A rapid rise in interest rates combined with quantitative tightening have profoundly changed the dynamics of the United States (US) and global financial systems in recent years. As macroeconomic conditions exposed weaknesses in banks’ asset-liability management strategies, some banks struggled and even failed. Others were able to weather the changes, minimizing downside risks while taking advantage of rate rises to increase net interest income (NII).

Interest rate forecast and risk management

Looking ahead, uncertainty remains about the frequency and magnitude of interest rate changes in the short- to medium-term. Now is the time for financial institutions to re-evaluate their management approach to interest rate risk management and ready themselves for an unpredictable monetary policy environment. Effective efforts will have a meaningful impact on outcomes ranging from short-term profitability to long-term stability.

While the regulatory focus on interest rate risk management may have taken a back seat relative to liquidity and capital risk management in the era of low interest rates, there are strong signs of increased scrutiny by the US supervisory community.

Interest rate risk strategies for banks amid macroeconomic changes

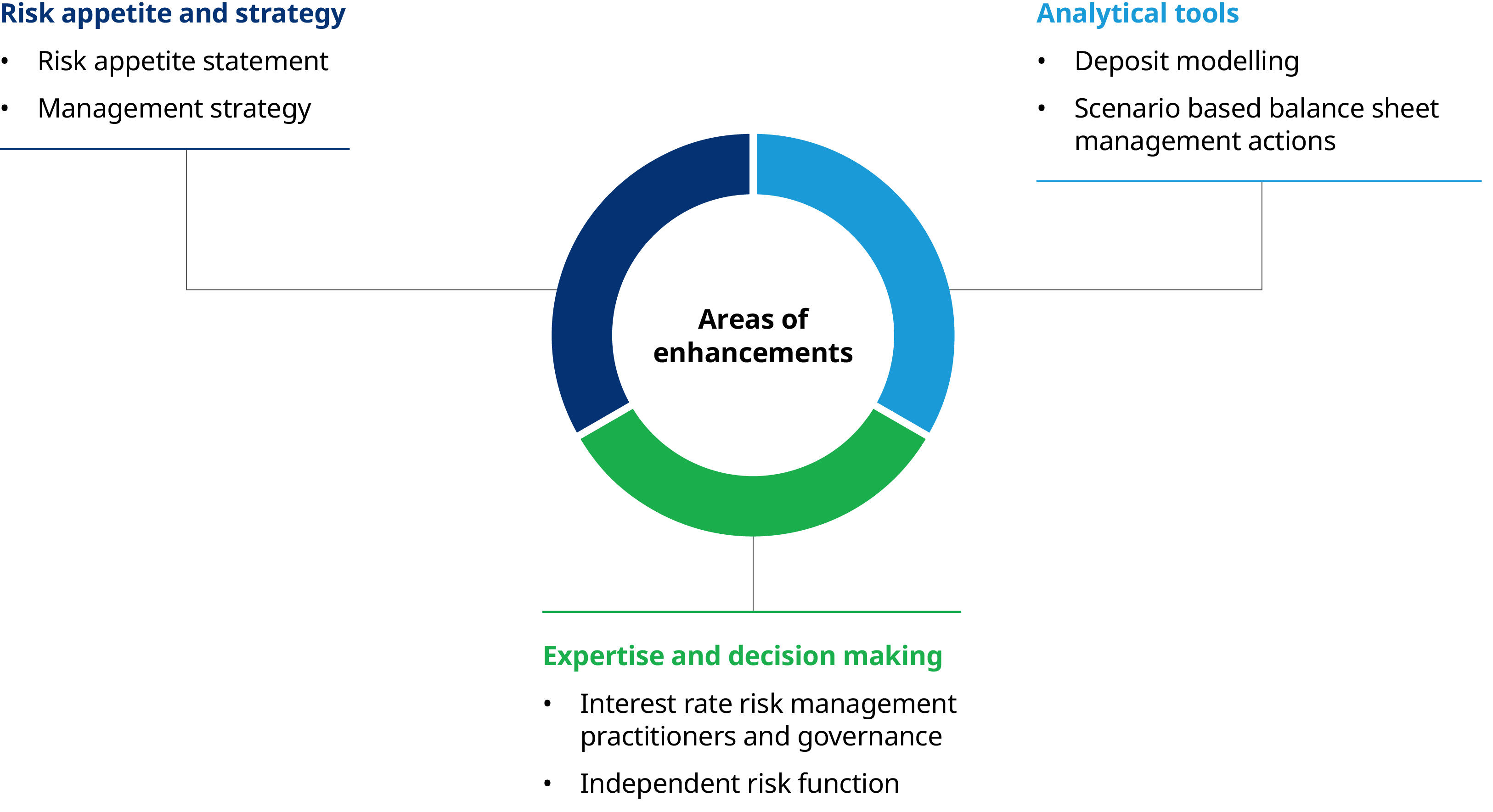

In our latest paper, “Transforming Interest Rate Risk Management Practices To Thrive In Era Of Uncertainty,” we provide a summary of the relevant macroeconomic changes that took place in recent years and the challenges that they have posed to banks in managing their balance sheets. We specifically highlight three crucial areas of improvement across integrated interest rate risk management framework that can help banks navigate the complexities of interest rate risk management while making informed decisions aligned with their overall objectives.

Recalibrate risk appetite and strengthen strategy

Refresh and recalibrate the risk appetite statement commensurate with ever-changing market conditions and in line with risk-taking preferences; strengthen balance sheet and profit and loss management strategy within risk appetite.

Upgrade analytical tools

Implement agile analytics to assess the impact of balance sheet management actions under a range of scenarios, update deposit analytics in line with changing client behaviors.

Invest in expertise and decision making

Develop team expertise and talent, streamline governance and decision-making processes, and strengthen effectiveness and stature of independent risk function.

How to move forward for a robust financial system

While the near-term prospects of the US economy and monetary policy remain uncertain, one thing is clear: Increased attention to interest rate risk management is necessary for a safe and sound financial system. We are observing an increased focus on robust interest rate risk management practices from bank executives, boards, investors, and supervisors. This focus can and should have a broad impact on banks, from how they think about risk appetite to how they calibrate their models and consider trade-offs when designing business strategies.