The Greater Bay Area (“GBA”) is a large, fast-growing, and vibrant region with the highest concentration of high net worth (“HNW”) individuals and investible assets – an attractive wealth pool for wealth and asset managers. With the vision of creating an integrated region, reforms and new policies have been issued to encourage cross-border investment, including Wealth Management Connect.

While this provides direct access to the GBA wealth pool, we believe that wealth and asset managers, as well as relevant financial institutions should define their value proposition, products, and customer experience to cater to the GBA retail investor’s needs and behavior characteristics.

Through Oliver Wyman’s proprietary GBA retail investor survey, we have constructed profiles of the target retail investors who have expressed an interest in participating in cross-border investment.

Know your Greater Bay Area Investors

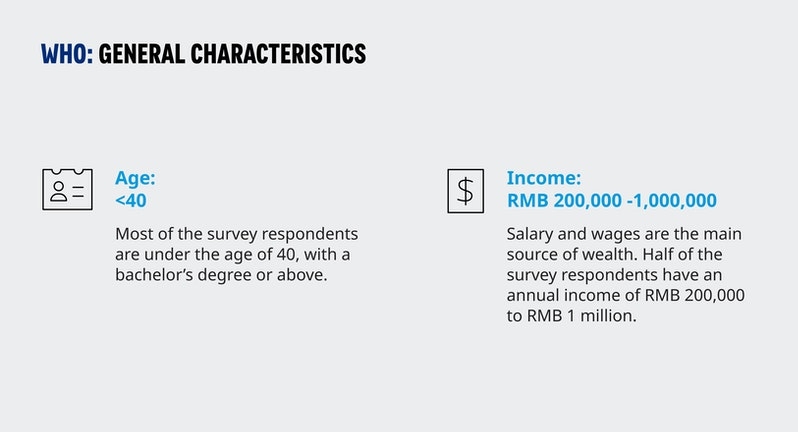

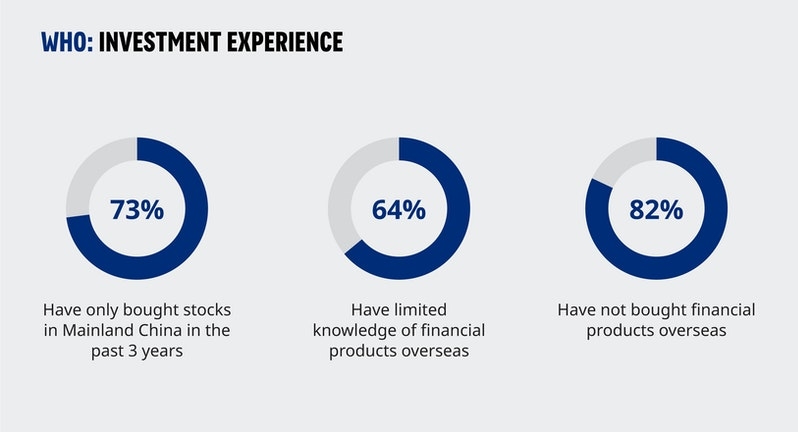

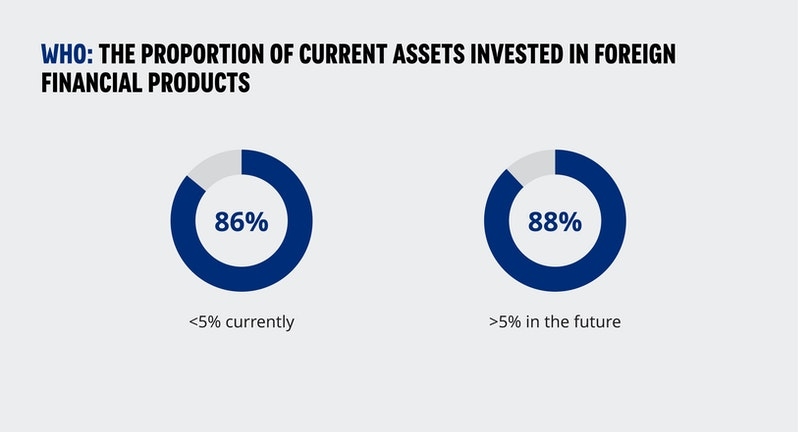

Typical GBA retail investors are young and experienced in stock investment. However, while there is interest in overseas investment, most have limited or no prior experience investing overseas. In addition, these investors believe they are less knowledgeable in overseas financial products. The perceived lack of knowledge and fear of being misinformed is one of the key concerns for most retail investors wishing to make a cross-border investment.

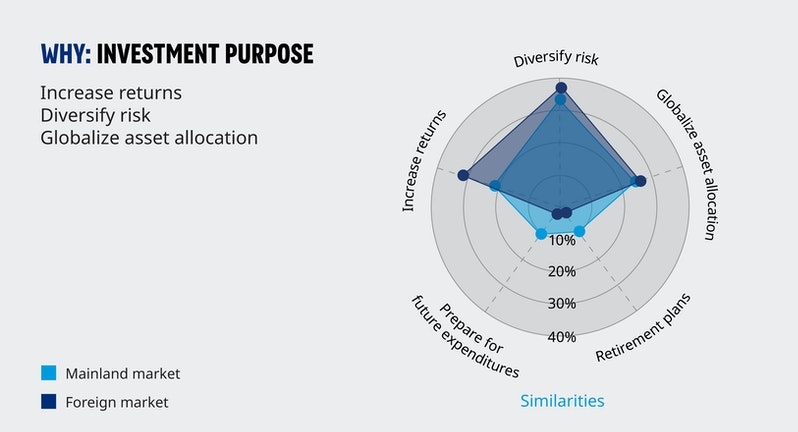

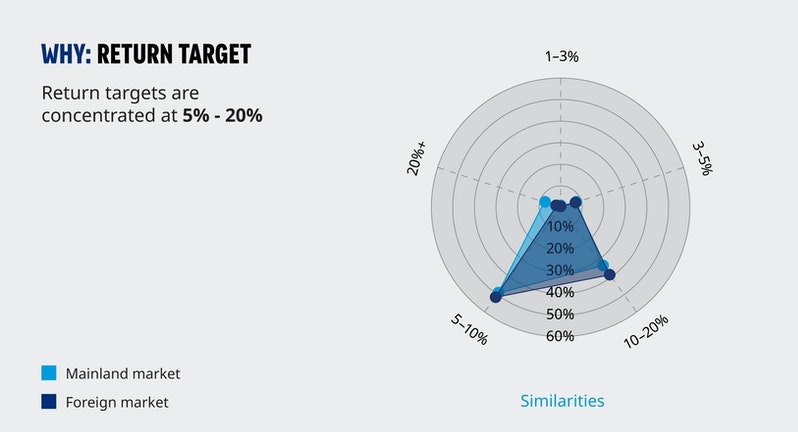

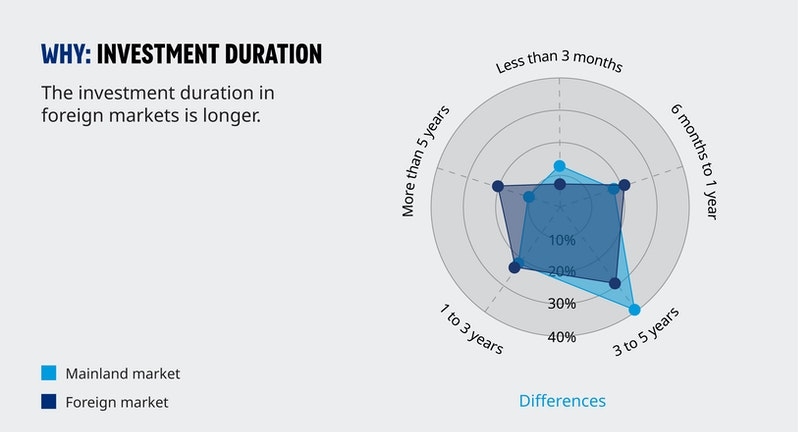

GBA retail investors, to a certain extent, expect their offshore investments to meet similar objectives as their onshore ones, which include additional return, risk diversification, and asset allocation.

Wealth Management Connect Opportunities

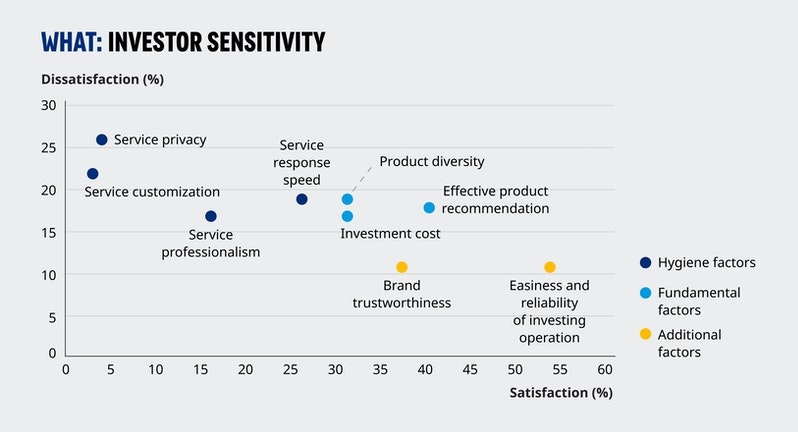

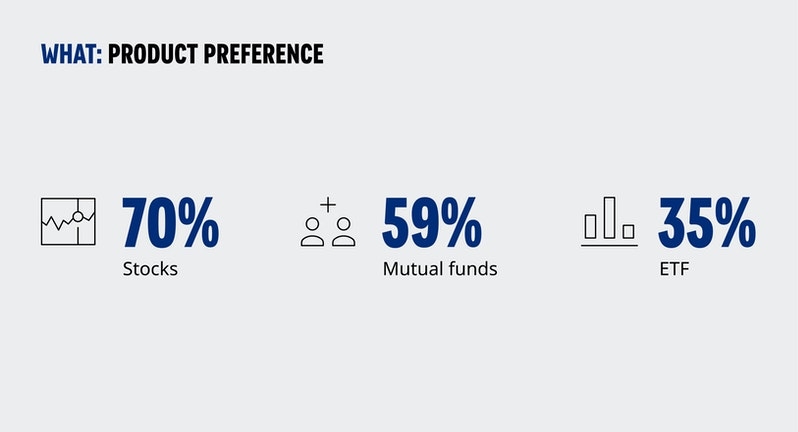

There is a strong interest in mutual fund products, in addition to stock and ETF investments, which correlates with the strong interest seen in the relevant GBA cross-border investment schemes (namely, Wealth Management Connect and Stock Connect). GBA retail investors emphasize the need for ‘product’ quality when it comes to driving satisfaction versus dissatisfaction towards their overseas investments, and they consider the quality of ‘service’ as a hygiene factor.

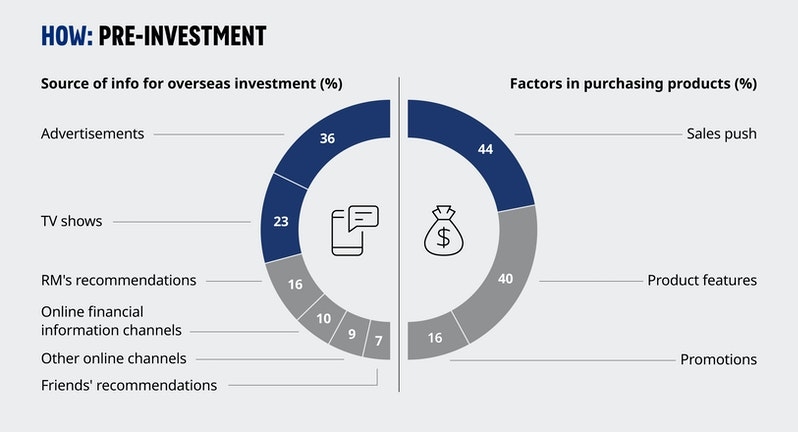

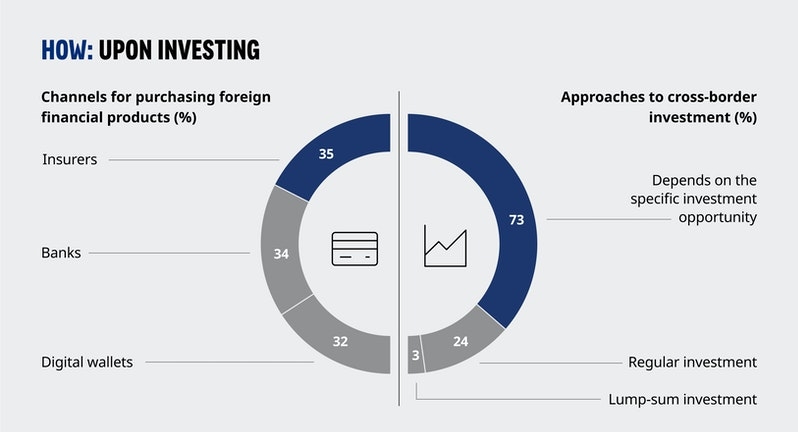

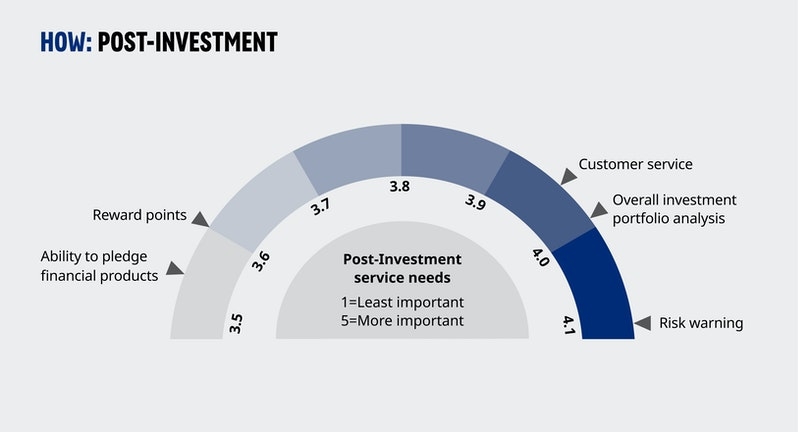

Given the self-perception of knowledge gaps, GBA retail investors have expressed a strong preference for ‘pushed’ communications regarding cross-border information and product features, before any consideration of making an actual investment. When they do invest, they prefer traditional financial institutions as the channel of choice, followed by digital wallets. Post-investment services and active communications are also highly valued.

Greater Bay Area opportunities

We believe that it is time for financial institutions to start taking concrete action, as stated below, to prepare for and win the rising market opportunities offered by the GBA:

As offshore products become more accessible, the demand for holistic portfolio management covering both onshore and offshore investments will continue to grow. GBA-focused players should not only aim to address the need for an ‘offshore wallet’. Rather, they should define holistic ‘onshore + offshore’ integrated offerings, as well as support services beyond traditional wealth management.

In order to win over potential onshore investors, GBA players need to compete against onshore product offerings and offshore ones alike, as GBA investors may not distinctively separate onshore versus offshore markets when making their investment decisions. For example, foreign players can create differentiation by offering new products that give unique investment exposure, or are currently under-penetrated or less sophisticated onshore (e.g. smart beta, thematic, and broad-based ETFs, as well as ESG-themed products and other alternatives).

Currently, the cross-border investment journey is a fragmented experience for GBA investors. Organically building capabilities to address the customer-experience gaps end-to-end would be costly and slow to market. Therefore, GBA-focused players should explore broader value chain and ecosystem partnerships that bring in a seamless customer journey across the border, from investor education and demand origination, to customer acquisition and conversion, to eventual onboarding, transaction, and ongoing post-investment services.