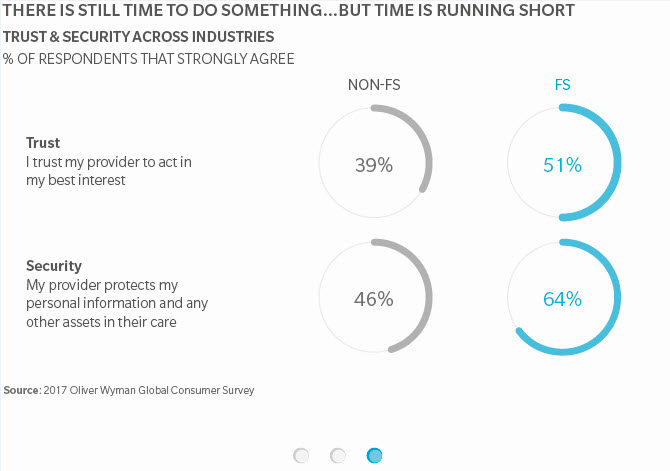

Who will close the customer value gap in Financial Services and reap the rewards?Traditional financial services firms will need to accelerate customer value creation or risk conceding an increasing share of customer attention and wallet to other firms, primarily to ‘big tech.’ While financial services incumbents have largely recovered towards relative health ten years on from the financial crisis and conditions have improved significantly, there is a gnawing sense of concern regarding the prospects for future underlying industry growth.

-

Read More

Read MorePress Release Who Will Close the Customer Value Gap in Financial Services and Reap the Rewards? Big tech offers important lessons for Financial Services incumbents in the race to create new value for customers and drive growth. -

Read More

Read MoreEvents Oliver Wyman At Davos Oliver Wyman led discussions at the 2018 World Economic Forum Annual Meeting on how to grapple with strategic issues in healthcare and financial services.

Over the last 10 years, the Financial Services industry has fought its way back to relative health. But, in the meantime the techniques used to create new customer value have dramatically changed and the Big Tech industry are dominating customer mindshare and reaping the rewards. It’s time for Financial Services to learn and react, or continue to watch value shift to other parts of the economyTed Moynihan, Managing Partner and Global Head, Financial Services, Oliver Wyman

Join the social conversation and follow #SOFS.

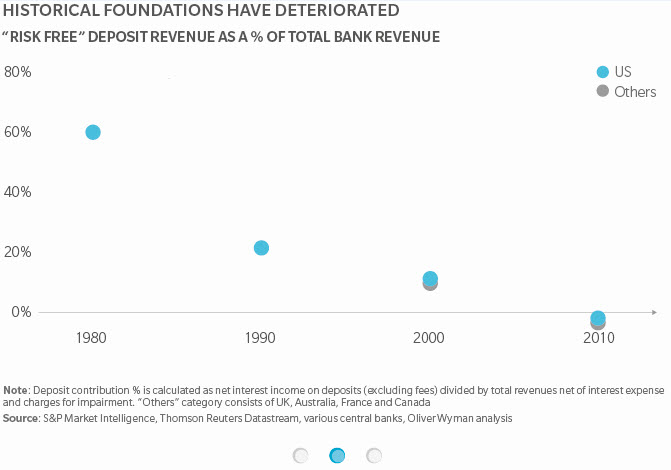

The Gnawing Sense of Concern

Related Insights

-

Read More

Read MoreFINANCIAL SERVICES Who Will Create The Google Maps Of Financial Services? It’s time for financial services to learn and react or continue to watch value shift to other parts of the economy. -

Read More

Read MoreJournals The State Of The Financial Services Industry 2017 Transforming for future value. -

Read More

Read MoreInsights Digitize To Defend In Section 1 of our State of the Financial Services Industry 2017 report, we discuss how financial services incumbents can adopt a strategy of “deep digitization” in order to radically reduce costs and defend profits. -

Read More

Read MoreInsights Identifying New Sources Of Value In Section 2 of our State of the Financial Services Industry 2017 report, we examine how financial services incumbents can develop new sustainable competitive advantages within ecosystems that are being reshaped by digital forces. -

Read More

Read MoreInsights Creating New Value In Section 3 of our State of the Financial Services Industry 2017 report, we discuss why we believe financial services incumbents must choose an archetype and how to move to the future. -

Read More

Read MoreInsights Modular Financial Services Our 2016 State of Financial Services report -

Read More

Read MoreInsights Managing Complexity During the nearly two decade bull run in financial services, from the 1988 peak in interest rates until 2006, banks and insurers became larger and more complex. -

Read More

Read MoreInsights The Challenges Ahead: SOFS 2014 This year’s report focuses on the growth challenge for the industry and identifies several “blind spots” that could impede the industry’s recovery and growth. -

Read More

Read MoreInsights A Money and Information Business State of Financial Services examines the industry’s greatest opportunity, and its greatest threat: information.