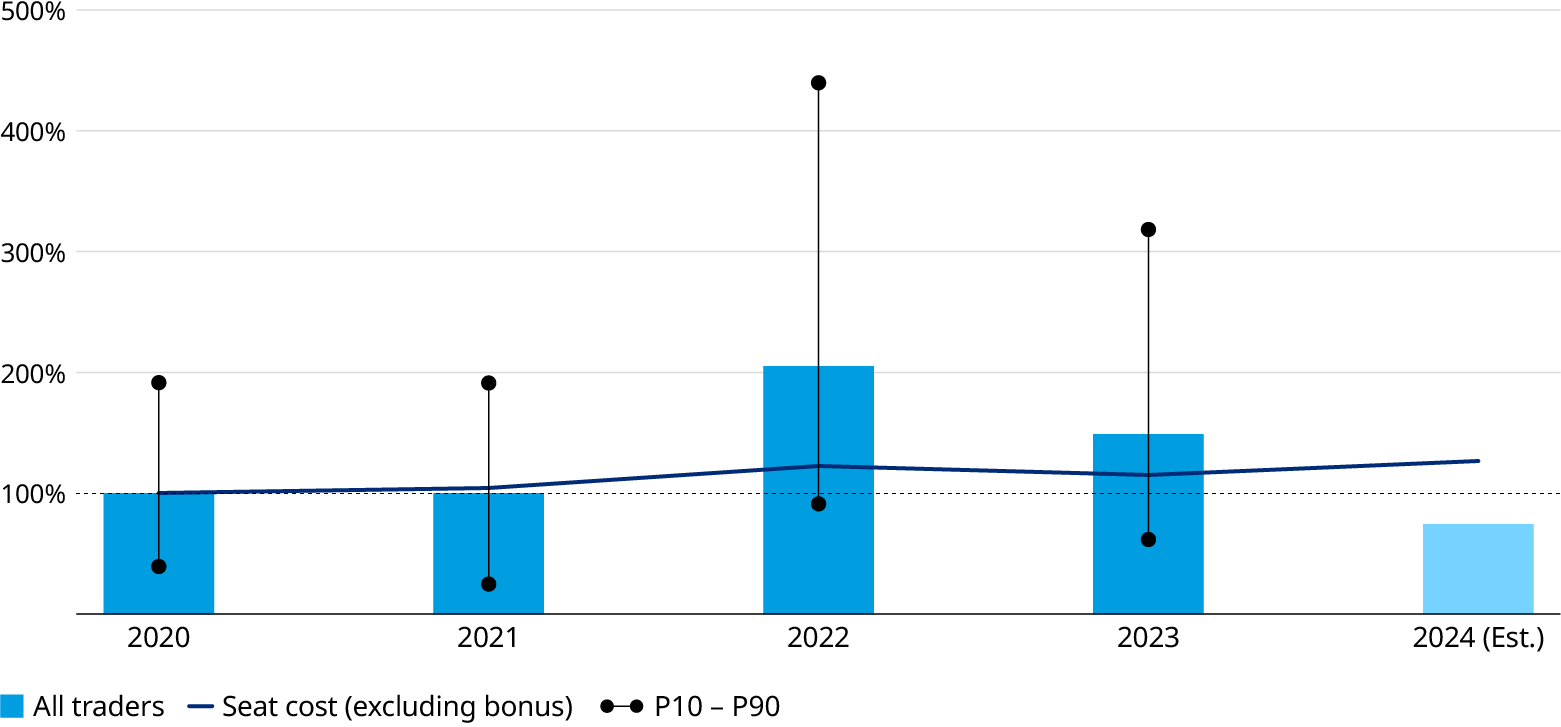

Traders are facing many headwinds. Since 2021, operating costs have increased by more than 20%. Working capital costs have also increased, buoyed by higher interest rates. On top of that, the topline is down year-on-year, with gross margin likely to be down between 20% and 60% on current trading.

While that sounds ominous, traders are still making healthy returns, and the outlook remains positive. Armed with substantial reserves of cash, now is the opportune time for industry leaders to define the new normal and not get swept up by the intensifying headwinds. This includes rethinking fundamentals around the balance between people and systems as well as defining a strong risk management and steering frame. It also requires embracing transformation and investing at scale into the portfolio.

Capital deployment in 2024 — key investment areas for traders

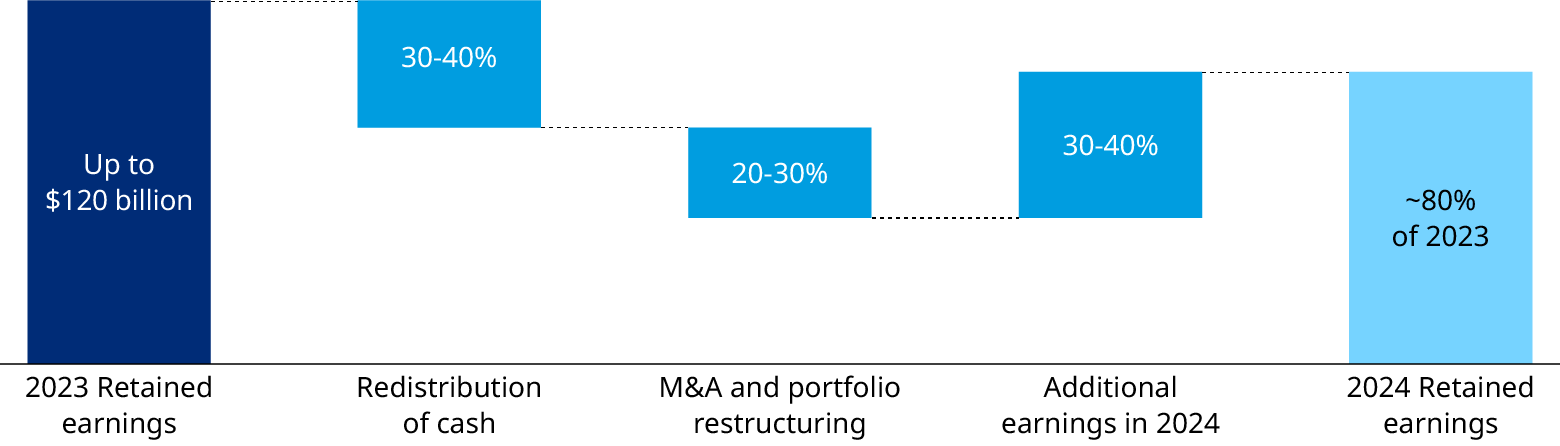

As we pointed out in an earlier analysis, the industry retained significant earnings from the boom years of 2022 and 2023 — amounting to more than $120 billion.

Traders have been active in spending this war chest, but still retain substantial firepower for future investment. The waterfall diagram in Exhibit 1 provides estimates on retained cash for 2024 and how traders are expected to have spent their cash.

Based on their estimated financial standing, we see that traders have deployed their capital across three main areas in 2024:

Shareholder returns

We see significant capital going back to shareholders. This includes multi-billion dividend payouts by leading independent traders grabbing the headlines as well as transfer of funds out of captive trading units to be given back to group shareholders as part of dividend schemes and share buy backs.

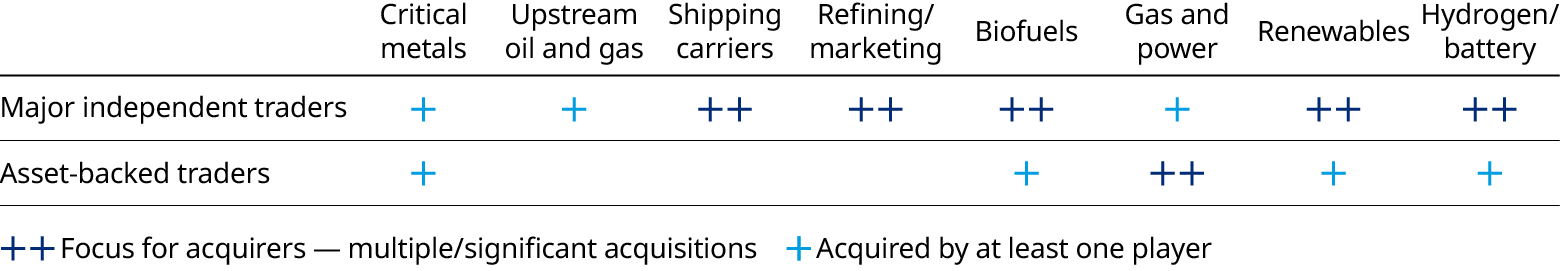

Mergers and acquisitions and portfolio restructuring

High dividends indicate some scarcity in opportunities to deploy capital in investments while meeting shareholder expectations on returns. Nevertheless, traders have still engaged in substantial mergers and acquisitions activity. Most of this activity has reinforced more established businesses and traditional value chains, including investment in fleets, refinery and storage capacity. Green investments also make up a meaningful commitment and have been largely directed towards electrification.

New earnings and cash carried forward

Despite a lower topline projected for 2024, traders will still be able to bolster their war chest with new earnings. In addition, we observe a material proportion of cash carried forward from previous years, which means that the problem of “how to spend it” remains.

In 2025, this (smaller) war chest will be up for redistribution under compensation schemes and through shareholder dividends. We estimate this will reduce funds available for investments into the trading platform and mergers and acquisitions (M&A) by at least 20% to 30%. The decision on cash redistribution needs to be taken with care and needs to consider total shareholder returns. A holistic approach to enterprise value steering — which considers all investments in a common framework — can help traders to better deploy their capital in 2025.

Transformative actions for traders in the next 18 months amid headwinds

Balance returns and spending

We see profits trending down by 20% to 60% below 2023 levels across books. Different commodity segments have had different trajectories — power has been more resilient, while oil and metals have struggled. This cross-commodity divergence is driving further diversification into new asset classes and geographies. In this context, Japanese power market entry is an area of focus, and traders are further expanding their energy activities in North and South America.

Growth and diversification come with limits on near-term earnings impact because it takes time for these platforms to mature and for returns to realize. Operationally focused, bottom-line oriented initiatives are more promising routes to short-term success.

With disruptions around artificial intelligence, portfolio integration, and the need to respond to geopolitical and regulatory challenges, organizations need to reset their operating models, including looking at their steering principles and resource allocation. In our experience, reducing operating expenditure by 20% to 40% is achievable within 12 to 18 months.

Another area with significant impact on bottom-line is resource efficiency. Defining a common currency for key working capital and risk capital resource allows for transparency and optimization. Traders can shave more than 25% in working capital requirement via optimization on liquidity management and liquidity risk.

Increase the ratability of returns

A couple of smart people, some bright ideas, good timing and a little bit of trading luck. Sounds like the founding story of many of the industry’s champions. Today, however, this does not make an equity story. As we see billions in cash outflow in form of dividends it is important to challenge what makes trading firms investable, and in return, more ratable.

The key is in variance around cash flows. Investors traditionally value people-exposed trading businesses at no more than two to four times EBITDA. We have seen success in demonstrating trading value from a full system — including assets and customer books. This shift from people to systems can bring valuations to around eight times EBITDA. The second big lever is in IT platforms — especially trading analytics and execution platforms – which carry value beyond the horizon of an individual trader’s career.

This imperative applies both to independent traders, but also increasingly to asset-backed traders that compete for capital within their broader organizations. Indicating contribution to group valuations requires demonstrating ratability to both internal and external stakeholders.

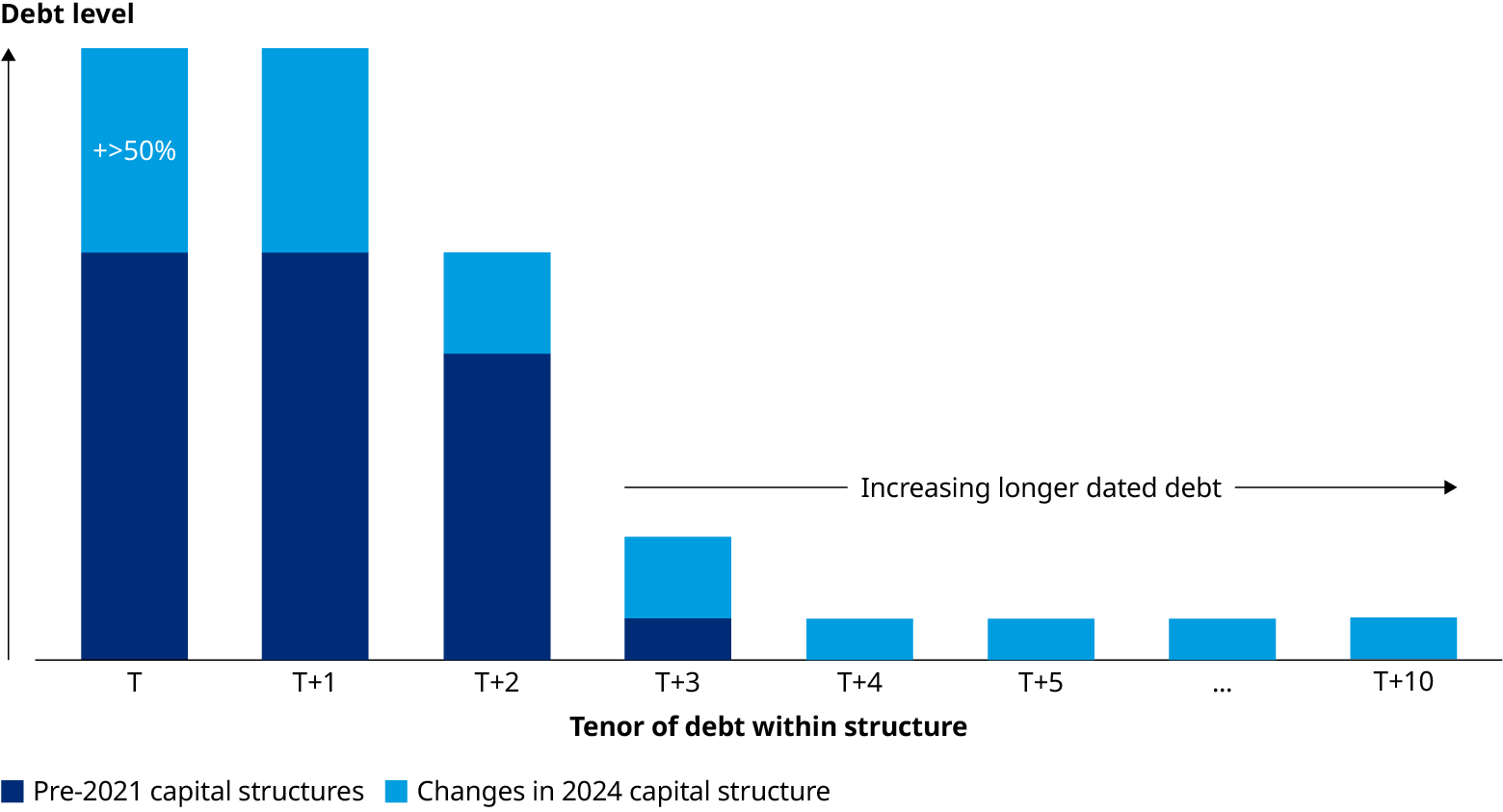

As trading businesses become increasingly integrated, their capital structure also transforms. Working capital finance still marks a key pillar, yet financing assets, customer-oriented activities, and project-financed ventures require longer lead times and a well-balanced mix on funding instruments being deployed. Clear communication with debt holders and firm steering towards a limited number of key covenants are a must to sustain competitive financing.

Improve integration of Mergers and acquisitions to unlock expansion synergies

Inorganic growth appears to be an obvious area to deploy the funds retained out of 2022 and 2023. However, not all organizations are ready for the integration and transformation challenge that increasing M&A activity brings.

Integrating customer businesses requires rethinking value chain optimization and positioning to comply to customer demands. In addition, there is a new set of management challenges around steering an increasingly heterogeneous portfolio of activities and talent pools.

Why commodity traders must transform now

The past few years have been action-packed, with many immediate challenges and rapid accumulation of platforms and people to maximize returns in a highly volatile environment. As markets settle, executives have an opportunity to re-focus — to reinstate discipline on costs, and plan for the future. Traders have the time, and the need, to transform their businesses to set themselves up for more efficient, ratable performance in the next supercycle.