Interest rates are key drivers of lapses for both fixed annuities (FA) and fixed index annuities (FIA). In light of recent changes to interest rates, we conducted an industry experience study encompassing over $200 billion in account value lapses.

Lapses were elevated in calendar year 2023 for almost all FA and FIA products compared to prior years. The level of increase was found to vary by the richness of product benefits and guarantees.

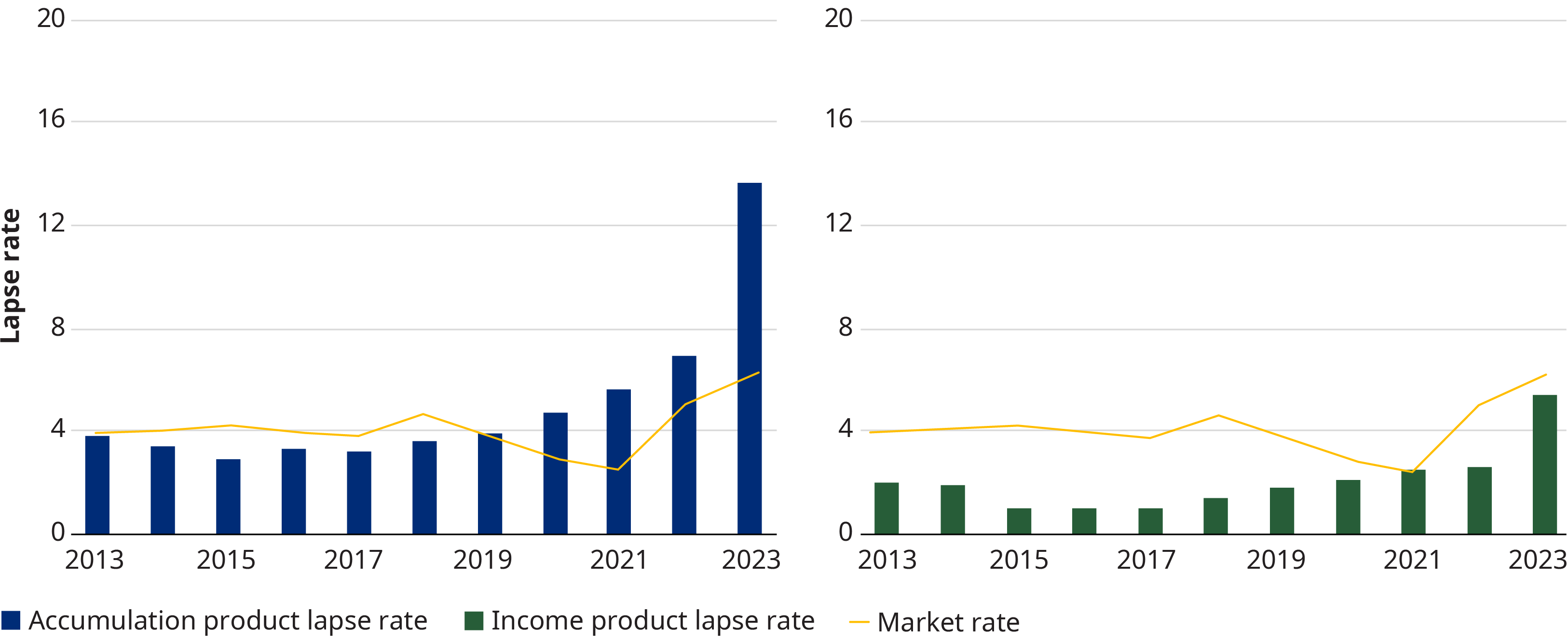

FA lapses as market rate increased in 2022 and 2023

Rising interest rates had a similar magnitude impact on policies with high and low guaranteed minimum interest rates (GMIR). Exhibit 1 compares lapses by calendar year to market rate for policies split by GMIR status. See our Study Metrics and Methodology section below for more definitions and methodologies.

Doubling of FIA lapses in 2023 driven by market rate increases

Lapses for accumulation-oriented FIA products doubled from 6% in 2022 to 12% in 2023 as policyholders sought FIA policies offering richer benefits due to the increase in the market rate.

Lapses for income-oriented products, however, experienced less of a dramatic increase in lapse rates. The income guarantee is seen as more valuable than the higher market rate, especially when the surrender value is lower than the guaranteed future income.

Exhibit 2 compares lapses by calendar year to market rate for policies split by product orientation.

Understanding annuity lapse trends through historical data and market rates

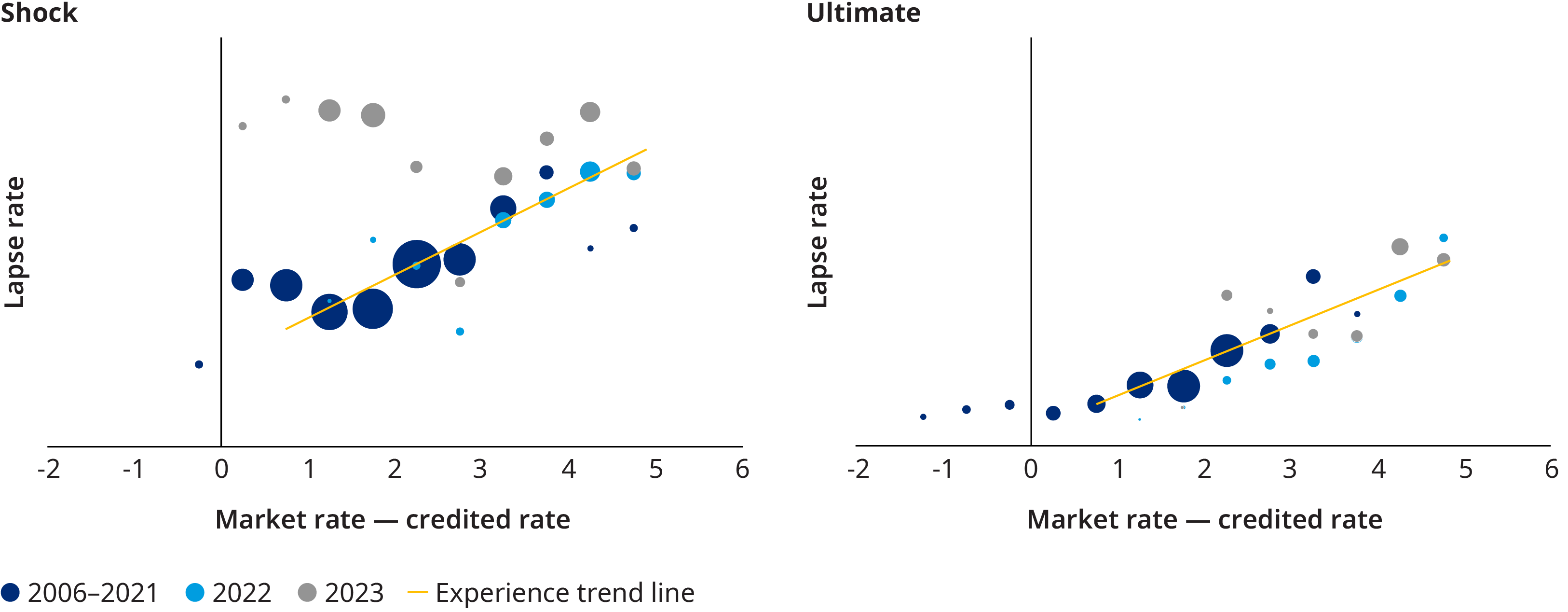

Dynamic lapses generally follow the trend of “market rate minus credited rate,” which measures competitiveness.

Drawing a line based on experience through 2021 can largely predict the experience for 2022 and 2023 lapse rates.

This is shown in Exhibit 3, which splits shock (end-of-surrender charge) lapses from ultimate (post-surrender charge) ones. The results in this exhibit are split into calendar year cohorts in order to show the predictive power of market rate in different interest rate environments.

Other factors driving fixed annuity lapses

While the shock and ultimate lapses observed in 2023 are primarily driven by the market-minus-credited-rate, there are other variables to consider.

Three-year multi-year guarantee annuity (MYGA)

Recently issued three-year MYGAs exhibit higher shock lapses compared to policies with surrender charge periods longer than three years, as illustrated by the cluster of bubbles toward the left side of the shock lapse graph in Exhibit 3.

Policy size

Larger policies have more efficient lapsation behavior than smaller policies. Shock lapses for policies $200,000 and over are approximately twice that of policies less than $50,000. Larger policies’ lapse rates diverge as market-minus-credited-rates grow exceeds 1.5%.

Ultimate surrender charge period

Lapse rates increased approximately fivefold in 2023 relative to 2021 for high GMIR policies currently in the ultimate surrender charge period. The data from 2023 provides additional insights into lapse behavior for policies in the ultimate period.

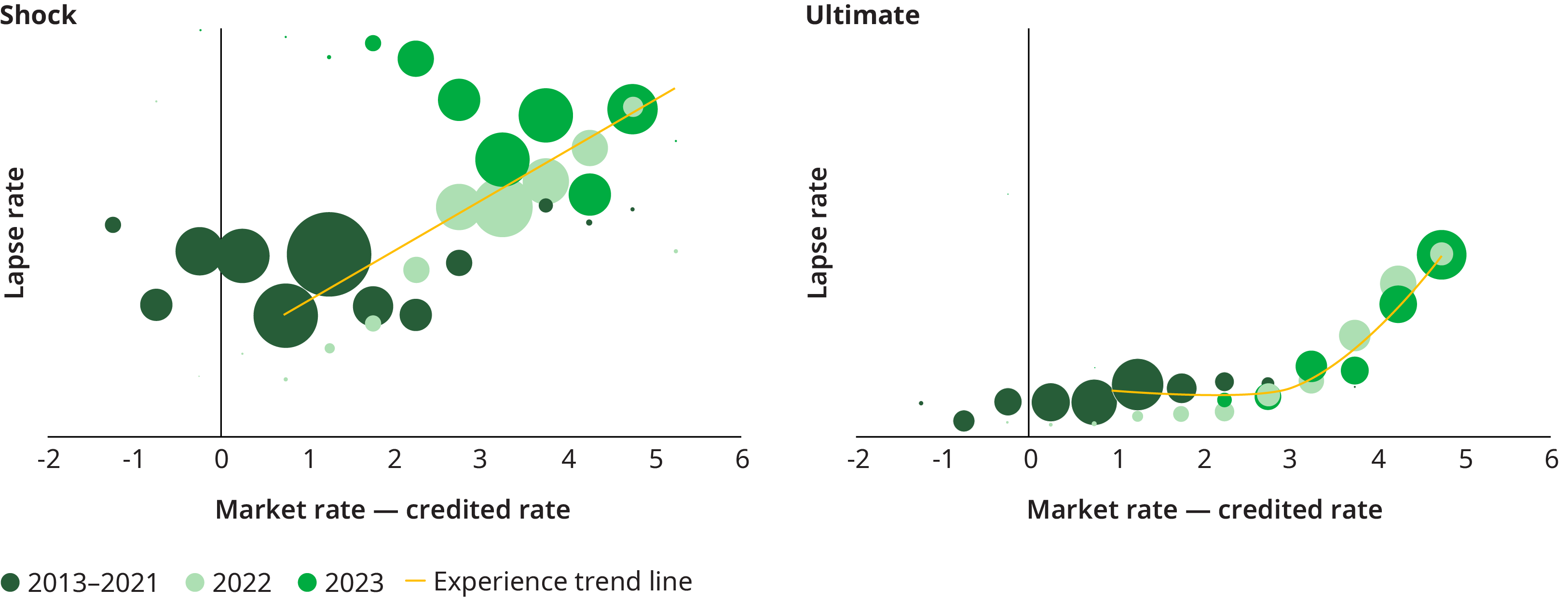

The 2022 and 2023 FIA accumulation lapses inform the sensitivity to interest rates in a higher rate environment. Experience prior to 2022 did not have sufficient information to predict 2022 and 2023 lapses in the higher rate environment.

Key factors influencing FIA dynamic lapse behavior

Product type

Dynamic lapse behavior varies by product type. During the shock lapse period, Income products show little sensitivity to interest rates relative to Accumulation products

Guaranteed lifetime withdrawal benefit (GLWB) activation status

Policies without the GLWB activated have shock lapses that are more sensitive to interest rates, showing lapses of two to three times market rate minus credited rate. Income products with the GLWB activated have very little sensitivity to interest rate changes suggesting that GLWB activation status should be considered when setting lapse assumptions.

Policy size

Larger FIA Accumulation policies have approximately 25% more shock lapse relative to smaller policies. Policy size does not impact FIA Income product shock lapse.

Fixed annuity study metrics and methodology

Fixed Annuity Study metrics

Our study included fixed annuities and fixed index annuities from 2006 to 2023, offered by 18 and 14 different companies, respectively. Fixed annuity exposure averaged $2.5 trillion and had an average lapse amount of $159.2 billion. Fixed index annuity exposure averaged $1 trillion with an average lapse amount of $56 billion.

Fixed Annuity Study methodology

- FIA Income products include a guaranteed living withdrawal benefit (GLWB) that is either elected or included with the base contract

- Accumulation products do not have a GLWB rider or option

- FIA credited rate is the weighted average of the fixed credited rate and the option budget for the S&P 500 index account

- Shock year is the year after the surrender charge period

- Ultimate period is all years after the shock year

- High GMIR are policies issued before 2009 and low GMIR policies are those issued after 2009 and later

- Market rate is the seven year treasury rate plus BBB spread

This article summarizes a limited number of findings from our experience studies. If you have interest in understanding additional findings, or if your company has interest in participating in the annual experience studies going forward, reach out to us. We will be collecting data in early 2025 for experience through 2024.