This report is co-authored with the City of London Corporation and the UK Carbon Markets Forum.

Carbon dioxide removal (CDR) is attracting mounting interest from potential corporate purchasers in search of a solution for hard-to-abate residual greenhouse gas emissions, as well as investors and project developers looking to participate in a high-growth emerging industry. It reflects a growing recognition that carbon removals must scale substantially to limit global warming to tolerable levels. Currently, it is estimated that over $30 billion has been invested in CDR projects globally in anticipation of that growth.

As research for this report, we spoke with more than 30 companies operating in the carbon removal space to explore the state of the market today and the conditions necessary to foster the industry’s expansion, globally and in the United Kingdom. We found promising signs of development across the ecosystem, but also major challenges that must be addressed if the market is to scale. If barriers to scale are addressed, we estimate that the global market may reach up to $100 billion a year between 2030 and 2035. However, without targeted interventions, it may only reach $10 billion in this timeframe.

Addressing key constraints to unlock the potential of the CDR market

While demand for CDR credits is growing, it is not yet at a scale to support the level of investment currently being made in underlying carbon removal projects, and far below the level experts say is required to achieve net zero. Removal purchases to date have been predominantly comprised of direct bilateral offtake agreements between a small group of highly motivated corporates and suppliers of CDR credits. Developing a wider potential demand base may prove difficult without a more explicit definition of how removals can be used in transition planning or until the price points fall.

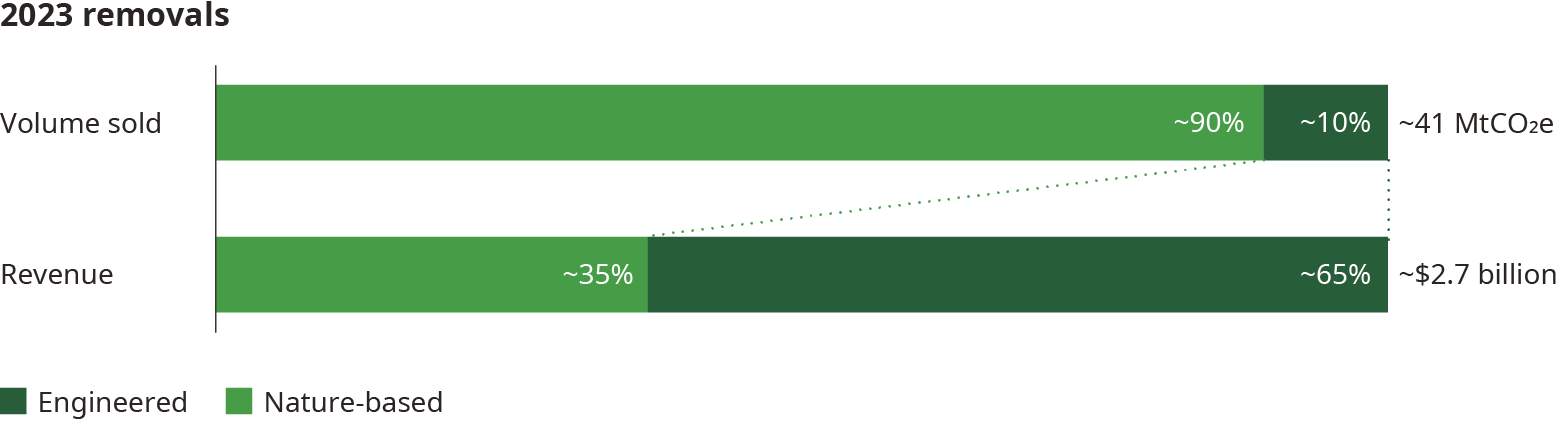

Currently, engineered solutions carry a significantly higher price point than nature-based projects. While engineered solutions accounted for only about 10% of issuance volume in 2023, they accounted for about 65% of sales because of their high price point. The demand base for engineered removals remains narrow, with over 90% of purchases to date from just 10 companies.

Scenarios for CDR growth

We estimate the market may expand up to $100 billion a year in the 2030 - 2035 timeframe, if scale constraints can be addressed globally, with greater alignment on the role of removals, further guidance for corporates, and support and directives for purchasers. But “business as usual” will not get us there. We have developed three growth scenarios to explore the various directions the CDR market could take.

The UK’s positioning in accelerating CDR activity

The UK has the potential to play a leading role within this global market. The UK benefits from attractive geology and existing infrastructure to support carbon storage and is already a burgeoning centre for R&D in engineered solutions. With the woodland and peatland codes already in place, it is also well positioned to significantly scale nature-based solutions. As a major financial centre, it can bring together the financing, trading, insurance, legal, and standard-setting capabilities that will be needed to establish the level of integrity necessary to create a large-scale market.

However, the UK must take action or risk losing ground to other markets that are also mobilising around the opportunity. We identify six actions that would help position the UK as a leading centre for CDR. They are:

- Articulate the role of carbon removals in the UK’s net zero strategy

- Set out how removal credits should be recognised within corporate transition plans

- Put in place clear minimum standards for credits, with independent oversight

- Include carbon removals in the UK Emissions Trading System (ETS)

- Additional subsidies and financial support mechanisms for projects

- Support the development of the carbon market ecosystem

The research underpinning this report was led by Oliver Wyman in collaboration with the City of London Corporation and the UK Carbon Markets Forum.