This content relates to a study commissioned by Blue Cross Blue Shield Association (BCBSA).

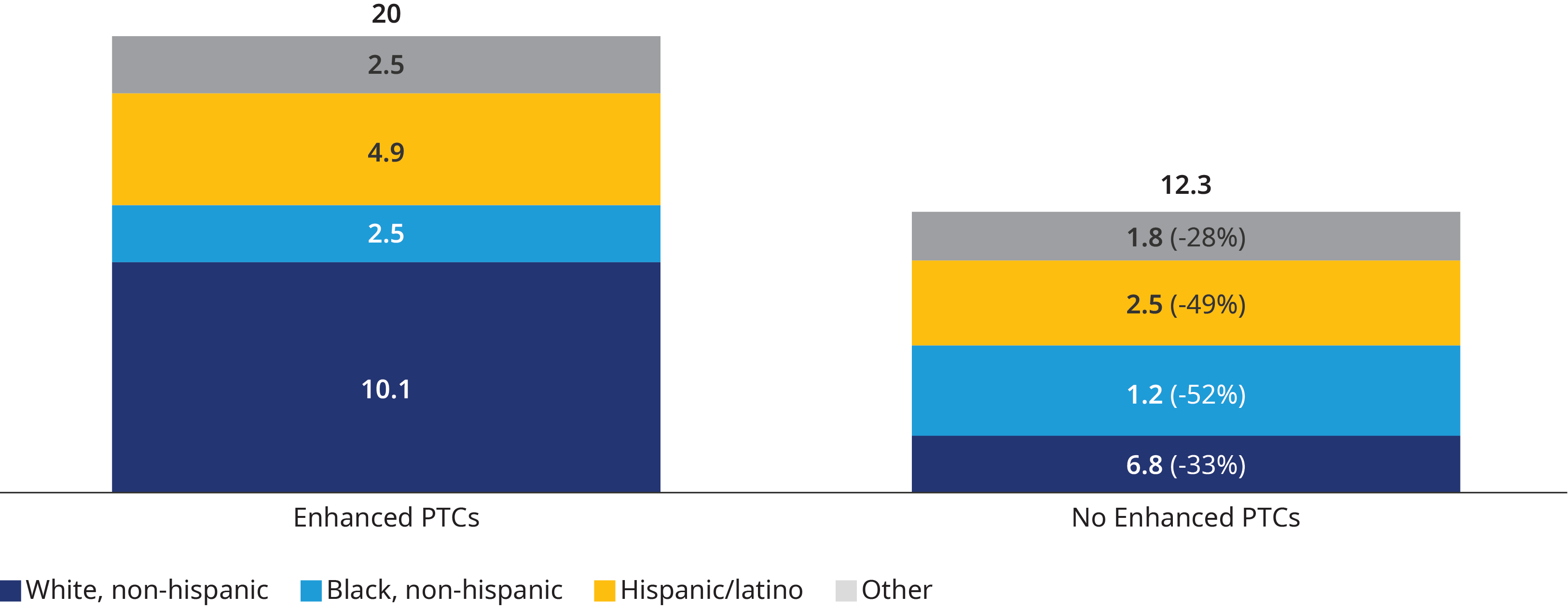

If the enhanced premium tax credits (PTCs) expire, 52% of Black, non-Hispanic enrollees and 49% of Hispanic/Latino enrollees receiving enhanced PTCs are projected to leave the individual Affordable Care Act (ACA) market. The enhanced PTCs currently help make insurance more affordable for millions of Americans who would otherwise struggle to purchase coverage on their own.

Since 2021, the enhanced PTCs introduced by the American Rescue Plan Act have significantly improved the affordability of health insurance for millions of Americans using the ACA Exchange. Those provisions were continued under the Inflation Reduction Act but will expire at the end of 2025 without congressional action. The enhanced PTCs are more widely accessible and offer greater financial protection than the original PTCs that first became available in 2014.

How PTCs impact coverage by race and ethnicity

ACA health insurance coverage for non-white populations has seen significant growth from 2020 to 2024. However, the expiration of enhanced PTCs is projected to reverse these gains. As shown in Exhibit 1, we estimate that 1.3 million Black, non-Hispanic enrollees and 2.4 million Hispanic/Latino enrollees who currently receive PTCs will leave the individual ACA market by 2027. That would result in coverage declines of 52% and 49%, respectively.

This is the second installment in a series of insights exploring how the expiration of the enhanced PTCs could impact stakeholders. Using our Healthcare Reform Microsimulation Model (HRM Model), we have identified key findings, ahead of a more comprehensive report, on how this will impact enrollees by race and ethnicity. Our next article will examine how the expiration of the enhanced PTCs could impact enrollee premium costs. Be sure to also read our first article, "How ACA Tax Credits Impacts Patients With Chronic Conditions", which covered the effects on enrollees with chronic conditions.