The macroeconomic environment in Europe is weakening, with gross domestic product (GDP) growth stalling and major economies such as Germany, France, and Italy performing poorly. At the same time, companies across Europe are dealing with a host of challenges, and 95% of the experts who participated in our recent survey about restructuring and financing in uncertain times believe the challenges they face now are more complex than in the past.

Survey respondents see the biggest challenges in geopolitical risks, the rising cost of transport and important commodities, and disruptive changes that require companies to adopt new technologies, reduce CO2 emissions, and leverage artificial intelligence (AI). However, the next generation of buyers and platforms for new demand creation are not seen as key challenges.

Financing cost increased significantly for corporations

As a result of these challenges, the debt load of non-financial corporations has increased significantly over the last few years. Meanwhile, interest rates have risen at a pace never seen before, which is especially difficult for companies that need to refinance upcoming debt maturities.

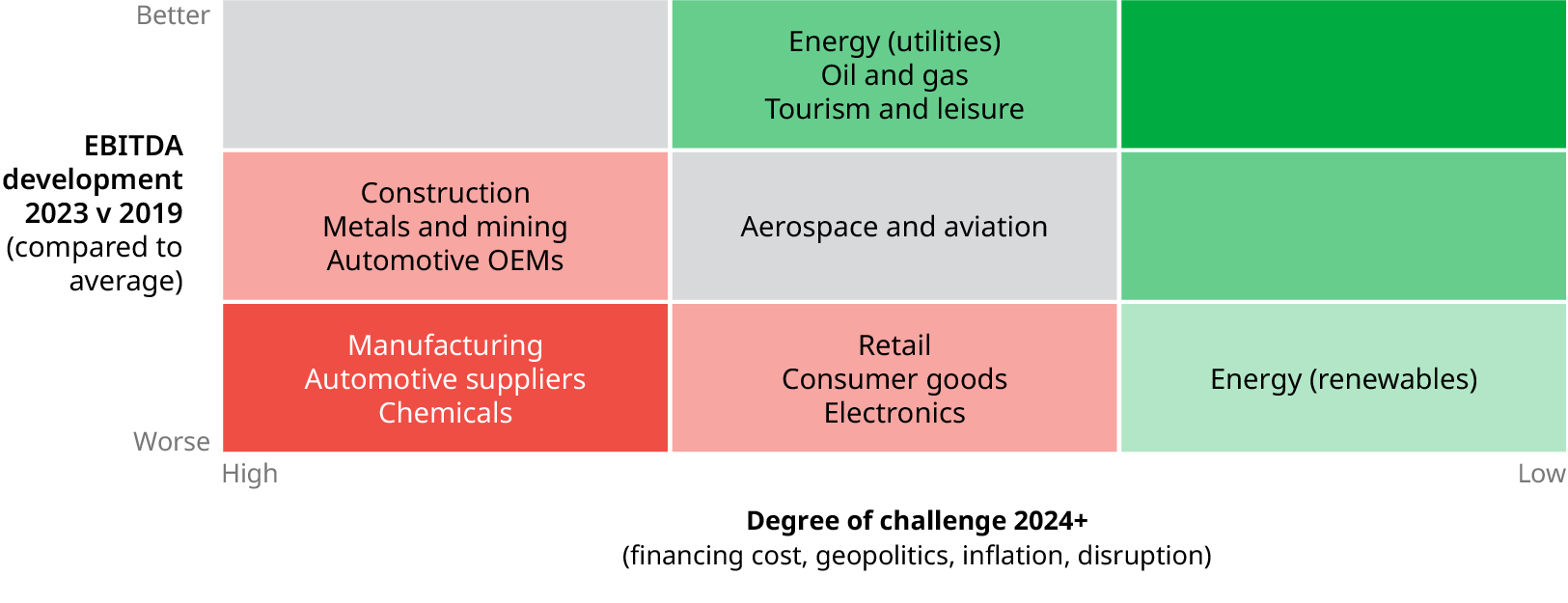

Nonetheless, companies in Europe have performed well on average over the past years. They have been able to grow revenues, improve their EBITDA margin, and increase cash and equivalents. However, the situation varies across different sectors: some, such as energy and automotive OEMs, have performed well, while others, like manufacturing, automotive suppliers, and chemicals, have struggled.

Effective adaption in dynamic business restructuring

To successfully restructure, companies and their advisers need a profound understanding of the business environment, the right business model, and a focus on operational performance and resilience. Restructuring concepts should analyze the market environment and adapt the business design to challenging and volatile conditions.

In a restructuring process, all key players, including CROs, financiers, consultants, and lawyers, need to improve their understanding of business challenges and collaborate effectively. They should develop and implement the right strategy, operational model, and bespoke financing solutions tailored to the distressed company and its specific market environment.

Overall, the increasing complexity of challenges makes the restructuring process more difficult but also allows for breakthroughs if the restructured company successfully completes its transformation.