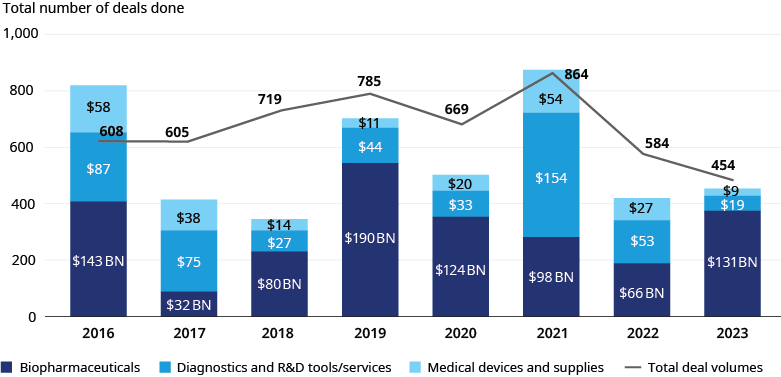

Life sciences M&A deal activity declined from 2022 to 2023, with performance varying by subsector. Overall transaction volume declined by 22%, while deal values increased by 8% due to larger average deal sizes. We saw these trends across subsectors:

- Biopharmaceuticals: Total deal value increased by 97% ($66.4 billion vs. $131 billion), while volume decreased by 16% (255 deals vs. 213 deals)

- Diagnostics and R&D Tools/Services: Total deal value decreased by 65% ($53 billion vs. $18.5 billion), while volume decreased by 27% (274 deals vs. 201 deals)

- Medical Devices and Supplies: Total value decreased 68% ($27.5 billion vs. $8.8 billion), while volume decreased by 27% (55 deals vs. 40 deals)

Biopharma’s rise in deal values was exemplified by Pfizer’s $43 billion acquisition of Seagen, Bristol-Myers Squibb’s $12.5 billion acquisition of Karuna Therapeutics, and Merck’s $10 billion acquisition of Prometheus Biosciences. These three deals represent half of all biopharma M&A deal values in 2023.

Diagnostics and R&D tools/services exhibited similar activity to medical devices and supplies as both subsectors experienced declines in deal volume and values. Still, surgical robotics garnered significant deal values driven by increasing demand for soft tissue, gynecologic, and bariatric procedures as well as a need for efficiencies among providers, given lingering staff shortages. Despite persistent post-pandemic headwinds in the form of inflation, clinical labor shortages, IPO market stagnation, and high capital costs, we are optimistic that life sciences dealmaking will see higher growth in 2024. From a macro standpoint, we anticipate overall growth to be fueled by the record $2.6 trillion in all-sector PE funds yet to be deployed, stabilizing interest rates, and a closing gap between buyer and seller expectations. Deal activity across subsectors will be boosted by higher revenue-potential drug approvals, R&D pipeline advancements, strengthening demand for pipeline-replenishment as key assets lose market exclusivity, more productive application of artificial intelligence, and initiatives to fortify supply chains and avoid disruptions.

We expect biopharma deal activity to be bolstered by continued interest in historically strong therapeutic areas for dealmaking, such as immunology and oncology, as well as in areas gaining traction, such as cardiovascular, metabolics and obesity, and neuroscience. Deals announced in late 2023 indicate areas of heightened interest, notably Roche’s $2.7 billion purchase of Carmot Therapeutics, AstraZeneca’s $2 billion license agreement with Eccogene, and Novo Nordisk’s $1 billion of investments in obesity and cardiometabolic biotechs. We also anticipate that biopharma IPO markets will slowly regain activity.

Investments in biopharma

We expect four key drivers to influence and support increases in deal activity in 2024:

- M&A Driver I – Patent Cliff

Collective product revenue streams facing loss of exclusivity are expected to accelerate drastically in the coming years. Between 2025 and 2030, close to 200 products, representing nearly $240 billion in total revenue, will see key patents expire, including a peak of $60 billion in 2029. By comparison, a total of $175 billion in product revenue was lost between 2019 and 2024 due to expiring exclusivity. This only heightens the urgency for the industry to replenish clinical stage pipelines, which in turn can be expected to accelerate M&A and licensing activity.

The immunology market may provide a preview of what to expect going forward. AbbVie’s Humira lost exclusivity in January 2023, triggering the launch of nine biosimilars through December 2023 and aggressive contracting that is expected to shift volume and reduce net price levels, this despite biosimilars reportedly having minimal adoption to-date. Janssen’s Stelara lost exclusivity in September 2023, which was promptly followed by the approval of Amgen’s biosimilar Wezlana in November. Although a patent infringement suit is expected to delay launch until January 2025, two additional Stelara biosimilars are anticipated over the next one to two years: Alvotech / Teva’s AVT04, set to launch February 2025, and Fesenius Kabi / Formycon’s FYB202, set for April 2025. Noteworthy drugs losing their primary patents in early 2024 include Regeneron’s Eylea for wet age-related macular degeneration, Alvogen / Almatica’s Gralise for neuropathic pain, Boehringer Ingelheim’s Ofev for idiopathic pulmonary fibrosis, and Gilead’s Complera and Merck’s Dutrebis and Isentress for HIV.

- M&A Driver II – Inflation Reduction Act

The IRA contains provisions on drug price negotiations, Medicare rebates, and capped out-of-pocket spending for Part D enrollees.

The law’s price negotiations terms will certainly affect how the industry and investors evaluate biopharma investment opportunities; for instance:

1. Successful products with Medicare indications will likely face negotiated discounts during their lifecycles

2. Indirect pricing pressure from a negotiated competitor may be felt earlier and have a greater impact

3. Spillover into commercial markets will likely occur as payers leverage IRA-driven terms in contracting negotiations

These changes will effectively alter risk calculus and the way in which forecasting & valuation assumptions are used in decision-making:

1. ROI calculation methods will require updated risk accounting and reevaluation

2. Indication selection and sequencing priorities may shift

3. Clinical efficacy bar — and value demonstration more broadly — to justify premium pricing could be raised

4. Lifecycle management strategies will need to be revised

5. Business development, licensing values and deal-drivers will in turn be impacted

Competition will intensify for first-in-class differentiated assets having extended time on the market prior to being impacted by negotiations, and transaction values can be expected to reflect this in terms of where investors are willing to pay premiums. Broader portfolio deals could also serve to bolster pipelines with multiple assets across therapeutic areas.

The net effect of lower deal values for less differentiated assets and increased competition for highly differentiated assets will be a push for biopharma to look externally to satisfy the market’s increased demand for innovation. Greater competition for fewer deals is anticipated to increase deal values going forward.

Additionally, IRA provisions would seem to portend a shift from small molecules to biologics, given differences in years on the market before Centers for Medicare and Medicaid Services negotiation begins — 11 years post-approval for biologics versus seven years for small molecules. However, while this incents biologics development, gene therapies are relatively small in number, and R&D in markets, such as immunology, are moving in the direction of small molecule targets.

- M&A Driver III – Antitrust Scrutiny

Amgen’s acquisition of Horizon Therapeutics and Pfizer’s deal for Seagen, both completed in 2023, are two cases that may indicate increased regulatory scrutiny going forward. The Federal Trade Commission’s case against Amgen and Horizon was unique in that agency focused on the potential inclusion of Horizon’s blockbuster drugs Krystexxa and Tepezza in Amgen’s rebate program. As part of its concessions, Amgen agreed to a consent order preventing it from bundling its products with the Horizon brands.

Although the regulatory environment may create uncertainty for investors, the long-term effect on the dealmaking landscape could prove to be limited to certain deal types. In 2024, the pressures of increased scrutiny of larger deals could beget higher volumes of deals with lower individual values per deal, such as an increased number of bolt-on acquisitions.

- Additional Drivers

A mix of R&D innovations, greater adoption of AI, and supply chain shifts are expected to fuel M&A activity in 2024. In terms of clinical development breakthroughs, novel vaccines and mRNA technology have begun human trials for such diseases as HIV, rabies, and Zika, while demand continues for multi-indication pharma products. These products are poised to open new sources of revenue for companies with an acquisition mindset.

Life sciences companies are also undertaking new supply chain approaches. By prioritizing enhancements in the use of real-time tracking technologies, more streamlined manufacturing procedures, improved cold-chain capabilities, and blockchain technology for data sharing, pharma and biotech are adapting their risk mitigation strategies. These favorable trends in operational stability and supply chain transparency will fortify investor sentiment on the space.

Investments in Diagnostics and R&D Tools / Services

There were some noteworthy deals in this subsector last year. The $7.1 billion acquisition of Syneos Health, a contract research and commercial services company, by a private investor consortium represented the largest deal of 2023. Other notable deals included Mars, the parent company of Antech Diagnostics, acquiring Heska, a global provider of advanced veterinary diagnostics and specialty products, for $1.4 billion, and Thermo Fisher Scientific’s nearly $1 billion acquisition CorEvitas closed in 2023.

In 2024, we anticipate M&A activity to increase in the diagnostics and R&D tools/services subsector. Both growth-stage and larger, more established companies, benefit from M&A activity, and there is heightened attention in next-generation sequencing and point-of-care diagnostics. In addition to larger players pursuing deals in this space, companies such as DiaSorin Molecular and QuidelOrtho are well-positioned for deal making in the new year. Both companies completed acquisitions in the past three years, as DiaSorin acquired Luminex in 2021, and Quidel acquired Ortho in 2022.

In the contract manufacturing and research services segment, investment in contract development manufacturing organizations — CDMOs — and contract research organizations — CROs — declined substantially following a record $28 billion of deal values in 2021. Only $600 million reported in 2023. We anticipate renewed interest in this space, as demand for outsourced biologics manufacturing and research capacity increases in addition to evolving CDMO and CRO capabilities to meet growing demand.

Investments in Medical Devices and Supplies

Significant dealmaking in this subsector included leading musculoskeletal solutions company Globus Medical’s merger with NuVasive in an all-stock transaction. Valued at $2.6 billion, it was the largest deal in this subsector in 2023, and when combined with Amtek’s $1.9 billion acquisition of Paragon Medical, the two deals comprise 51% of medical devices and supplies M&A activity for 2023.

In 2024, we anticipate M&A activity to rebound within the medical device and supplies subsector. Robotics is likely to exhibit strong performance due to an underlying demand for hernia, gynecologic, and bariatric procedures. To combat healthcare staff shortages, providers are increasingly investing in medical and surgical robots to minimize human error, shorten hospital stays, and improve outcomes for patients.