Many experts once expected so-called green hydrogen — hydrogen made with electrolyzers powered by renewable energy — to be produced in the next few years at the competitive cost of €1.5 per kilogram (kg) in regions with high renewable energy penetration. But that optimistic thinking has been replaced with reality, and a levelized cost of green hydrogen (LCOH) below €6 per kg is looking increasingly unrealistic in Europe for projects before 2030.

The outlook in the United States for developing a workable business model for green hydrogen is not much better. While the Inflation Reduction Act (IRA) of 2022 offered a lucrative tax credit to green hydrogen production, projects are being held up by proposed guidance from the US Treasury Department that may make it harder to qualify for the credit.

What happened to the new energy source that was once considered an essential component of Europe’s climate ambitions? Projects at the final investment decision stage are now facing inflated costs that have already led to the cancellation or downsizing of major ventures in Spain and Germany in 2023.

Overcoming high costs

The two largest drivers behind green hydrogen’s harsh reality check are the cost of supplying green electricity and the cost of capital. Consistently high wholesale market power prices can be seen across Europe, with the expectation that these will remain for most of the decade. Higher capital costs are impacting not only the financing of the electrolyzer itself, but also the cost of supplying off-grid renewable power as an alternative to the high wholesale market power prices. The combination of these factors is leading to many projects now forecasting an LCOH of over €6 per kilogram.

Despite the challenges, there are signs of hope for green hydrogen. Increasing clarity in both regulations and availability of government support are leading to greater certainty in the end-to-end economics, allowing more projects to move through to the final investment decision stage. In particular, the European Union’s enactment of the Renewable Energy Directive (RED) III regulations in November 2023 positioned the oil and gas industry to take the lead on green hydrogen in Europe. Refining of transportation fuels is already a major user of gray hydrogen and thus provides a predictable demand baseline. The RED III sets mandatory carbon dioxide (CO2) intensity targets for fuels and thus encourages the replacement of existing gray hydrogen production in refineries in Europe with green. Those kinds of mandates don’t exist yet in any other region.

By 2030, renewable fuels of non-biological origin (RFNBOs) must provide at least 1% of energy supplied to the transport sector in the European Union, equivalent to over one million metric tons of green hydrogen per year in simple energy terms. Not achieving these targets will lead to penalties, meaning a premium price would likely be supported by demand for RFNBO-compliant hydrogen, helping to bridge the cost gap to blue hydrogen. This also addresses a key hurdle in the financing of projects — a mechanism to secure long-term demand that can provide certainty in the cashflows to support the large initial investment. Despite advancements in electrification, hard-to-abate sectors like aviation and marine depend on cost-competitive supply of hydrogen and will continue to do so in the coming years as decarbonization efforts accelerate. In the United States, the regulation on tax credits for clean hydrogen production, section 45V of the IRA, provides a mechanism to reduce the levelized cost of green hydrogen by up to $3 per kg over 10 years.

Making the economics work for green hydrogen

While regulatory certainty is providing decision-makers with a clearer view on the economics of the projects in their pipeline, one major question remains: How do executives or investors ensure that the final investment decision is a yes and the project proceeds to completion?

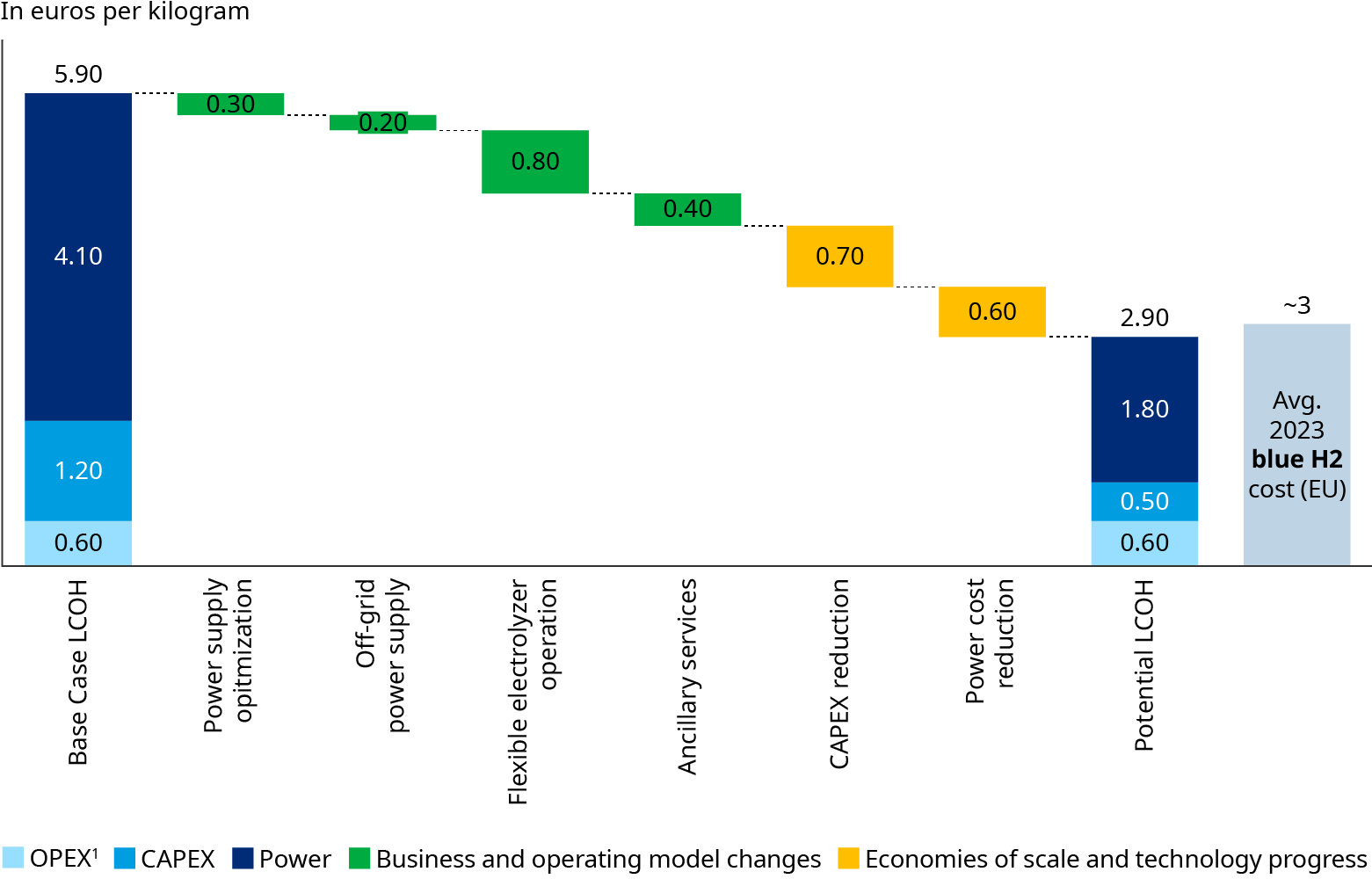

Green hydrogen projects entering production in the next few years frequently forecast an internal rate of return (IRR) below 12%, a typical hurdle rate for investments in the oil and gas industry. Raising the IRR becomes essential to attract enough investment to scale up production. That can be accomplished by bringing down the levelized cost of green hydrogen through less expensive capital or reduced power costs. Based on typical 2023 capital expenditures (CAPEX) and power cost assumptions, the exhibit below illustrates six levers that could collectively drive down the levelized cost of green hydrogen. This was conducted for a case study in Southern Europe, where subsidies for 50% of CAPEX are provided. These levers bring the cost into a range that can compete with blue hydrogen, an alternative low-carbon hydrogen produced by capturing the carbon dioxide emitted during high-carbon gray hydrogen production.

1. Including all operating expenses outside of power costs

Six levers for green hydrogen cost reductions

CAPEX and power cost reductions are likely to be driven primarily by economies of scale or technological progress and may take many years to materialize. Nevertheless, a levelized cost of green hydrogen reduction of over €1.5 per kg could already be achieved using current technology. Here are the levers:

Power supply optimization

Low-cost solar power generation is often cited as the key to achieving green hydrogen at scale. In practice, however, committing to large volumes of solar power under long-term power purchase agreements (PPAs) may lead to inflated power costs because users might not be able to take advantage of periods of very low or even negative market prices.

Regions with high solar penetration are set to benefit from a provision in the European Union Delegated Act on Hydrogen, which permit grid power to be used for RFNBO hydrogen production when the day-ahead market price falls below €20 per megawatt hour, regardless of the emissions intensity. This will allow for significant volumes of low-cost RFNBO-compliant power to be purchased from the wholesale market without the need for a PPA.

Securing a midterm supply with a carefully considered and geographically distributed balance of wind and solar, while maintaining flexibility in future power supply, can lead to significant reductions in total power supply costs over the lifetime of the project. When comparing an optimally structured power supply portfolio against one containing a 50/50 mix of wind and solar, the levelized cost of green hydrogen can be reduced by around €0.30 per kg.

Off-grid power supply

In bidding zones with high grid fees and balancing costs, a significant saving can be realized by providing part of the required electricity through direct connection to a wind or solar asset. Developing hydrogen production facilities as a part of an existing industrial site ensures that power can be utilized elsewhere during periods of electrolyzer maintenance. Over the life of a project, supplying 20% of power off-grid could lead to a reduction of around €0.20 per kg in the levelized cost of green hydrogen.

Flexible electrolyzer operation

Maximizing electrolyzer utilization does not always lead to a lower levelized cost of green hydrogen. By taking advantage of price volatility in the wholesale power market and selling electricity instead of producing green hydrogen when prices are high, the net power cost per unit of green hydrogen can be reduced by as much as 30%. This equates to a levelized cost of hydrogen reduction of around €0.80 per kg in the case study.

This approach enhances the overall profitability of the project, although it would necessitate a larger electrolyzer and the inclusion of hydrogen storage to allow supply targets to be met. The introduction of ancillary services markets may further amplify this effect by improving the economics for battery storage, enabling power to be purchased at low cost and used when prices are high.

There remains some uncertainty around the level of additional wear on the electrolyzer stack when it is operated on a flexible schedule. As more electrolyzers enter commercial operation, the impact will become clearer, and the potential cost of increased stack replacement can be more accurately factored into economic forecasts. New technologies such as proton exchange membrane electrolyzers are known to exhibit improved performance in this respect, when compared with alkaline electrolyzers.

Ancillary services

Initial analysis indicates that an additional €0.40 per kg reduction in levelized cost of green hydrogen could be captured from the ancillary services market through flexible operation of the electrolyzer. This is in addition to the potential savings achieved through power sales when flexibly operating the electrolyzer.

CAPEX reduction

As capacity commitments progress, this will enable economies of scale that should bring down initial CAPEX. Additional government funding, such as the $750 million in funding for 52 clean hydrogen projects announced by the US Department of Energy (DOE), will also help reduce the initial commitment required.

The mounting attention to green hydrogen has encouraged collaboration on supportive technologies between original equipment manufacturers (OEMs), industrial customers, and project owners. Based on the pipeline of announced projects, the International Energy Agency (IEA) estimates CAPEX costs could fall to only US$800 per kilowatt (kW) by 2030. Reaching even a CAPEX cost of €1000 per kilowatt could reduce the levelized cost of green hydrogen by around €0.70 per kg.

Power cost reduction

As the cost of power is the single largest contributor toward the levelized cost of hydrogen, reducing the price paid for contracted PPAs remains a key economic lever. With the cost of capital for new renewable supplies likely to fall from current levels, a decrease in the price of new PPAs entering the market may follow. This would represent a levelized cost of hydrogen reduction of €0.60 per kg in this case study, for a 25% decrease in PPA prices.

Regulatory implications in green hydrogen production

While the newly enacted RED III regulations provide clear guidelines, a challenge is imposed by the strict definition of RFNBO-compliant green hydrogen. By 2030, producers in the EU must be able to demonstrate that the power consumed by their electrolyzer matches the production from the renewable power generation source at an hourly level. In the US, the 45V regulation imposes similar restrictions, with hourly matching to be introduced in 2028. Navigating the complexities of matching power consumption with renewable production requires significant investment in both capabilities and people for hydrogen producers and renewable energy providers alike. New business models will need to be considered and collaborations across value chains established. Without the correct organization and tools in place, producers may miss out on significant value embedded in the operational flexibility of assets:

Operational challenges

Downstream industrial customers will use hydrogen to supply continuous production processes that cannot be varied to align with renewable power production. Embedding hydrogen storage into the process will help to smooth short-term fluctuations, but the cost of large-scale storage facilities is still prohibitively high. Green hydrogen production must therefore be planned in tandem with existing gray hydrogen production to ensure a consistent supply is available. This requires accurate modelling of renewable power production volumes in both the short and long term.

Financial opportunities

As the penetration of renewable power increases, greater volatility in wholesale market prices is expected. During periods of high-power prices, reselling power procured through a PPA instead of producing hydrogen will significantly reduce the net power cost. In addition to adding material value, this flexibility can also help to de-risk the investment by minimizing the impact of a rise in wholesale power costs on the project. To realize the full benefit, trade-offs will need to be considered on an hourly basis, while ensuring that downstream operations are not affected.

Managing all this energy

In the world of RFNBO and 45V compliant hydrogen, not every electron is created equally. What has long been considered a utility expense must now be considered as a feedstock, with robust procurement strategies and risk management approaches in place. A fully off-grid solution benefits from lower fees but limits the potential upside from reselling power to the market. Long-term PPA commitments provide price stability but can leave significant value on the table from RFNBO compliant wholesale market purchases. Understanding and capturing these relationships is essential to correctly scoping the project during the development phase and can provide reassurance to decision makers.

In operation, active management of power purchases and sales and control of the associated price and credit risks will play an important role in realizing the full value of green hydrogen and de-risking the overall investment. This is also relevant for the wider electrification of industrial processes, which will represent a significant additional power cost in the coming years. Key to unlocking this potential across value chains is the implementation of an integrated energy management approach. Siloed business units need to be brought together to create a cohesive strategy and transversal way of working that monetizes asset-backed operational flexibility, creates financial synergies, and facilitates economies of scale.