How can insurers integrate Sustainability Risk into their quantitative risk management under Solvency II?

Since the Paris agreement of 2015, climate change has received increased focus from the public as well as legislative and regulatory bodies. Corresponding actions and initiatives of European institutions towards a greening of the financial industry have also led the supervisory authorities to put increased attention on climate-change related risks for the financial sector.

In recent publications, regulatory bodies have left little doubt that they expect the insurance industry to actively address all material risks related to climate change within Pillar II requirements (ORSA) - this does not only include physical risk stemming from changing climate itself, but also changes in investment conditions due to the transition towards a low-carbon economy (transition risk). This raises the question, how these transition risks can be quantified within Solvency II risk capital calculations.

In this publication, we present a practical approach for insurers for addressing and quantifying climate change related asset risks within an ORSA setting. The essential ingredient is a forward-looking valuation approach, which effectively translates climate policy scenarios into tangible impacts on the asset base. A particular focus of the presented approach lies on effective implementation into existing processes, using readily available data sources for both scenario construction and risk quantification.

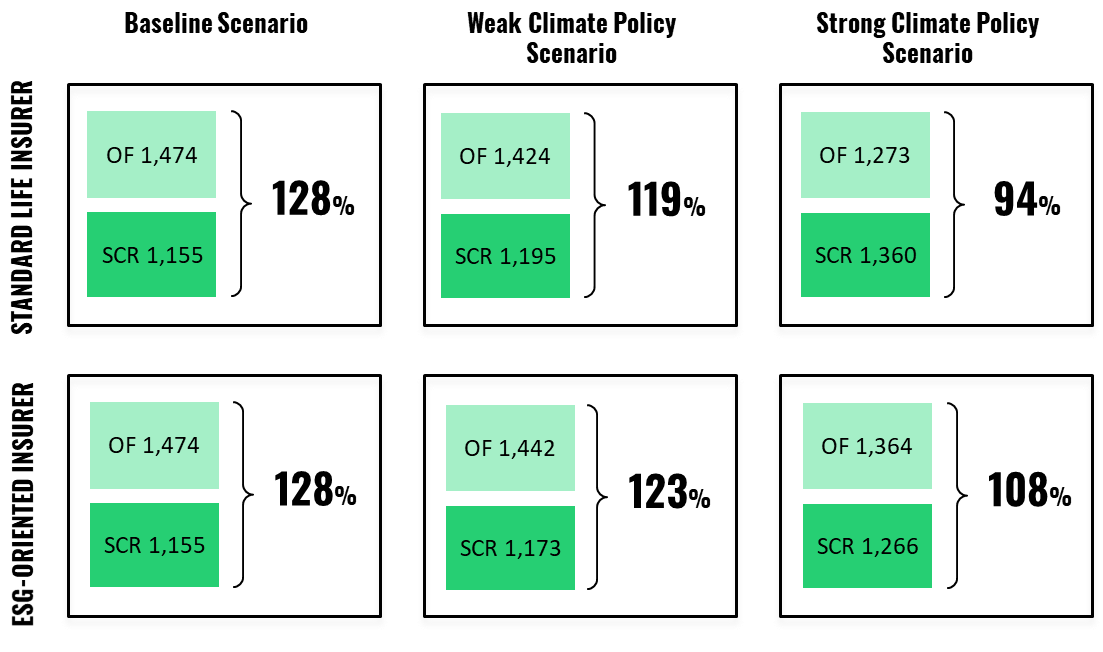

The feasibility of this concept and the potential materiality of the transition risk on insurance companies’ capital requirements under Solvency II are demonstrated via a case study based on a generic European life insurer. Given a representative asset allocation, we study the impact of different climate policy scenarios on the Solvency II capital requirement and resulting coverage ratio. The case study shows that insurers can expect material, but not devastating exposure towards climate transition risk. We also show that this risk may be substantially mitigated by adopting an investment approach that is more aligned with climate protection targets by putting increased attention on Economic, Social and Governance criteria.

The quantitative assessment of sustainability risks will play an increasingly significant role in the further development of the Solvency II regulatory requirements and wider industry-wide climate risk exposure assessments. Insurers should be ready to meet these requirements – with regard to both their individual risk exposure, as well as process-wise integration.