Digital banks, also known as virtual or online banks, have emerged over the past decade as a new type of bank to address the limitations of traditional banking. Essentially, digital banks leverage financial technology (fintech) to offer core banking services such as deposits, loans, and transfers through online channels. Digital banks have also played a significant role in promoting financial inclusion by providing banking services to underserved populations. This is particularly relevant in developing markets, where digital banks provide small-amount financial products conveniently and with reasonable fees to individuals and small businesses.

Digital banks began to emerge around the world between 2009 and 2014. Driven by fintech advancements and regulatory support, the early waves of their development took place in Europe and North America. They have also developed rapidly in Asia and South America thanks to large populations and strong demand from individuals and businesses with limited access to traditional banking services.

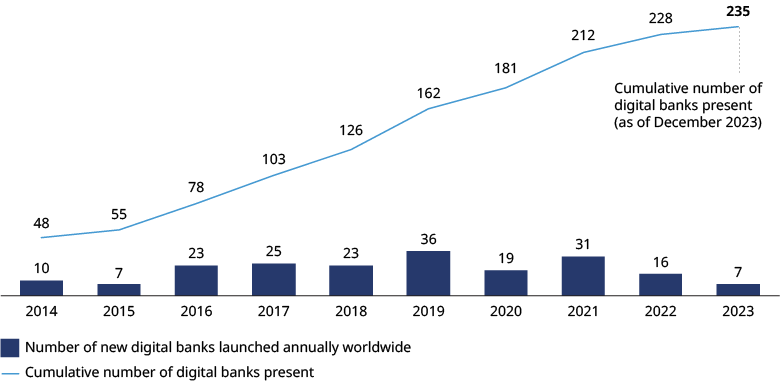

Since 2019, there has been significant growth in terms of digital banks’ customer base, asset size, revenue, and market share, driven by improvements in key infrastructure such as cloud computing and mobile internet accessibility. The COVID-19 pandemic has also accelerated this growth. By the end of 2023, the global count of licensed digital banks had reached 235, while the number of players offering broader digital banking services had already exceeded 300.

The digital banking model has proven commercially successful across various regions. Whether in developed or developing markets, digital banks have shown their unique value to the financial services industry. Notably, digital-native banks in Asia turned profitable shortly after their establishment and have maintained robust growth, showing strong capabilities in technological innovation and commercial operation.

How five key themes are transforming the future of digital banking

Leading digital banks worldwide have taken diverse paths in their development due to differences in market environments, resource endowments, and business strategies. In recent years, they have been considering similar themes for their continued development, and each has made various efforts and explorations in this regard, including:

Improving profitability and building a sustainable business model

As digital banking enters its second decade of development, the competition in commercialization is no longer driven by the favor of capital markets. Instead, digital banks have entered a stage where they can improve profitability by leveraging economies of scale. Digital banks focusing on large-scale retail customers are continuously improving their technology and operational capabilities for better profitability per customer. Meanwhile, those focusing on niche markets are deepening their understanding of customer needs and risks to further optimize their product offerings and risk management.

Leveraging unique ecosystem resources to provide better services

To improve existing business models, digital banks are increasingly focusing on resources within their ecosystem. Players that are deeply embedded in a particular ecosystem are exploring opportunities to further leverage ecosystem data to enable precise services and enhance customer credit profiles. At the same time, they are looking to create a seamless user experience that perfectly fits into different scenarios within the ecosystem.

Digital banks unlock new revenue with BaaS and tech solutions

eading digital banks are exploring diversified business models and revenue streams beyond their existing financial services. They are actively productizing their capabilities and intangible assets, such as technological capabilities, operational expertise, customer resources, and data assets. Current initiatives include offering technology solutions, Banking as a Service (BaaS), and non-financial services to end customers.

Regional expansion as a growth strategy for digital banks

Multi-market coverage is also a key strategic move for leading digital banks seeking sustained growth and secure positions. Following earlier global expansion efforts by a few pioneers, leading digital banks are now focusing on becoming regional champions. They aim to gradually increase their coverage in geographically closer markets, enhance economies of scale, and improve profitability.

Supporting seamless data flow by offering open-source technologies

Leading digital banks are also making efforts to support a seamless data element flow. They are offering their capabilities in secure computing, privacy computing, and federated learning to other firms as open-source or productized solutions. This aims to address data silos, encourage data sharing, and maximize data value, all while ensuring data security and fairness.

As business models evolve and traditional banks’ digital capabilities significantly improve, the boundaries between traditional and digital banks are gradually blurring. In the future, emerging technologies such as generative artificial intelligence and Web 3.0 will further stimulate the emergence of new forms of banks. Regardless of whether these will still be referred to as digital banks, they will continue to drive innovation and foster a more dynamic and customer-centric financial services industry.

This report was jointly authored by Oliver Wyman and WeBank.