Given Brazil’s abundance of natural resources, large population, and emerging industries, it can and should play an important role in the decarbonization of the global economy. And, as proprietor of 60% of the Amazon, the largest rainforest on Earth, nowhere could Brazil’s unique influence be more evident than in its potential to protect the planet’s natural capital through active efforts to prevent deforestation and preserve biodiversity.

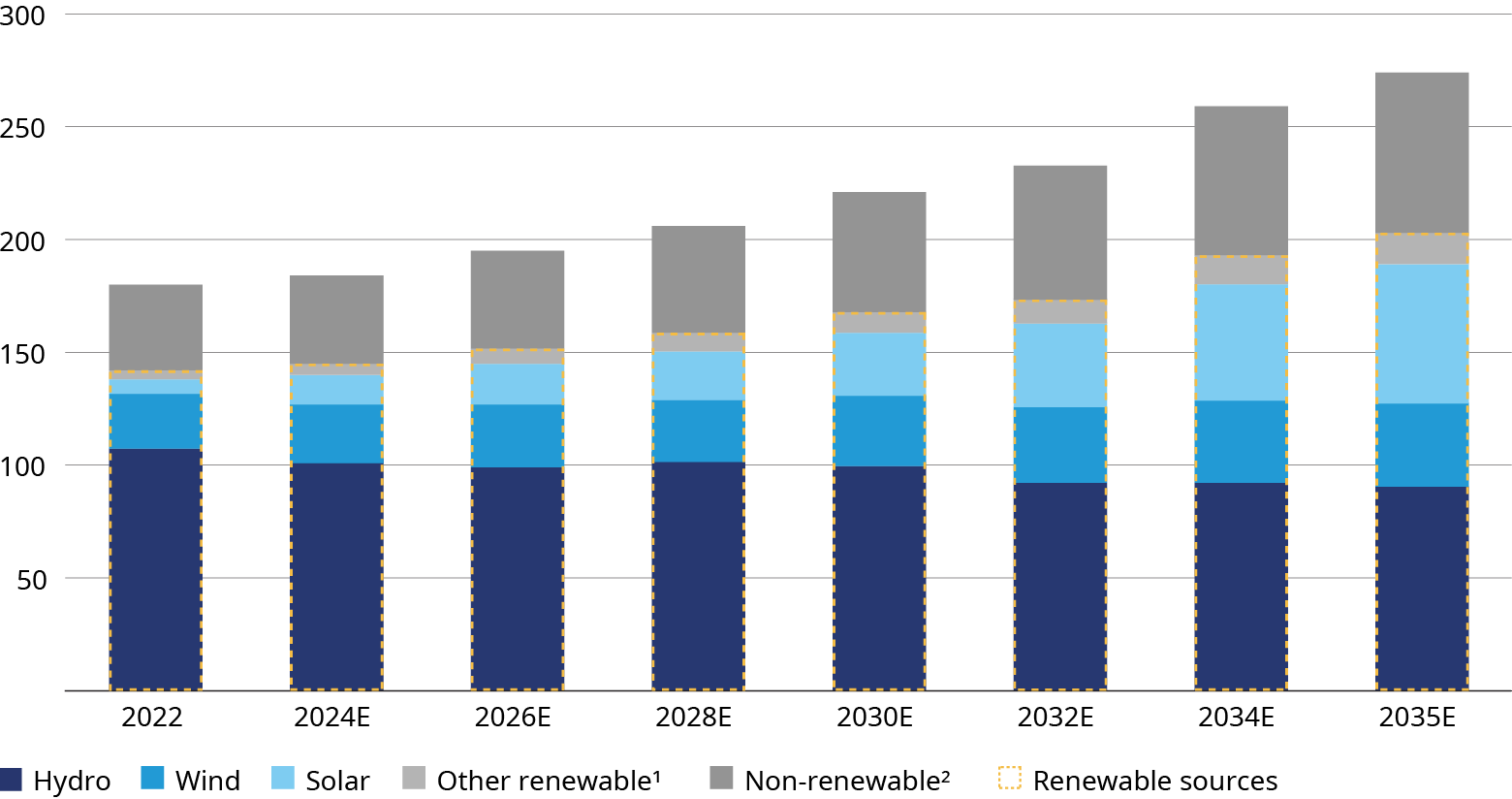

While many developed countries still need to decarbonize large portions of their energy and power sectors, Brazil already boasts a highly attractive renewable energy matrix (88%), thanks to its abundance of hydropower and recent investments in solar and wind, and significant use of biofuels representing one-fifth of the volume of fuels consumed in the country. If it can limit deforestation, apply low carbon techniques on a large-scale across its agricultural sector, and realize its potential to generate carbon offsets based on nature, Brazil has the potential to become one of the first countries in the world to achieve its net zero commitments. But those are not insignificant goals to achieve and will require strong commitments from the government, industry, and the financial sector to move forward.

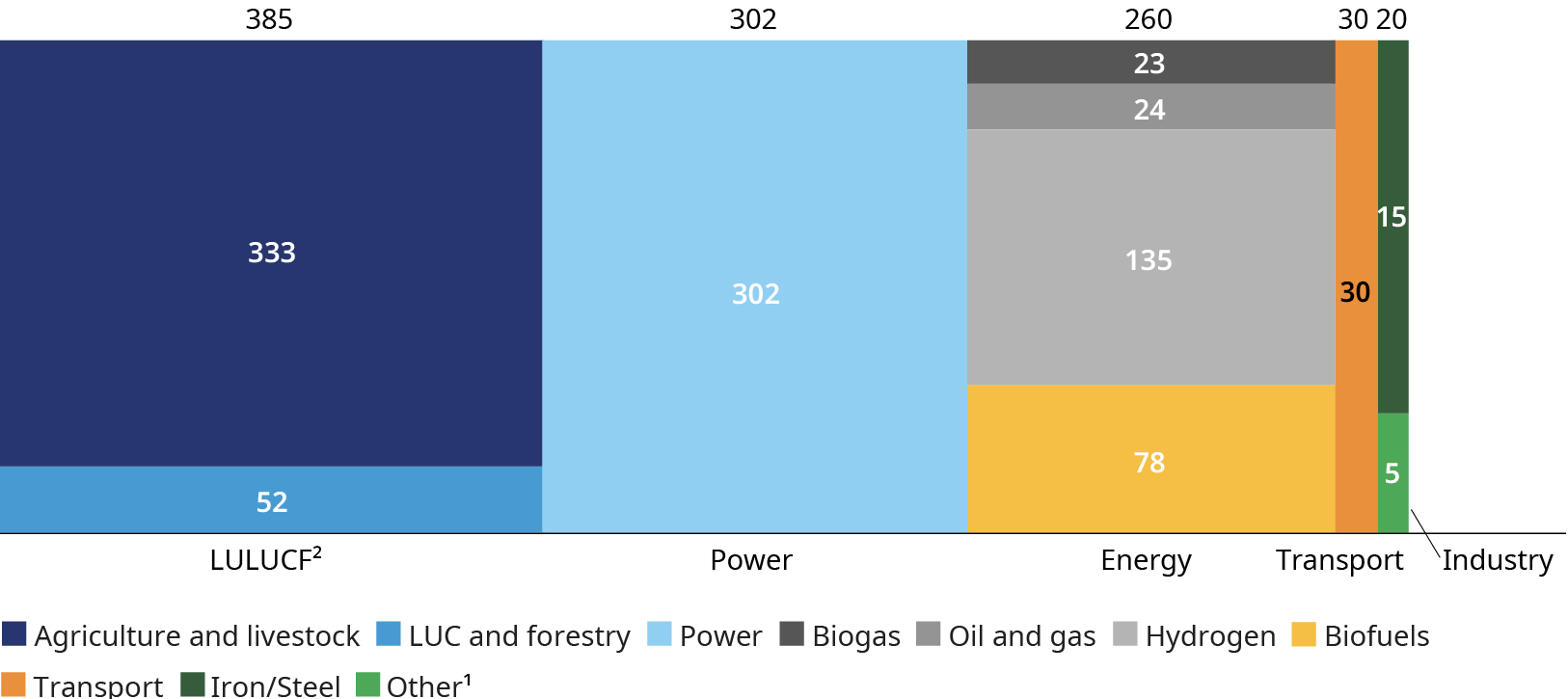

To fulfill its potential and capture the enormous benefits from a greener economy, Brazil will need to mobilize a significant amount of capital in the next years. By 2030 alone, Oliver Wyman estimates that the required investment to achieve national transition targets amounts to approximately one trillion Brazilian real, or about $208 billion. This level of investment will necessitate both public and private flows of capital into the most relevant economic sectors.

Aware of this requirement and the potential benefits from the decarbonization of the Brazilian economy, banks are recognizing the significant role they must play in financing the transition, given their expertise and access to capital. Their lending and investment policies can also influence the behavior of other industrial and agricultural sectors. Bottom line, the transition to a low-carbon economy will not happen without them as vital players in the mix.

As Brazilian banks prioritize sustainability and decarbonization as part of their commercial strategy, several key dynamics are reshaping the landscape and fostering a more sustainable and resilient financial ecosystem. These include an evolving regulatory environment, new financing approaches, and the emergence of alternative financing opportunities and tools. Understanding these dynamics is crucial for Brazilian banks to navigate the changing landscape, seize opportunities, and effectively contribute to the transition toward a low-carbon future.

After assessing the challenges and opportunities ahead, a fundamental first step is for each to operationalize sustainable strategies across their business units that establish new ways to assess and manage climate-related risks, review and update credit policies, and engage and incentivize commercial teams to prioritize sustainable financing. They must also proactively structure a diverse range of innovative products and services that meet the evolving needs of climate transition.

Brazilian Carbon Market (BCM)

In Brazil, the implementation of the Brazilian Carbon Market (BCM) has gained significant momentum and is poised to play a pivotal role in the country's decarbonization efforts. The BCM aims to establish a regulated market for the trading of emissions allowances, creating an economic incentive for companies to reduce their greenhouse gas emissions. By setting a cap on emissions and allowing for the buying and selling of allowances, the BCM encourages companies to adopt cleaner technologies and implement emission reduction projects.

In the meantime, Brazil is already witnessing significant growth in the voluntary carbon market, further bolstering the country's efforts to become a relevant player in the greener economy. According to a German report from the International Climate Initiative and supported by the International Emissions Trading Association, Brazil is currently the most important carbon credit supplier in Latin America.

The voluntary carbon market enables companies and individuals to offset their emissions by purchasing carbon credits from projects that reduce or remove greenhouse gas emissions. These projects can encompass a wide range of activities, including reforestation, renewable energy, and sustainable land management.

The current Brazilian government is proposing the imposition of regulation on the carbon market in Brazil, which would open opportunities for banks to play a vital role in facilitating the financing of emission reduction projects across various sectors. These could include renewable energy, transportation, manufacturing, and agriculture.

As the nation strives to achieve a greener economy, Brazilian banks must embrace their pivotal role in decarbonization and actively incorporate sustainable practices. By leveraging their expertise, resources, and influence, banks can be catalysts for the transformation and become the building blocks of a thriving low-carbon economy.

Additional contributors: Amilton Neto, Felipe Nicola, and Lucas Ribeiro.