The value-based care (VBC) landscape is changing. Independent practice associations (IPA) are at risk of losing their independence if they can’t adapt to the new market trends. What are these new market trends? How are IPAs going to be able to navigate the new financial landscape? These are critical questions to answer if IPAs want to be able to retain their independence and continue to provide care in their communities. Here, we offer some insights.

Market trends point towards more risks for IPAs

Provider reimbursement continues to shift away from fee-for-service to pay-for-performance models driven by the goals of the Centers for Medicare and Medicaid Services (CMS) and private payors to slow the growth in healthcare costs. These include initiatives such as bundled payments, Medicare Accountable Care Organizations, Merit Based Incentive Payment System, and the Making Care Primary Model. Providers are being asked to take on more financial risk, including downside risk, to meet this goal. This is the new reality. If IPAs are going to adapt and survive, it’s important to understand the problems they’re facing today.

Three challenges faced by IPAs today

- Financial performance. There is uncertainty in financial performance due to factors outside of the group’s control, such as patients’ own actions regarding treatment compliance. Additionally, more advanced payment models, like ones including downside risk, will require a stronger balance sheet. Groups with strong financial performance may be able to leverage their successful care models to produce higher returns on assets by strategically taking on more risk.

- Patient retention. More payors are utilizing tiered performance networks that offer lower cost-sharing to patients who use high-performing providers. Providers who struggle to meet the quality and efficiency goals of VBC may lose patients to providers who are successful in meeting these goals.

- Growth. COVID-19 has brought many preexisting problems in the US healthcare system into focus. Providers are understaffed and the demographic changes in the US will continue to put strains on the provider system. To grow, providers will need to optimize existing resources and cannot fully rely on staff increases to meet future patient growth. One opportunity is telehealth. This will allow physicians to see more patients and match the preferences of younger demographics who enjoy the convenience of telehealth. Additionally, patients lacking adequate transportation also benefit from access to telehealth. In general, providers who efficiently manage patient panels will have more opportunities for growth.

The shift towards value-based care arrangements

The Health Care Payment Learning & Action Network, which was established as a collaborative network of public and private stakeholders to achieve the goals of better care, smarter spending, and healthier people, has authored several influential policy papers to help accelerate adoption of value-based payment models. In their latest white paper, they illustrated the expected shift away from fee-for-service payments towards more value-based care arrangements.

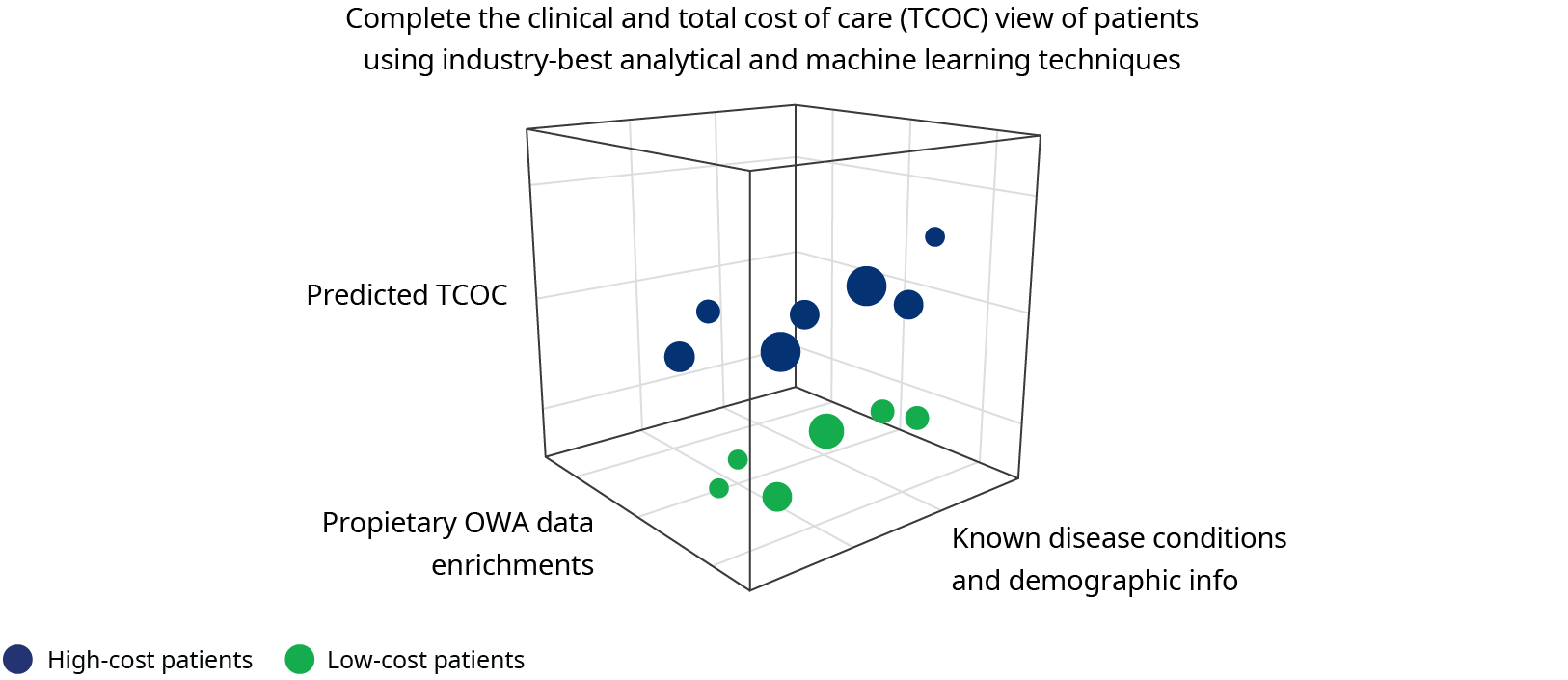

How do we adapt to the changes, and thrive in this new landscape? Data. This landscape today uses ever-improving technology, artificial intelligence, and analytics to create a full picture of the current situation and can help predict future scenarios. This allows for better insights and proactive approaches to resolve problems.

Anticipating the future with predictive data analytics

Predictive data analytics have several functions. It can do the following:

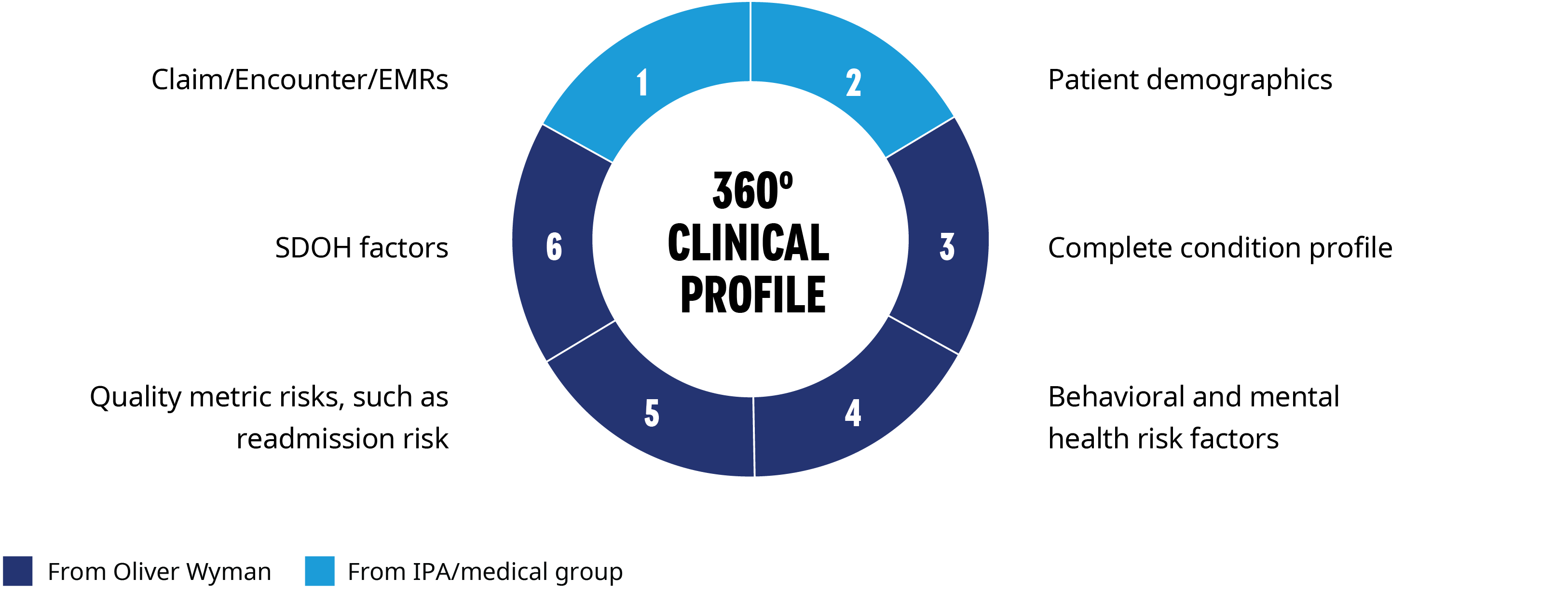

- Complete the patient view and provide a 360-degree clinical profile for all patients in a group’s panel. This includes additional potential conditions that are not found in the medical group’s records, and HEDIS and quality-focused metrics, such as readmission risk, behavior and mental health risks, and social determinants of health (SDOH). For new patients, demographics can be augmented with SDOH and non-claim (HRAs, house calls) data to give a clinical risk profile before the member is seen by the group. This helps the group understand their full exposure and additional risk and opportunities under VBC arrangements. It can also give insight into incomplete views on patients. Care delivered to patients outside of the medical group may not be reported back to the IPA or medical group. Even if it is, it takes coordination and capacity for the patient’s primary care physician to act on this latest information. This increases the complexity in determining which patients require increased clinical focus. The utilization outside their system may impact the VBC contract performance and stop-loss rates.

- Improve financial performance and strategize how to manage existing VBC contracts and evaluate new opportunities to improve financial performance. Groups with strong clinical and financial performance will continue to retain their independence in care delivery decisions and be given favorable network tiering status by payors.

- Provide risk adjustment. Accurate and complete coding and documentation is important in risk-based VBC arrangements and can impact provider and payor revenue. Current coding is analyzed to identify areas of opportunity relative to peer panels. This includes the mix of hierarchical condition categories (ACA and Medicare HCCs, Medicaid CDPS) and utilization rates of annual wellness visit and annual physical exams. By identifying and solving the structural issues that impact coding and documentation, such as benefit plan design, scheduling issues with physician’s offices, lack of transportation, or lack of telehealth services, the providers can create a long-term solution to provide the best clinical care and financially succeed in VBC arrangements.

- Align resources on complex patients and stratify patients into cohorts for suitable care management programs. Leverage strengths and capabilities of each medical group to identify the most impactable patients. This helps the group optimize existing resources.

- Guide stop-loss negotiation. With a more complete picture of the population under management, medical groups are in a stronger position to negotiate better stop-loss rates and make an informed decision about the types of stop-loss products to purchase.

- Provide healthcare data experts. We have expertise in a wide range of domains, such as actuarial, analytics, data science, and financial risk management, while specializing in helping clients within the healthcare industry.

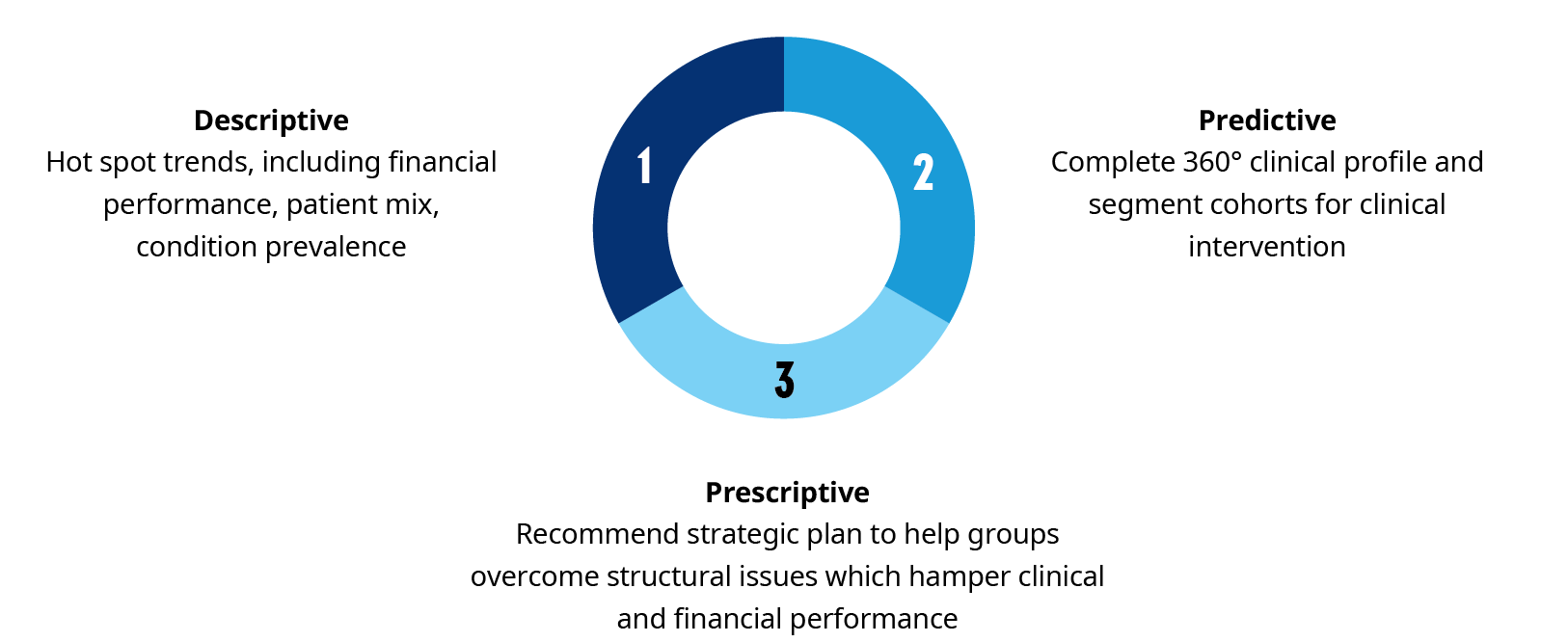

Oliver Wyman has created a team that has combined its market and industry knowledge with its data and analytics capabilities to partner with IPAs and medical groups. This Predictive Insights group can help you better understand patient panels and manage the financial risks and opportunities related to VBC. The key to this process is Oliver Wyman’s best practice approach to problem solving, which combines descriptive and predictive analytics to create strategic solutions to address the needs of our clients.

We know the market trends are here to stay. We also know that adapting to these trends is crucial for IPAs to retain their independence and thrive in the new landscape. The Predictive Insights team has the data and predictive analytics IPAs need to implement a lasting strategy to succeed in today’s changing market.