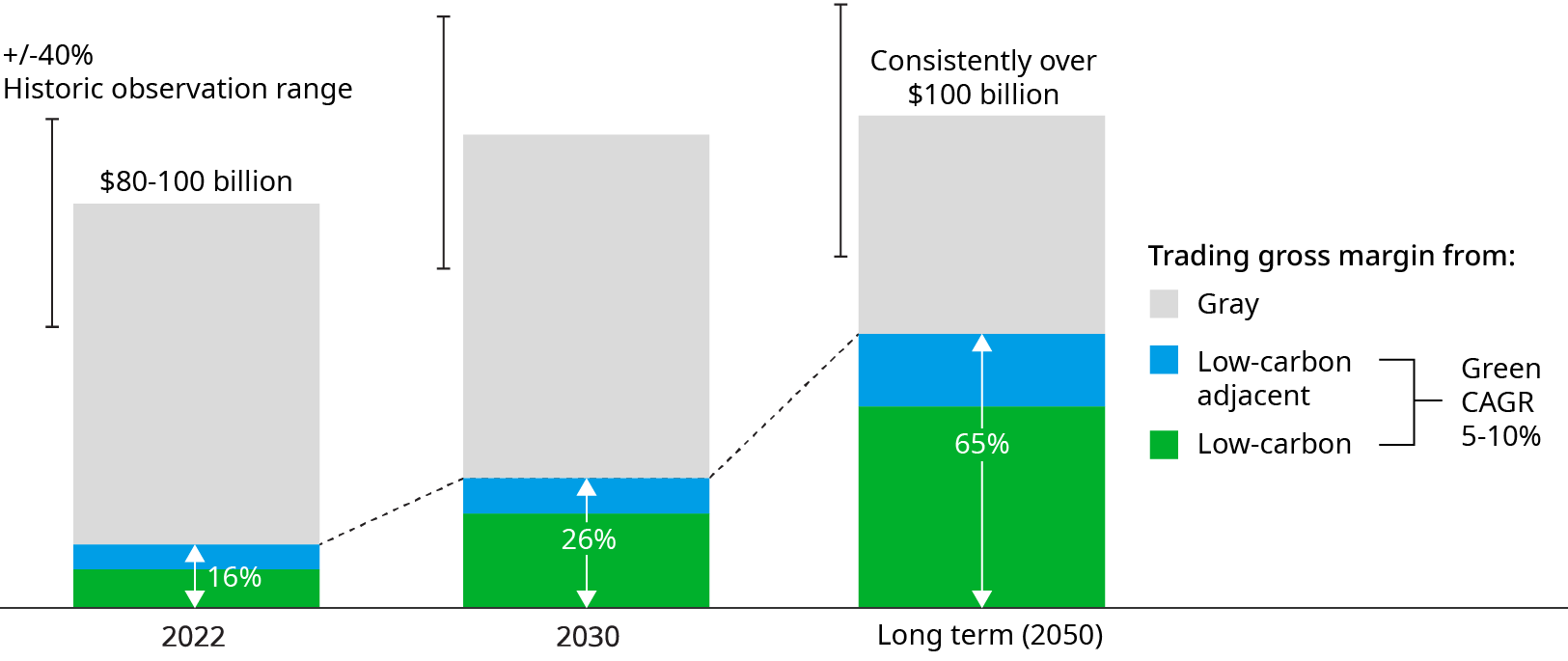

Trading gross margins from low-carbon segments is expected to double by 2030 and further increase two-to-threefold to an average of

$60 to $70 billion by mid-century (Exhibit 1). In the same period, trading gross margins from fossil fuels or carbon-intensive

(‘gray’) commodities – such as oil or coal – is expected to maintain through the mid-term as volumes decline in some commodities,

but risk – and therefore margins – increase to compensate this. Ultimately, these flows will decline as net-zero targets are met,

and low-carbon commodities flow hit scale.

Trading gross margins from low-carbon segments is expected to double by 2030 and further increase two-to-threefold to an average of $60 to $70 billion by mid-century

With increasing challenges to financing and insuring fossil energy, at least by most global public institutions, conventional

fossil trading volumes are expected to first change in trading patterns while continuing to yield attractive trading margins in

tighter markets for those able to adapt, before declining faster than fossil energy consumption by mid-century. In the long term,

it’s likely that gray hydrocarbon will be traded fewer times and primarily marketed by entities with special backing (for example

governments or players committed to emission abatement) within or across sub-markets.

In markets with a strong decarbonization agenda, price discovery will also be altered as the price of energy will increasingly

correlate with the price of renewable or low-carbon electricity. For instance, green hydrogen investment decisions, often spearheaded

by legacy hydrogen consumers – such as operators of oil refineries – are already accounting for green premia from renewable road fuels

or sustainable aviation fuels. Forward-thinking energy traders have chosen to bring power, natural gas, and carbon closer together,

often under one unit to ensure that incremental revenue and cost avoidance opportunities are managed in an integrated way. Ensuring that the

right low-carbon solutions can be offered to a customer will require increased collaboration and a conscious trade-off between fossil and

low-carbon businesses.

Exhibit 1: Peak normalized average global commodity trading gross margin by carbon intensity

Source: Oliver Wyman propietary data and analysis

Where to play in this new low-carbon world

To participate in low-carbon commodities, traders will not only need to continue building asset- and contract-backed

optionality in low-carbon markets, but also seek to create connectivity across regions, supply chains, and segments

to originate and place the low-carbon commodity where it is worth the most.

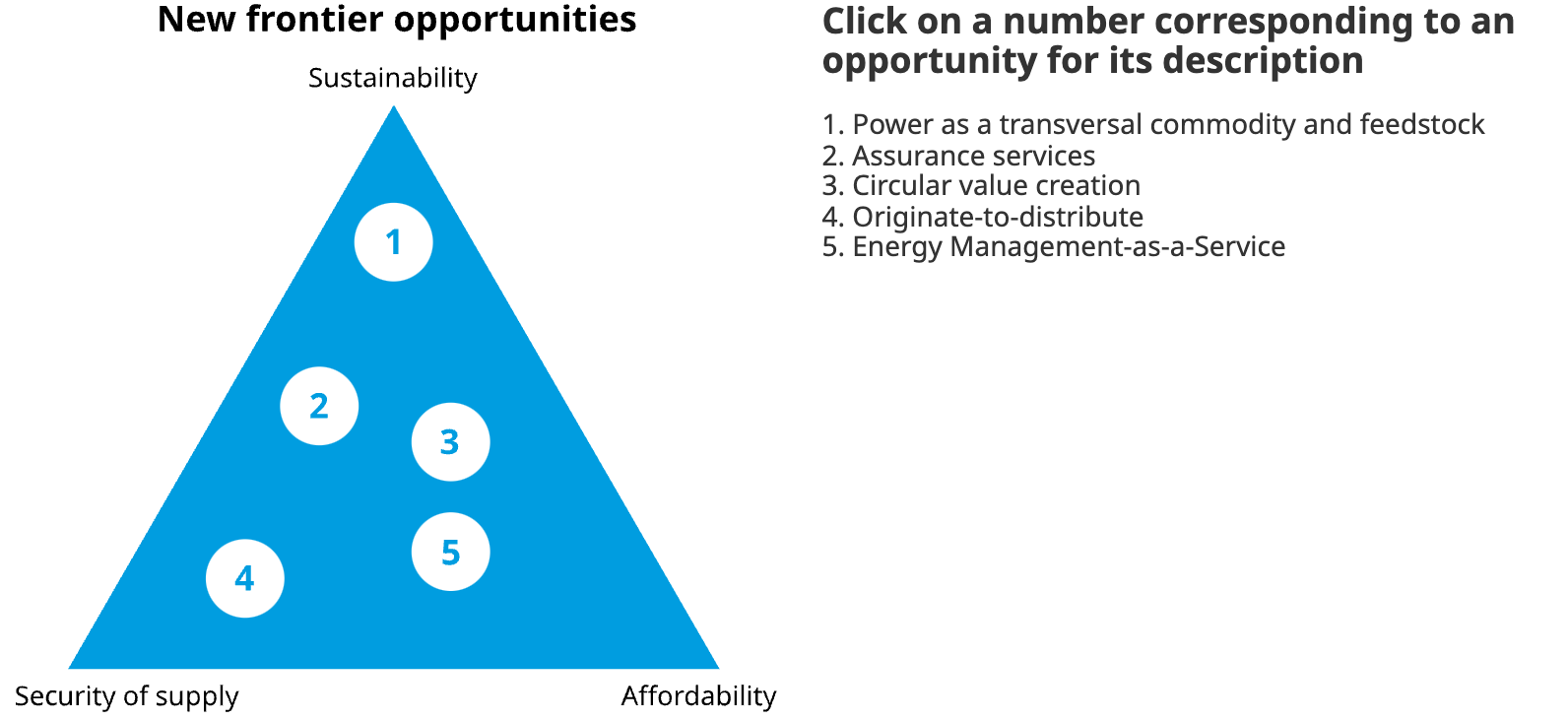

For many corporates, these low-carbon markets are associated with non-trivial risks that more entrepreneurial and

nimble commodity trading organizations are often better equipped and better experienced to cope with. Using their

existing toolkit and capabilities, they can already offer new solutions (Exhibit 2) aiming to manage these risks for

corporates to ensure that they are able to further entrench their position as intermediaries as new cross-value

chain collaborations emerge from the old world. For instance, in ocean shipping new partnerships are already emerging

between sustainable energy producers, technology providers, and consumers that seek to ensure energy supply and

infrastructure readiness. Similarly, green steel producers or cement producers are ramping-up their in-house green power,

biomass feedstock, and carbon management capabilities as the value of biogenic carbon dioxide – which, has been previously

captured through natural biological processes – becomes more apparent for advanced fuels. The ability to do this is especially

relevant in regions that are highly determined to decarbonize, like Europe – where large industrial energy consumers are

already expanding capabilities in energy procurement and management in the face of increasing carbon-related regulation

and introductions of carbon border taxation.

Exhibit 2: Select new trading and origination opportunities by each energy trilemma dimension

Source: Oliver Wyman propietary data and analysis

The impact of regionalization on commodity markers

Efforts to foster sustainability through low-carbon commodities and security of supply will lead to more locally sourced

components, requiring new supply chains with actors seeking economies of scale to ensure affordability.

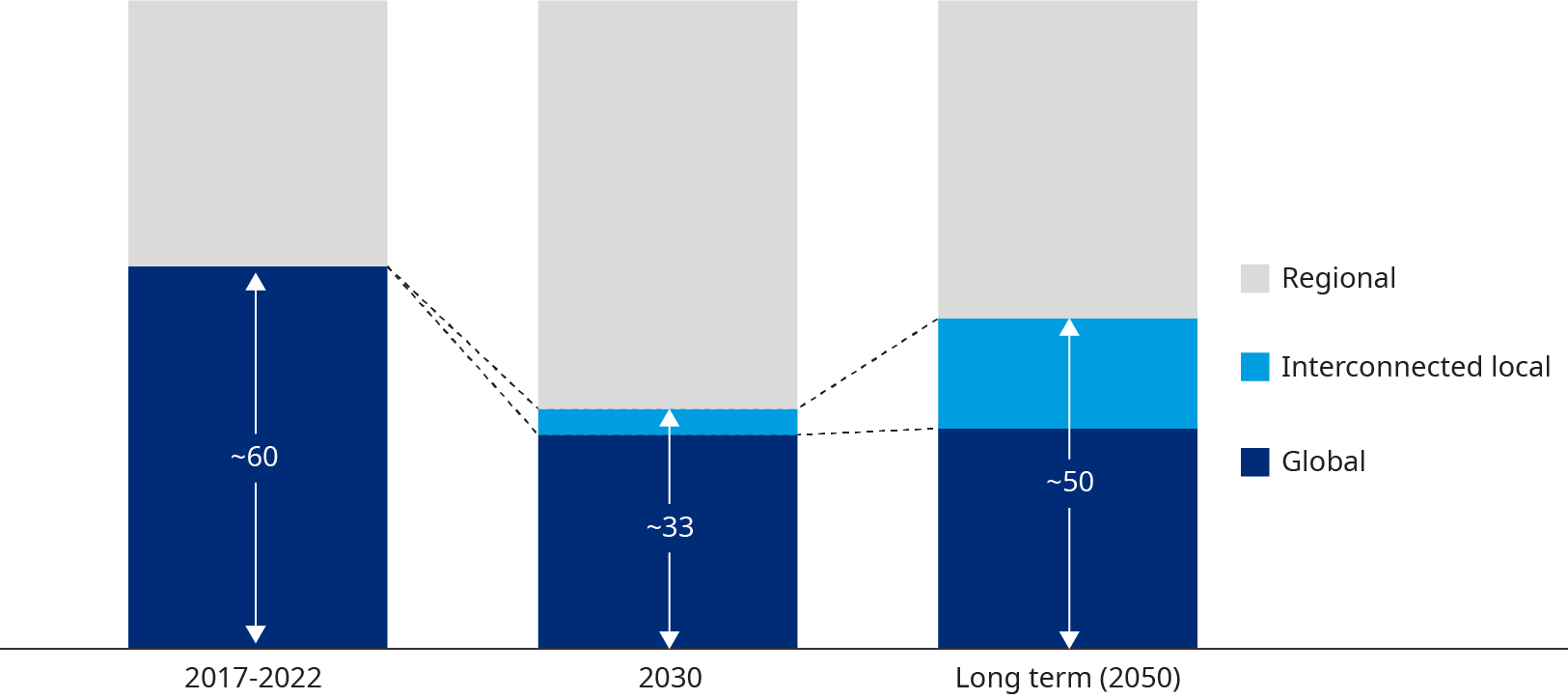

The regionalization of commodity trade flows, amplified by the transversal role of green electricity, submarkets for sustainability

attributes, and efforts to establish circular supply chains will imply that low-carbon commodities and services will be increasingly

traded in regional markets and local currencies (Exhibit 3).

Exhibit 3: Evolution of energy-related commodity trading gross margin and the gradual regionalization of trade flows

Source: Oliver Wyman propietary data and analysis

Different regional priorities regarding affordability, security of supply, and sustainability of energy and critical

raw materials will also result in different approaches to technologies and supply chains. It’s already becoming apparent

how hydrogen policies, the approach to carbon capture and storage, feedstock requirements for advanced fuels, and US and

European ambitions to grow influence in battery metals can change the relevance of existing trading hubs. Conversely, these

circumstances can also create opportunities for new hubs – for instance in Singapore or the UAE – to build upon an abundance

of renewable resources and stable institutions.

A ‘re-globalization’ in low-carbon commodities is certainly conceivable later this century, however, will require greater global

collaboration – for instance more integration in carbon markets or new physical infrastructure allowing low-carbon

commodities to cover long distances.

Global players will co-exist with new breeds of actors

Global specialists with diversified portfolios spanning across regions and robust balance sheets. These players are poised to

focus on cross-regional trading of low-carbon commodities as well as the development of new supply chains and infrastructure

that will be required, potentially backed by large low-carbon commodity producers or consumers or clean tech partners. Based on

a hyper-optimized, global operating model, these players can leverage operating platforms without legacy constraints to achieve

economies of scale from advanced analytics and highly digitized platforms. The winning players will be able to leverage balance

sheets to pay upfront for optionality, enhance control and resilience of global supply chains as well as effectively blend own

and third-party capital at scale to optimize risk-adjusted returns.

Regional champions focus on one or more regions with a strong understanding of the value of low-carbon commodities, enabling

them to optimize operations in alignment with site-specific conditions and requirements, often determined by factors such as

weather and biological processes as well as customer needs and regulatory dynamics. As a result, they are poised to emerge as

successful advisors to clean energy producers and consumers within and across regions. With the ambition to cater to the specific

supplier and buyer requirements and dealing with first and last mile issues of 'hyper-regional' markets, a highly digitized operating

model needs to set conscious minimum-size thresholds

How to succeed in low-carbon commodity trading

For global multi-commodity traders, this development will require a multi-layered approach, including: a clearer strategy regarding portfolio and capital allocation (given different risk-reward profiles, cost of capital and regional requirements), centrally managed global platform capabilities and service propositions (such as originate-to-distribute services, intelligence-backed assurance services, infrastructure to offer renewable asset optimization as a service), positioning of new businesses in relation to existing businesses (for example a one-stop shop of a multitude of fuels with different carbon intensities, level of active cannibalization of primary metal volumes with recycled content), and a level of regional business autonomy with acceptable level of fragmentation and scalability sought.

The commodity trading industry has a significant role to play in addressing one of the largest challenges in modern history

The commodity trading industry has a significant role to play in addressing one of the largest challenges in modern history. It’s

structurally poised to cope with uncertainties – in fact, much better than many other stakeholder groups. Hard-to-reverse decisions

must be taken to navigate the diverse landscape of emerging low-carbon markets and demanding leaps of faith will be required in

transforming operational platforms amidst the ambiguity of market signals.

This is nothing new: For decades, commodity traders have performed the role of hedge and lubricant of the markets, buying other

people’s risks and converting them into profit. By now expanding their horizons into the asset classes related to the energy

transition, we are seeing the double impact of increased market trust given the additional liquidity and an acceleration of

investment into green technologies given the stakeholders can limit their risk through these novel trader offerings.

Ultimately this is how we will end up trading our way to net zero – old dogs, performing old tricks, for old reasons, in a brand-new world.

Additional contributors: Alexander Franke, partner and head of European Oil and Gas at Oliver Wyman, and Albert Linney, Oliver Wyman alum (now senior trader at ADM).