The next big wave of innovation in financial services will be driven by existing firms taking a greenfield approach.

For an industry whose product – the movement and storage of money and the management of risk – is electronic, financial services processes are manually intensive. Surveys show that customers are rarely inspired by the service and yet the consensus is that a digital overhaul of legacy systems will be the work of many years.

At the same time, new businesses underpinned by digital capabilities are gaining traction.

Imagine if you could combine what is possible in a new build with the business model advantages of an existing firm. We call this approach greenfield.

It means tapping into the same flywheel momentum of growth employed by Big Tech, breaking out of the low-returns cycle. The quality and low cost of new technology, the potential for dramatic change in competitiveness, the reduction in conduct and cyber risks if done correctly, and modern methods for migration, all make this idea compelling right now.

In the 2019 edition of our State of Financial Services report we examine the potential for the industry to start again and point to the first steps in the journey – "go build!"

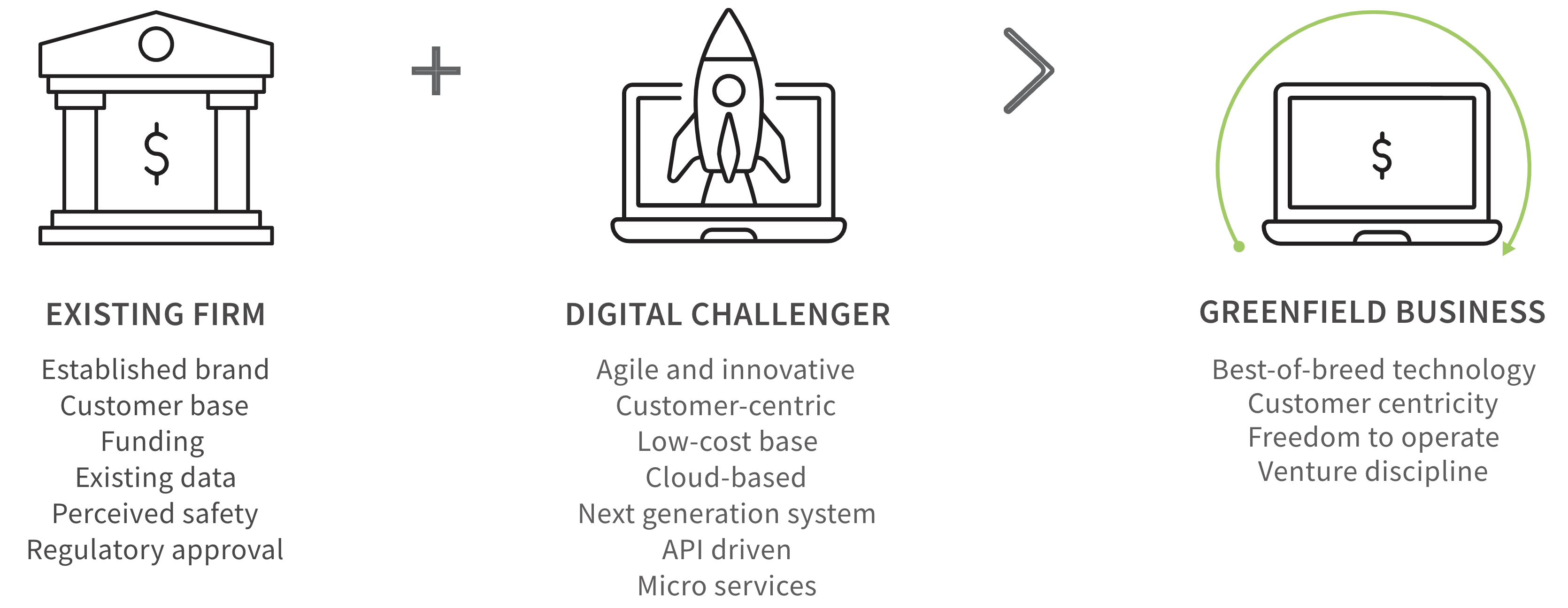

INTRODUCING GREENFIELD

Greenfield is a method for existing firms to build new businesses. The starting point is an unmet customer need, identified from existing customer data, or the potential for a radically lower cost approach. Greenfield businesses can be built to defend areas that are already strategically important, or to kick-start expansion.

Exhibit: INTRODUCING THE GREENFIELD CONCEPT

Source: Oliver Wyman analysis

THE POWER OF NEW

Digital challengers are gaining traction in parts of the financial services market, even whilst facing skepticism about whether they can scale up. What is most interesting are the possibilities these new businesses point toward: the falling time to market, significantly lower run costs, and the fact that new business models and data-driven approaches are winning customers over.

Exhibit: HOW EXISTING BANKS COMPARE TO DIGITAL CHALLENGERS

Source: Oliver Wyman analysis; Press Releases

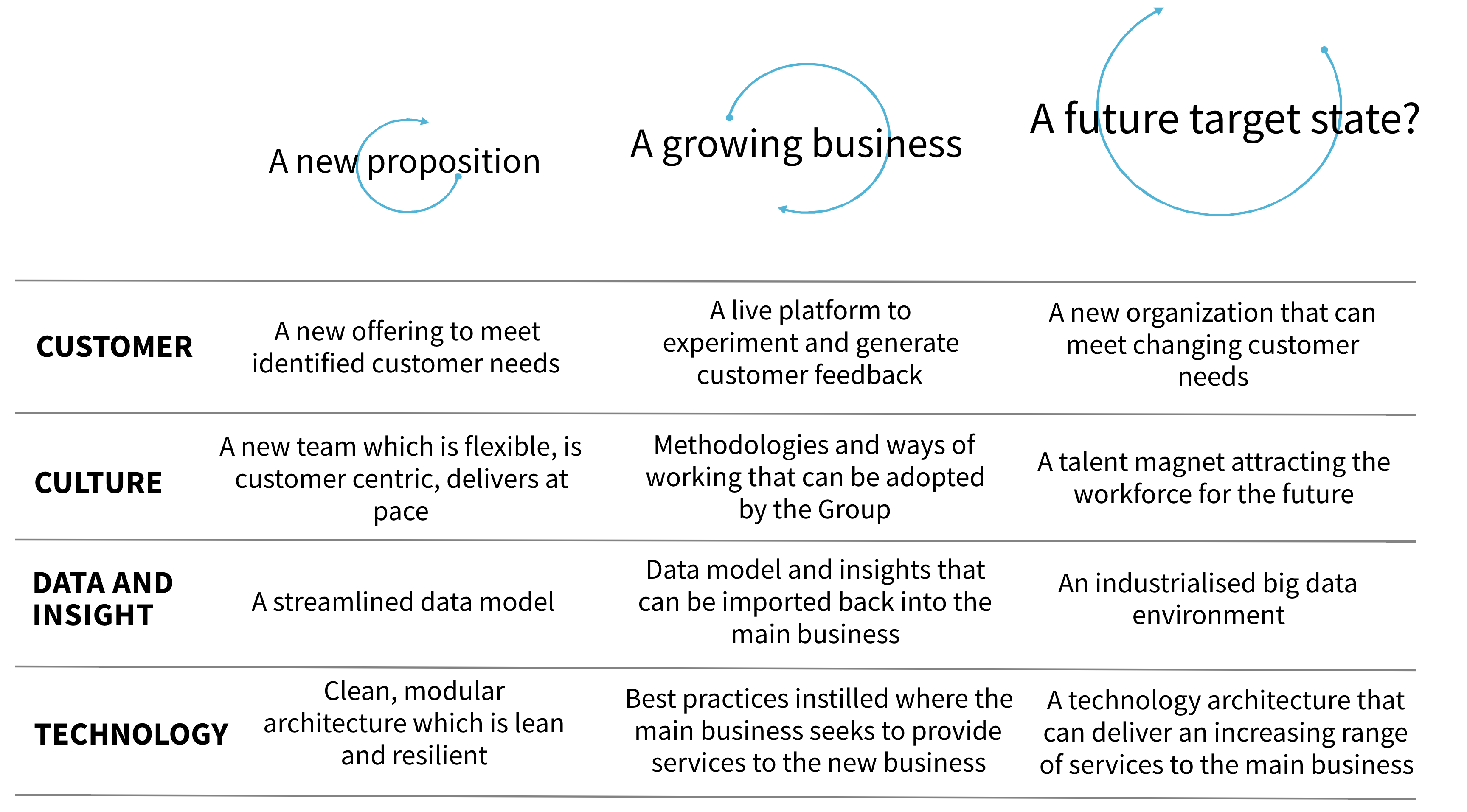

A CATALYST FOR CHANGE

Greenfield businesses accelerate change in the parent organization. Conventional wisdom gets heavily challenged, customer offerings can be tested more quickly, and access to external innovation is improved. As it expands, the operating platform can be leveraged across the whole business, providing an alternative approach to transformation.

Exhibit: GREENFIELD AS A CATALYST FOR CHANGE

Source: Oliver Wyman analysis

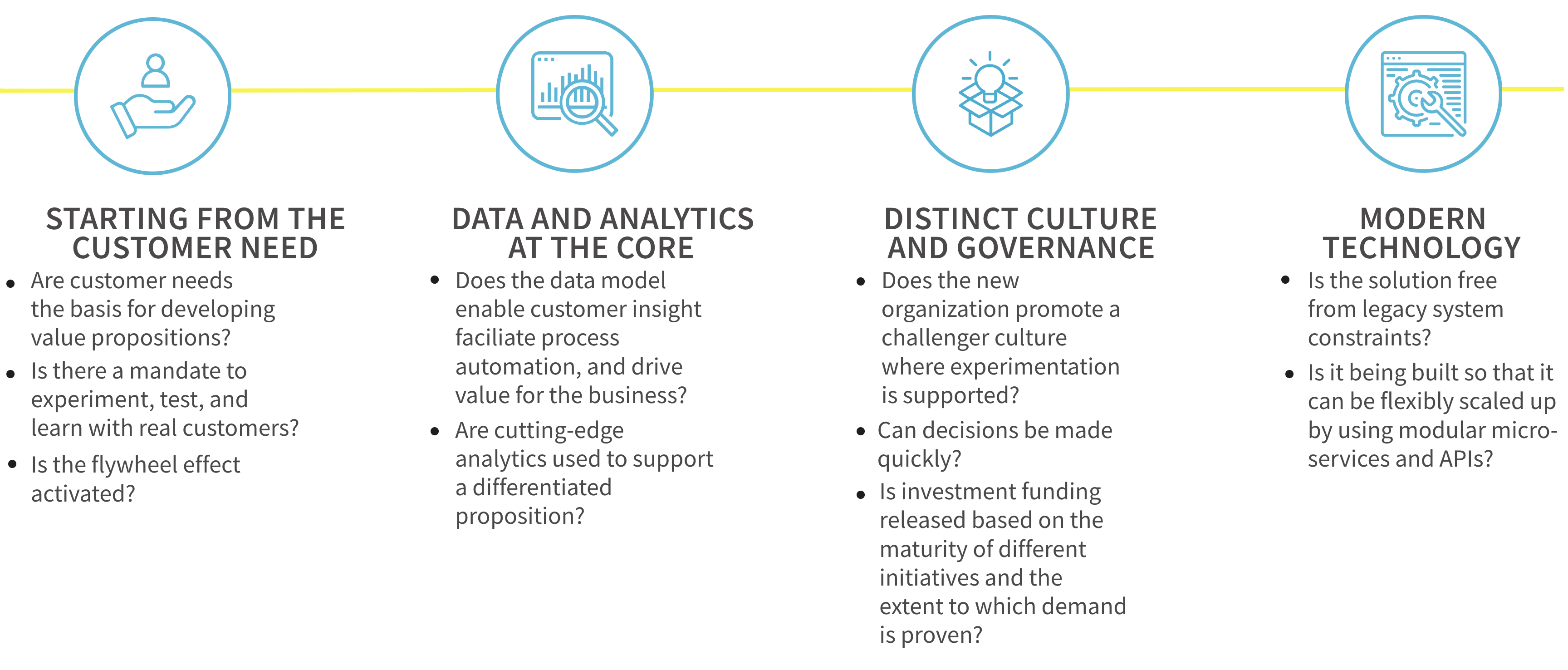

HOW TO SUCCEED AT GREENFIELD?

A greenfield build is an attempt to break free from the constraints imposed by existing systems, business models, and talent models. To succeed, it needs to start from the customer, put data and analytics at the core, have a distinct culture and governance, and be built so it can scale up, whilst meeting security demands.

Exhibit: GREENFIELD BUILD SUCCESS FACTORS

Source: Oliver Wyman analysis

How To Deliver A Greenfield Build

GO BUILD!

To drive growth in today’s environment, financial services firms need to get on the front foot, and build. Rich seams exist across all of financial services from which new solutions can be developed and grown into greenfield businesses.

With the development process getting cheaper, and the potential to reuse components across the business, the downside is small and the potential exists for transformative effects across the business. Most important is for senior management to believe in the endeavor, to give sufficient time, support and attention, and to pro-actively drive the benefits back into the core business.

CONTACT

Oliver Wyman Deborah O'Neill  Read More

Read MoreOliver Wyman Deborah O'Neill Deborah O'Neill is the co-head of our Digital Practice in Europe and part of our artificial intelligence (AI) platform, Quotient, AI by Oliver Wyman.Oliver Wyman Chris Allchin  Read More

Read MoreOliver Wyman Chris Allchin Chris Allchin is a Partner in our Financial Services Practice. With more than 20 years in the firm, he has authored many of our flagship publications.Oliver Wyman Rick Chavez  Read More

Read MoreOliver Wyman Rick Chavez

Previous reports and related insights

Hub The Customer Value Gap: Re-calculating Route  Read More

Read MoreHub The Customer Value Gap: Re-calculating Route The State Of The Financial Services Industry 2018Journals The State Of The Financial Services Industry 2017  Read More

Read MoreJournals The State Of The Financial Services Industry 2017 Transforming for future value.Insights Modular Financial Services  Read More

Read MoreInsights Modular Financial Services Our 2016 State of Financial Services report